Apellis Pharmaceuticals, Inc. APLS incurred a first-quarter 2024 loss of 54 cents per share, which matched the Zacks Consensus Estimate. The company had incurred a loss of $1.56 per share in the year-ago quarter.

Total revenues amounted to $172.3 million in the reported quarter, beating the Zacks Consensus Estimate of $160.5 million. In the year-ago quarter, the company had reported revenues of $44.8 million.

The top line skyrocketed 284% year over year, owing to higher sales of Syfovre (pegcetacoplan injection) in the first quarter.

Syfovre was approved for the treatment of geographic atrophy (GA) secondary to age-related macular degeneration by the FDA in February 2023.

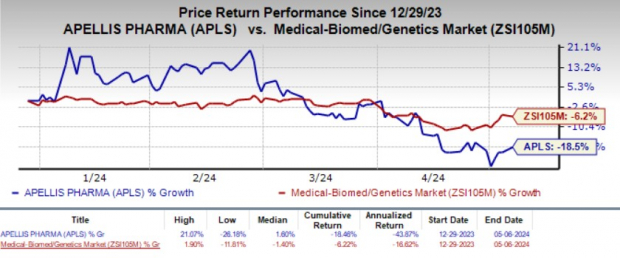

Year to date, shares of APLS have plunged 18.5% compared with the industry’s decline of 6.2%.

Image Source: Zacks Investment Research

Quarter in Detail

Revenues in the reported quarter included product sales of the marketed drugs — Empaveli (pegcetacoplan) and Syfovre — and licensing and other revenues under the collaboration agreement with Sobi.

Syfovre recorded sales of $137.5 million in the first quarter, which increased 20.3% sequentially, owing to continued strong demand. Syfovre sales beat the Zacks Consensus Estimate of $132.5 million as well as our model estimate of $120.1 million for the reported quarter.

Apellis delivered more than 72,000 commercial vials and nearly 5,000 samples of Syfovre to doctors in the first quarter. As of Mar 31, 2024, the total number of doses of the drug delivered since launch was 250,000.

The potential approval and successful launch of Syfovre in additional geographies will add an incremental stream of revenues to APLS in the future.

Last year, the company received the permanent J-code for Syfovre, which is set to help the company streamline billing and reimbursement of the medicine.

Empaveli recorded sales of $25.6 million in the reported quarter, up 25.5% from the year-ago quarter’s figure, owing to the increasing number of patient switches from AstraZeneca’s Ultomiris (eculizumab).

Empaveli sales beat the Zacks Consensus Estimate of $25.5 million as well as our model estimate of $24.5 million.

Empaveli is approved in the United States for the treatment of paroxysmal nocturnal hemoglobinuria. The drug is also approved in Europe under the brand name Aspaveli for the same indication.

Licensing and other revenues came in at $9.3 million, up 55% year over year.

Research and development expenses decreased 23% from the prior-year quarter’s level to $84.7 million. This was due to a decrease in program-specific external costs and other external costs.

General and administrative expenses totaled $129.5 million, up 26.8% year over year. This was due to higher employee-related costs, an increase in professional and consulting fees and general commercial preparation activities, and higher office costs.

As of Mar 31, 2024, Apellis had cash, cash equivalents and marketable securities worth $325.9 million compared with $351.2 million as of Dec 31, 2023. APLS expects its cash balance, combined with cash anticipated from sales of marketed products, to be enough to fund its operations in the foreseeable future.

Pipeline Update

Apellis’ phase III VALIANT study is currently evaluating systemic pegcetacoplan for treating immune complex membranoproliferative glomerulonephritis and C3 glomerulopathy. Top-line data from the study are anticipated in mid-2024.

Regulatory Update

In January 2024, the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) voted against the approval of Syfovre for the treatment of GA secondary to age-related macular degeneration.

Following the negative opinion, Apellis demanded a re-examination of the marketing authorization application (MAA) for Syfovre with the EMA. However, in March 2024, the Court of Justice of the European Union (CJEU) issued a judgment that ruled on the organization of EMA’s expert groups, posing implications for the EMA’s policy for handling competing interests of experts.

Based on the CJEU’s judgment, the EMA reset the review of the Syfovre MAA for the GA indication to the last phase of the initial assessment (day 180) in April 2024. The review is expected to be conducted by the original rapporteurs and the regulatory body intends to convene a new expert group meeting soon.

Apellis expects an opinion from the CHMP no later than July 2024.

The company clarified that the decision to reset the Syfovre MAA review was strictly procedural in response to the CJEU judgment and did not imply any shortcoming in the submission package for the drug, which was intended to support the approval in the EU.

Apellis Pharmaceuticals, Inc. Price and EPS Surprise

Apellis Pharmaceuticals, Inc. price-eps-surprise | Apellis Pharmaceuticals, Inc. Quote

Zacks Rank & Stocks to Consider

Apellis currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the drug/biotech industry are Ligand Pharmaceuticals LGND, ANI Pharmaceuticals ANIP and Annovis Bio ANVS. While LGND sports a Zacks Rank #1 (Strong Buy), ANIP & ANVS carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, the Zacks Consensus Estimate for Ligand’s 2024 earnings per share has remained constant at $4.56. During the same time frame, the estimate for Ligand’s 2025 earnings per share has remained constant at $5.27. Year to date, shares of LGND have gained 2%.

Ligand beat estimates in each of the trailing four quarters, delivering an average surprise of 84.81%.

In the past 30 days, estimates for ANI Pharmaceuticals’ 2024 earnings per share have risen from $4.43 to $4.44. Meanwhile, during the same period, the estimate for ANI Pharmaceuticals’ 2025 earnings per share has remained constant at $5.04. Year to date, shares of ANIP have climbed 22.2%.

ANI Pharmaceuticals beat estimates in each of the last four quarters, delivering an average surprise of 109.06%.

In the past 30 days, the Zacks Consensus Estimate for Annovis’ 2024 loss per share has narrowed from $3.35 to $2.93. During the same period, the estimate for Annovis’ 2025 loss per share has widened from $2.82 to $2.83. Year to date, shares of ANVS have plunged 71.2%.

ANVS beat estimates in two of the trailing four quarters and missed the mark on the other two occasions, delivering an average negative surprise of 15.70%.

Where Will Stocks Go…

If Biden Wins? If Trump Wins?

The answers may surprise you.

Since 1950, even after negative midterm years, the market has never had a lower presidential election year. With voters energized and engaged, the market has been almost unrelentingly bullish no matter which party wins!

Now is the time to download Zacks’ free Special Report with 5 stocks that offer extreme upside for both Democrats and Republicans…

1. Medical manufacturer has gained +11,000% in the last 15 years.

2. Rental company is absolutely crushing its sector.

3. Energy powerhouse plans to grow its already large dividend by 25%.

4. Aerospace and defense standout just landed a potentially $80 billion contract.

5. Giant Chipmaker is building huge plants in the U.S.

Hurry, Download Special Report FREE >>

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

Apellis Pharmaceuticals, Inc. (APLS) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.