It’s another busy slate of earnings this week, with a wide variety of companies on the reporting docket. We’ve gotten through the big banks’ results and a few quarterly releases from ‘Mag 7’ members, whose results didn’t cause any meaningful spooks.

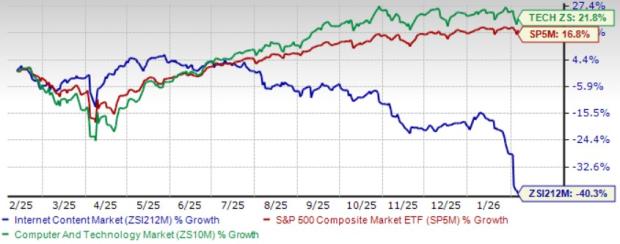

And concerning this week’s docket, investor favorite Apple AAPL is slated to unveil quarterly results. Shares have been considerably weak year-to-date, losing roughly 10% compared to the S&P 500’s 8% gain.

Image Source: Zacks Investment Research

Is the stock a buy heading into earnings? Let’s examine expectations and a few key metrics to watch in the release.

Apple

Apple’s woes in 2024 have primarily been fueled by fears concerning slowing growth and weakening demand from China, with its quiet-natured approach to artificial intelligence (AI) also causing some head-scratching.

Shares faced pressure post-earnings following its latest release, with positivity surrounding its Services portfolio unable to excite the market. It’s worth noting that revenues in China totaled $20.8 billion throughout the quarter, down 13% from the year-ago period.

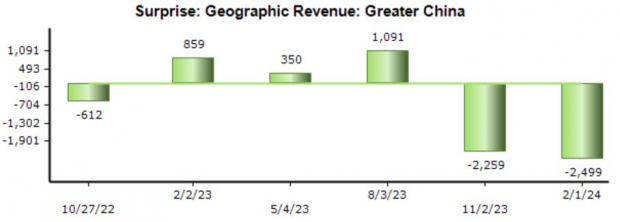

For the quarter to be released, the Zacks Consensus Estimate for sales in China stands at $16.6 billion, suggesting a 6.7% decrease from the year-ago period. As shown below, AAPL’s China revenue has fallen short of consensus expectations in back-to-back releases, with the most recent miss totaling $2.5 billion.

Image Source: Zacks Investment Research

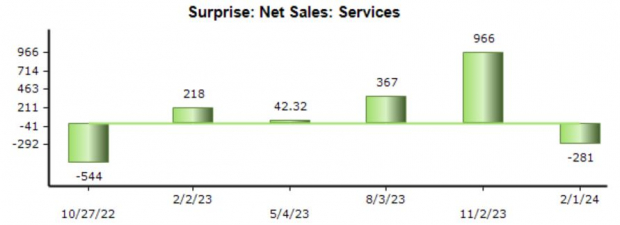

Concerning the Services portfolio, the Zacks Consensus Estimate stands at $23.3 billion, 11.5% higher than the $20.9 billion reported in the year-ago period. The tech titan has regularly exceeded our Services expectations but modestly fell short in its latest release.

Image Source: Zacks Investment Research

Of course, iPhone results will also be in focus. Our consensus estimate for iPhone sales stands at $46.2 billion, reflecting a nearly 10% pullback from the year-ago mark of $51.3 billion. The company snapped a streak of negative iPhone surprises in its latest release, with the beat totaling roughly $1 billion.

Image Source: Zacks Investment Research

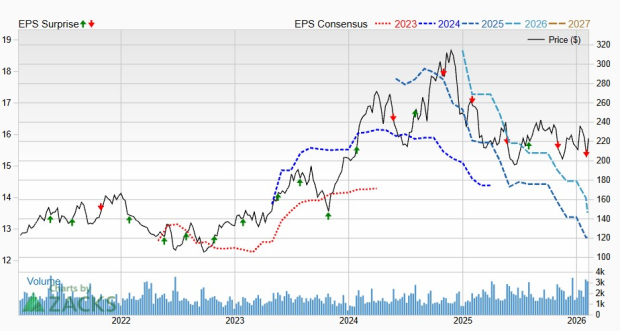

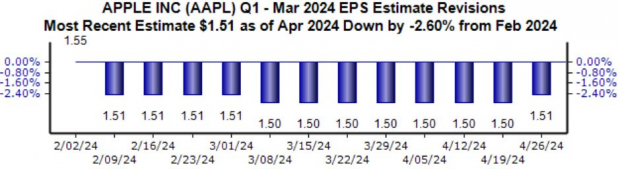

Analysts have modestly lowered their earnings expectations since the beginning of February, with the $1.51 per share estimate down 2.6% and essentially flat compared to the year-ago figure. Revenue revisions have moved in a similar fashion, as the $90 billion expected is down the same amount over the same period.

Image Source: Zacks Investment Research

Bottom Line

We have many investor favorites on the reporting docket for this week, a list that includes tech heavyweight Apple AAPL.

Investors will be tuned into the company’s China results, which have recently faced pressure amid rising competition. The Services portfolio will undoubtedly be another major highlight, an area of the company that’s been a solid growth driver recently.

Heading into the release, Apple is currently a Zacks Rank #3 (Hold).

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

Apple Inc. (AAPL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.