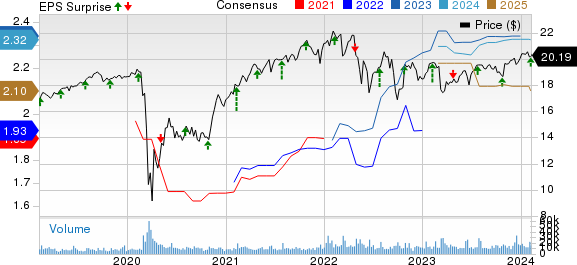

Shares of Ares Capital Corporation ARCC surged 1.3% following the release of its fourth-quarter and 2023 results. Quarterly core earnings of 63 cents per share surpassed the Zacks Consensus Estimate of 59 cents, identical to the prior-year quarter’s figure. Results were uplifted by amplified total investment income and robust portfolio activity, though an escalation in expenses somewhat dented the results.

GAAP net income witnessed a substantial rise to $413 million or 72 cents per share, compared to $174 million or 34 cents per share in the prior-year quarter. Additionally, core earnings for 2023 stood at $2.37 per share, above the Zacks Consensus Estimate of $2.34, signifying a 17.3% increase from 2022.

Total Investment Income Improves, Expenses Rise

Total investment income for the quarter reached $707 million, marking a 10.5% rise year over year, driven by escalated interest income from investments and dividend income. The full-year total investment income also soared, reaching $2.61 billion, a 24.7% increase year over year.

In stark opposition, the total quarterly expenses mounted to $353 million, reflecting a 29.3% surge year over year.

Portfolio Activities Robust

The fourth quarter saw Ares Capital commit to gross commitments worth $2.4 billion to new and existing portfolio companies, a slight dip from the prior-year quarter. Furthermore, exiting $1.4 billion of commitments in the reported quarter compared to $2.3 billion a year ago showcased the company’s strategic maneuvering.

As of Dec 31, 2023, the fair value of Ares Capital’s portfolio investments was $22.9 billion, with the fair value of accruing debt and other income-producing securities resting at $20.4 billion.

Balance Sheet Strong

As of Dec 31, 2023, the company’s cash and cash equivalents totaled $535 million, showcasing a substantial rise from the previous year. Ares Capital also reported $4.9 billion available for additional borrowings under existing credit facilities and a total outstanding debt of $11.9 billion.

Moreover, as of Dec 31, 2023, total assets were $23.8 billion and stockholders’ equity was $11.2 billion. Meanwhile, net asset value reached $19.24 per share, up from $18.40 as of Dec 31, 2022.

Our Take

Elevated demand for customized financing is expected to sustain the growth in Ares Capital’s total investment income. Furthermore, augmented investment commitments will likely keep propelling the company’s financials. However, expansion strategies may lead to a surge in costs, potentially impacting the bottom line.

Performance of Other Finance Stocks

In the same quarter, LPL Financial and Charles Schwab witnessed differing fortunes in the financial domain. LPL Financial’s fourth-quarter 2023 adjusted earnings surpassed the Zacks Consensus Estimate, reflecting a year-over-year decline, whereas Charles Schwab also exceeded expectations, despite a decrease from the prior-year quarter’s performance.

The financial sector continues to be a roller coaster of fortunes, with companies navigating through varying degrees of successes and challenges.