Revenue Growth Woes

The tale of ATN International (ATNI) unfolds with a poignant narrative of slowing revenue growth that casts a shadow on its immersive range of communication companies and renewable energy assets. The ebb in optimism is palpable as ATN strives to navigate the turbulent waters of profitability, earning itself a Zacks Rank #5 (Strong Sell) and a rather unenviable title – the Bear of the Day.

Diminishing Sales Prosperity

An expansive top line often heralds a company’s future earnings bonanza, propelling speculative high-growth stocks to astronomical heights even before they hit profitability milestones. Carvana (CVNA) and the crypto miners like Marathon Digital (MARA) and Riot Platforms (RIOT) serve as recent portrayals of this phenomenon.

Yet, when the revenue stream of such speculative stocks trickles down and profitability eludes, the market’s once-bright optimism can evaporate swiftly, painting an all too familiar picture for ATNI’s shares.

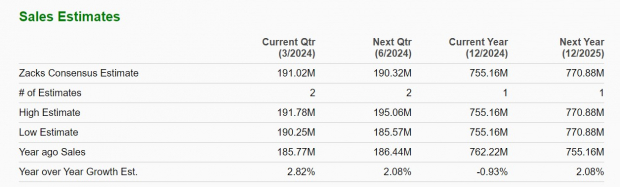

Image Source: Zacks Investment Research

Peering into ATN’s crystal ball, the outlook reveals a forecasted 1% dip in total sales for fiscal 2024, settling at $755.16 million, with the company slated to bear an adjusted loss of -$0.29 per share. While a glimmer of hope emerges for next year with a projected profit of $0.30 per share, a modest 2% sales growth fails to instill resounding confidence.

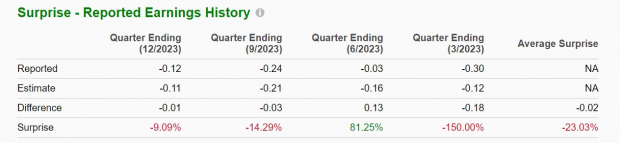

Image Source: Zacks Investment Research

Q4 Quandaries and Plummeting EPS Predictions

The tempest of concerns around ATN’s profitability intensifies further as the provider of infrastructure and communication services falls short of its Q4 earnings anticipation. With a net loss of -$5.8 million and an adjusted loss of -$0.12 per share in contrast to the projected -$0.11 per share, the tides grow turbulent.

While Q4 sales surged to $198.97 million, exceeding the estimates of $192.07 million and marking a 3% year-over-year growth, the jubilation wanes as ATN disappoints the market sentiment, missing earnings projections in three of its last four quarterly showcases.

Image Source: Zacks Investment Research

Adding to the disquiet, the annual earnings estimates take a sharp dive post-ATN’s Q4 report for both FY24 and FY25.

Image Source: Zacks Investment Research

The Dismal Denouement

ATN International’s stock descent by 13% in 2024 lays bare the harsh reality of slower revenue growth and dwindling earnings forecasts. The company’s diversified operations offer a life raft, yet the current outlook paints a less than assuring picture, cautioning investors to steer clear of this stormy sea.

Zacks Names #1 Semiconductor Stock

It’s merely 1/9,000th the size of the behemoth NVIDIA, which witnessed a meteoric rise of over 800% since Zacks’ endorsement. While NVIDIA still stands tall, the latest top chip stock in the limelight holds promising potential for significant growth.

With robust earnings growth and an expanding clientele base, it stands poised to satiate the voracious appetite for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor realm is primed to surge from $452 billion in 2021 to a forecasted $803 billion by 2028, a realm ripe for exploration.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

ATN International, Inc. (ATNI): Free Stock Analysis Report

Marathon Digital Holdings, Inc. (MARA): Free Stock Analysis Report

Carvana Co. (CVNA): Free Stock Analysis Report

Riot Platforms, Inc. (RIOT): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.