PENN Entertainment PENN, a Zacks Rank #5 (Strong Sell), provides integrated entertainment, sports content, and casino gaming experiences. It operates online sports betting and an online casino under brands such as Hollywood Casino, ESPN BET, and theScore Bet Sportsbook.

The company’s portfolio also includes PENN Play, a customer loyalty program that offers a set of rewards and experiences. Formerly known as Penn National Gaming, PENN Entertainment was founded in 1972 and is based in Wyomissing, Pennsylvania.

PENN faces cut-throat competition in the gaming industry. Its challenges are likely to hinder the company’s ability to finance operations, secure capital, pursue acquisitions, and adapt to market dynamics. Also of concern is the fact that most of its properties are located by waterbodies, making the company vulnerable to floods and other natural disasters. Weather-related downturns can affect revenues and profitability.

The Zacks Rundown

PENN Entertainment has been severely underperforming the market over the past year. The downtrend has continued in 2024 as PENN stock hits a series of 52-week lows. The company represents a compelling short opportunity even as the major indices hover near all-time highs.

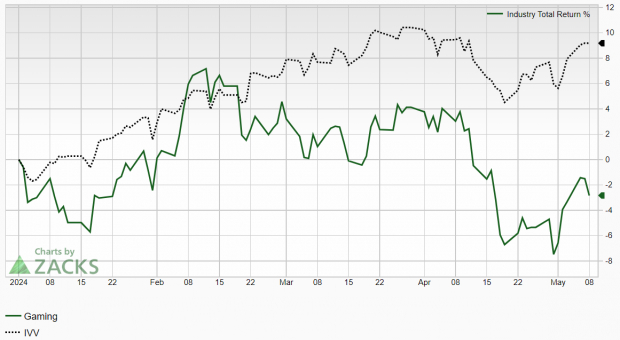

PENN is part of the Zacks Gaming industry group, which currently ranks in the bottom 38% out of approximately 250 industries. Because this industry is ranked in the bottom half of all Zacks Ranked Industries, we expect it to underperform the market over the next 3 to 6 months. This industry has widely underperformed the market so far in 2024:

Image Source: Zacks Investment Research

Candidates in the bottom half of industry groups can often represent potential short candidates. While individual stocks have the ability to outperform even when included in weak industries, their industry association serves as a headwind for any potential rallies. PENN Entertainment continues to fight an uphill battle and the stock is confirming this notion, lagging the general market by a wide margin.

Recent Earnings and Deteriorating Forecasts

The online sports betting and casino provider missed the earnings mark in two of the past three quarters. Just last week, PENN posted a first-quarter loss of -$0.79/share, a -33.9% miss versus the -$0.59/share consensus estimate. The company also missed revenue projections for the second consecutive quarter. Consistently falling short of estimates is a recipe for underperformance.

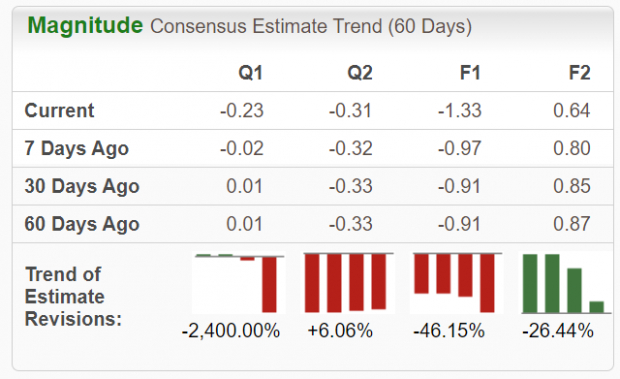

Analysts covering PENN decreased their earnings estimates recently. Looking at the current quarter, estimates have been slashed by -2,400% in the past 60 days. The Q2 Zacks Consensus Estimate sits at -$0.23/share, reflecting a -147.9% drop from the year-ago period.

Image Source: Zacks Investment Research

Technical Outlook

PENN shares have been steadily falling since late last year and have now established a well-defined downtrend. Notice how both the 50-day (blue line) and 200-day (red line) moving averages are sloping down. Shares have declined nearly 38% this year alone.

Image Source: StockCharts

The stock has also experienced the dreaded death cross, whereby its 50-day moving average crosses below its 200-day moving average. PENN Entertainment would have to make an outsized move to the upside and show increasing earnings estimate revisions to warrant taking any long positions in the stock. Shares remain in negative territory this year while the general market has eclipsed its former highs.

Final Thoughts

A deteriorating fundamental and technical backdrop show that this stock is not set to return to its former glory anytime soon. The fact that PENN is included in one of the worst-performing industry groups provides yet another headwind to a long list of concerns.

A history of earnings misses and falling future earnings estimates will likely serve as a ceiling to any potential rallies, nurturing the stock’s downtrend. Potential investors may want to give this stock the cold shoulder, or perhaps include it as part of a short or hedge strategy. Bulls will want to steer clear of PENN until the situation shows major signs of improvement.

Free Report – The Bitcoin Profit Phenomenon

Zacks Investment Research has released a Special Report to help you pursue massive profits from the world’s first and largest decentralized form of money.

No guarantees for the future, but in the past three presidential election years, Bitcoin’s returns were as follows: 2012 +272.4%, 2016 +161.1%, and 2020 +302.8%.

Zacks predicts another significant surge. Click below for Bitcoin: A Tumultuous Yet Resilient History.

Download Now – Today It’s FREE >>

PENN Entertainment, Inc. (PENN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.