As we endeavor to find needles in the haystack that is the stock market, we occasionally come across diamonds in the rough. It’s like discovering a classic car in a rundown garage – the potential is undeniable. Let’s take a closer look at three stocks with commendable buy ranks and robust value characteristics that are worth considering as of January 22.

The Goodyear Tire & Rubber Company

An inspiring tale of resilience and foresight, The Goodyear Tire & Rubber Company has secured a Zacks Rank #1. Over the past 60 days, the Zacks Consensus Estimate for its current year earnings has surged an awe-inspiring 40%. The company’s price-to-earnings ratio (P/E) of 8.91 is a testament to its fortitude, especially when compared with the industry’s towering 73.90. The tire manufacturer flaunts a Value Score of A, a clear sign of its undervalued status.

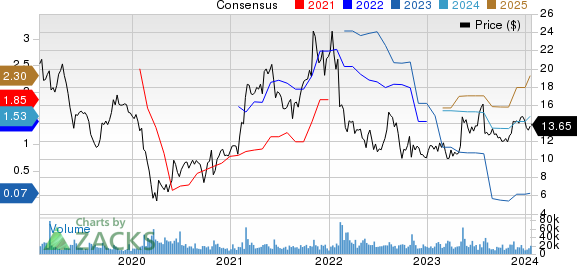

The Goodyear Tire & Rubber Company Price and Consensus

The Goodyear Tire & Rubber Company price-consensus-chart | The Goodyear Tire & Rubber Company Quote

The Goodyear Tire & Rubber Company PE Ratio (TTM)

The Goodyear Tire & Rubber Company pe-ratio-ttm | The Goodyear Tire & Rubber Company Quote

Powell Industries, Inc.

Powell Industries, Inc., a custom equipment manufacturer, proudly carries a Zacks Rank #1. The Zacks Consensus Estimate for its next year earnings has soared an impressive 35.1% over the last 60 days. The company’s P/E ratio of 15.34, when juxtaposed with the industry’s 17.30, indicates that it is a beacon of value. With a Value Score of A, Powell Industries stands as a testament to the enduring nature of value stocks.

Powell Industries, Inc. Price and Consensus

Powell Industries, Inc. price-consensus-chart | Powell Industries, Inc. Quote

Powell Industries, Inc. PE Ratio (TTM)

Powell Industries, Inc. pe-ratio-ttm | Powell Industries, Inc. Quote

Ingredion Incorporated

Oh, the story of Ingredion Incorporated! With a Zacks Rank #1 in its cap, the company has observed a steady 1.2% increase in the Zacks Consensus Estimate for its next year earnings over the past 60 days. Its price-to-earnings ratio (P/E) of 11.28, in comparison to the industry’s 11.60, indicates a significant value proposition. Add to this its Value Score of A, and we are looking at a true value gem.

Ingredion Incorporated Price and Consensus

Ingredion Incorporated price-consensus-chart | Ingredion Incorporated Quote

Ingredion Incorporated PE Ratio (TTM)

Ingredion Incorporated pe-ratio-ttm | Ingredion Incorporated Quote

For the entire list of top-ranked stocks, follow this link.

Dive deeper into the Value score and its calculation here.

Do you want to receive the latest recommendations from Zacks Investment Research? You can now download 7 Best Stocks for the Next 30 Days. Simply click here.

Free Stock Analysis Report for The Goodyear Tire & Rubber Company (GT)

Free Stock Analysis Report for Ingredion Incorporated (INGR)

Free Stock Analysis Report for Powell Industries, Inc. (POWL)

Read the full article on Zacks.com here.

Find more insights at Zacks Investment Research.

Remember, the views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.