Throughout history, Benjamin Graham, the renowned mentor of Warren Buffett, often alluded to Mr. Market, an erratic figure oscillating between bouts of optimism and despair. This colorful allegory beautifully encapsulates the stock market, a point especially relevant when evaluating Brookfield Renewable Corporation (NYSE: BEPC) and its counterpart Brookfield Renewable Partners (NYSE: BEP). This piece takes a closer look at Brookfield Renewable, pondering the merits of investing in it today.

Understanding Brookfield Renewable’s Operations

In essence, let’s consider both share classes of the company under the banner of Brookfield Renewable. The enterprise maintains a globally diversified portfolio featuring approximately 30 gigawatts of operational capacity spanning across hydroelectric power, solar, wind, storage, and other renewable energy resources. Notably, hydroelectric power plays a pivotal role in the portfolio due to its time-tested efficiency in providing base-load power.

Image source: Getty Images.

However, it serves as the cornerstone upon which the company builds its positions in solar, wind, storage, and other areas. Yet, the compelling narrative of Brookfield Renewable is the backlog, hovering at approximately 134 gigawatts. With an expected annual run rate of new projects at around 7 gigawatts, the backlog presents investment prospects for several decades to come. Even if not all the backlog reaches fruition, substantial growth opportunities lie ahead for Brookfield Renewable.

Most of the company’s assets are secured by long-term contracts that furnish stable cash flows. As new assets are integrated, Brookfield Renewable’s dividend-paying capacity expands. Between 2012 and 2023, its payout increased at an annualized rate of roughly 6%, aligning with the company’s targeted dividend growth of 5% to 9%. Given the extensive backlog, there are no indications that this renewable energy specialist will falter in its commitment to rewarding investors in the future.

Underpinning this stance is a balance sheet with an investment-grade rating and, crucially, the support of investment powerhouse Brookfield Asset Management (NYSE: BAM), which oversees the day-to-day operations of Brookfield Renewable and co-invests with it. Consequently, the company boasts a solid financial bedrock and further reinforcement. Brookfield Renewable appears well poised to capitalize on the global shift to clean energy.

Investing in Brookfield Renewable

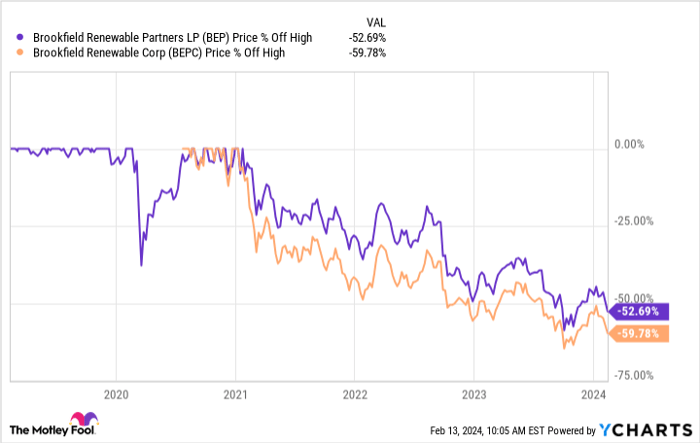

Undoubtedly, there are compelling fundamental reasons to consider investing in Brookfield Renewable. Moreover, the current downturn in the stock price, having plummeted significantly from its 2021 peaks, presents an opportune entry point. Both share classes have halved in value.

BEP data by YCharts

This decline, though, is more a reflection of investor sentiment than any intrinsic weakness specific to Brookfield Renewable. While higher interest rates may pose challenges, they are unlikely to impede the company’s long-term growth. Thus, for those intrigued by the business prospects, the shares now appear considerably more affordable than not long ago.

Interestingly, purchasing now offers the opportunity to lock in a dividend yield exceeding 5%. Furthermore, there is a strong likelihood that the dividend will continue to grow in the future as new capital investments become operational, generating cash flows. Slow and steady seems to be the prevailing theme; however, this makes the company particularly appealing to investors seeking growth coupled with income. Even those focused on maximizing current income are likely to find a 5%-plus yield alluring.

Holding Brookfield Renewable

As for holding the stock, the rationale mirrors that of buying it. The business displays resilience, with years of prospective growth ahead. For those who entered the market at higher prices, why crystallize those losses if one believes in the company? Brookfield Renewable appears highly likely to continue rewarding investors with dividend growth, which should ultimately lead to a recovery in the stock price. In the interim, investors benefit from a robust income stream, a proposition hard to dismiss.

After all, the pendulum of investor sentiment perpetually sways between optimism and pessimism in the ceaseless cycle of Wall Street. Mr. Market is undeniably capricious. Hence, there is ample reason to believe that given sufficient time, the value offered by Brookfield Renewable will be acknowledged by investors once again.

Selling Brookfield Renewable

Conversely, investors who bought into a bullish market phase could find themselves nursing significant capital losses, a situation unlikely to reverse swiftly. This scenario potentially allows capturing those losses to offset gains elsewhere in one’s portfolio. After 30 days, repurchasing Brookfield Renewable would avoid triggering red flags with the IRS and nullifying those losses for tax purposes. This strategy is applicable solely in taxable accounts.

Another reason to sell would be if an investor identified a superior investment opportunity outside the scope of this article. Presently, the company is efficiently managed, with business expansion anticipated over several years. It seems more plausible for investors to augment their positions to lower their average purchase price than to offload an underperforming investment.

A Rosy Outlook for Brookfield Renewable

Nobody relishes witnessing a 50% decline in a stock they own, yet such occurrences are not uncommon. With Brookfield Renewable, the long-term narrative remains largely unchanged despite the recent downturn in investor sentiment toward clean energy stocks. This presents an opening for new investors to initiate positions and for existing shareholders to increase their stakes. At present, there appears to be scant rationale for divesting (apart from strategic portfolio considerations), even for those disinclined to acquire additional shares.

Should you invest $1,000 in Brookfield Renewable right now?

Before investing in Brookfield Renewable, it’s worth noting that:

The Motley Fool Stock Advisor analyst team has identified what they envision as the 10 best stocks for investors to buy now, with Brookfield Renewable absent from the list. These 10 stocks are anticipated to yield substantial returns in the years to come.

Stock Advisor furnishes investors with a straightforward roadmap to success, encompassing portfolio construction guidance, regular analyst updates, and two new stock picks monthly. Since 2002, the Stock Advisor service has outperformed the S&P 500 index by a factor of more than three*.

Explore the 10 stocks

*Stock Advisor returns as of February 12, 2024

Reuben Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Brookfield Asset Management and Brookfield Renewable. The Motley Fool recommends Brookfield Renewable Partners. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.