Record-Breaking Performance in Renewables

The Andersons, Inc., ANDE, has consistently shown bullish tendencies, culminating in its extraordinary third quarter 2023 results in Renewables. With an impressive Zacks Rank #1 (Strong Buy), the company’s earnings are projected to surge by 32.2% into 2024. This agribusiness firm, which has flourished over an illustrious 77-year history, evolving from a solitary grain elevator to a multifaceted enterprise encompassing commodity merchandising, renewables, and nutrient and industrial specialties, is undoubtedly reaping the rewards of its strategic development.

A Record Result for Renewables in the Third Quarter

The third quarter earnings report released on Nov 7, 2023, revealed that The Andersons missed the Zacks Consensus by $0.39, with earnings at $0.13 compared to the anticipated $0.52. However, the gleaming star was the remarkable performance of Renewables, attributed to stellar operating efficacy in ethanol plants, favorable margins, and commendable results from the renewable diesel feedstock merchandising team. The Trade segment also delivered robust core operating performance, albeit offset by a currency loss in the international business. Moreover, the typically sluggish third quarter for Nutrient & Industrial witnessed year-over-year improvements in both the ag and manufacturing businesses. The acquisition of ACJ International, a pet food ingredient supplier, further illustrates The Andersons’ proactive approach to expansion, as it actively seeks growth opportunities within the Renewables sector.

Big Growth Expected for 2024

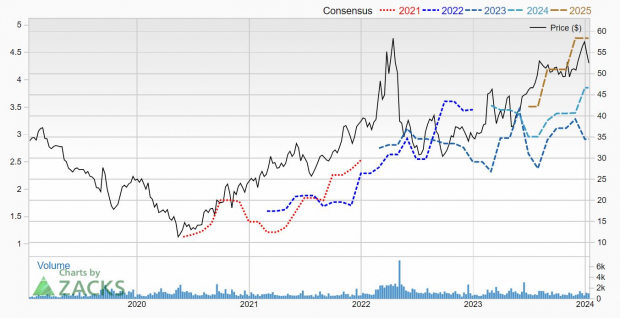

Looking ahead to 2024, The Andersons is positioned to build on its successes, buoyed by a surge in earnings estimates. Although specific Q4 figures are yet to be disclosed, The Andersons has garnered considerable attention, particularly as its earning projections have been upwardly revised in the past 60 days. This notable surge has propelled the Zacks Consensus for 2024 to $3.86 from $3.40, marking a substantial 32% leap from the anticipated 2023 earnings of $2.92.

Rallying Shares and Investor Prospects

In the realm of market performance, The Andersons’ shares experienced a notable upswing in 2023, soaring by 48.4% and attaining fresh 5-year highs. While a recent minor retreat of 3.5% from these peaks may give some cause for reflection, the company’s stock remains attractively valued with a forward P/E ratio of just 13.6. Investors seeking exposure to a small cap agribusiness company with significant potential for 2024 success would be remiss in neglecting The Andersons.

Conclusion

The Andersons, Inc., Through its shrewd business maneuvers, robust financial position, and a clear commitment to shareholder interests, The Andersons has not only weathered market fluctuations but has flourished in the competitive agribusiness landscape. As The Andersons charts its course for 2024, investors can expect a continued trajectory of growth and resilience, making it a compelling proposition in the financial markets.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.