Enter the battleground of Bull vs. Bear, a recurring duel where ideas clash, and opinions collide. Today’s combatants, Elle Caruso and Nick Peters-Golden, engage in a verbal joust over the relevance of value ETFs in the current investment landscape.

Elle Caruso, representing the value corner: Greetings, Nick. Today, let’s delve into the often-overlooked world of value ETFs. Despite their recent decline in popularity, value investments offer unique benefits that warrant a closer examination.

Nick Peters-Golden, advocating for growth: While I acknowledge the merits of value investing, the current economic climate favors growth over value. It’s crucial to recognize the prevailing winds of change and adjust our sails accordingly.

The Crucial Role of Value ETFs in Diversification

Caruso: Diversification is the bedrock of a resilient investment portfolio. Unfortunately, many investors are unknowingly overexposed to growth stocks, particularly in the technology sector.

The lopsided flow of capital into tech, with over $17.5 billion pouring in while other sectors face net outflows, highlights the sectoral imbalance plaguing many portfolios. As tech giants balloon in market cap, they exert a gravitational pull towards growth, skewing the market composition.

Balancing exposure to both value and growth assets ensures a well-rounded portfolio that can weather economic shifts. By historical precedent, different market conditions favor either growth or value, making a case for a diversified approach.

Investors seeking exposure to large-cap value stocks can consider vehicles like the iShares Russell 1000 Value ETF (IWD) and the Avantis U.S. Large Cap Value ETF (AVLV)

Insights from Munger’s Investment Philosophy

Peters-Golden: The wisdom of Charlie Munger, an icon of value investing, offers valuable insights into the current investment landscape. Despite his reverence for value principles, Munger’s cautionary words hint at a changing paradigm within the value realm.

The aftermath of the Global Financial Crisis, characterized by ultra-low interest rates, distorted market dynamics, creating an environment ripe for value hunting. However, the seismic shock of the pandemic may have recalibrated the economic compass, muddling traditional value propositions.

While certain sectors like tech appear frothy, propelled by AI advancements, the resilience of these growth darlings complicates the narrative. Even purported value ETFs carry tech heavyweights in their portfolios, blurring the line between value and growth.

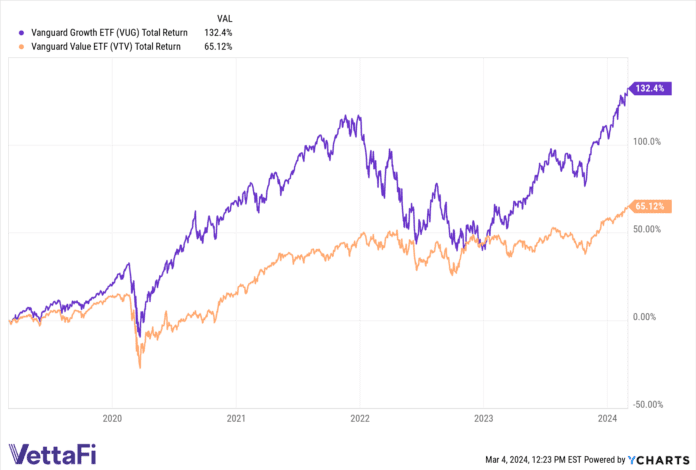

Comparing the performance of growth and value ETFs over the past five years reveals a stark divergence, with growth maintaining a dominant position. The battle between Vanguard Growth ETF (VUG) and Vanguard Value ETF (VTV) exemplifies the enduring supremacy of growth in recent times.

Strategic Defensive Positioning with Value ETFs

Caruso: Amid market uncertainties, many investors remain cautious, hoarding cash on the sidelines. However, embracing high-quality value ETFs can provide a tactical advantage, allowing participation in market upswings with reduced equity exposure.

Defensive value ETFs like Hartford Multifactor US Equity ETF (ROUS) offer a prudent compromise, enabling investors to navigate choppy markets with a balanced risk-reward profile. These ETFs employ multifactor strategies to enhance returns while minimizing unwarranted risks.

In summary, value ETFs represent a defensive bulwark amidst market volatility, allowing investors to maintain strategic equity exposure. By leveraging the multifaceted approach of ETFs like ROUS, investors can chart a steady course in turbulent investment waters.

The Dynamic Landscape of Value Investing and ETFs

Is the Sun Setting on the Era of Value Investing?

As financial titans gaze at the battlefield between VUG and VTV, the plot thickens. A fleeting moment in January 2022 saw value strutting its stuff, albeit modestly. Alas, like a wisp of smoke, it dissipated. According to YCharts, VUG has lorded over VTV by a resounding 30% over the previous year!

Sure, past glories seldom forecast future victories. Yet, hopes were high for value during that ephemeral triumph, particularly as the Fed readies its rate-cutting guillotine. When the monetary floodgates creak open, brace yourself for the AI jubilee akin to a child’s delight at a pizza-laden birthday bash. The markets may dance a wild jig, intoxicated by the cocktail of AI fervor and cheap credit.

Amidst this dizzying spectacle, brace for a likely carnival of AI valuations spiraling out of control in the tech realm. This speculative “may” perches precariously on the edge. In my book, the growth narrative seems a surer horse to back. For value stocks, the carousel looks ill-prepared to embrace the frothy whirlwind of rate cuts.

In essence, value shall have its resurrection. AI, with its grand promises, might overextend on its generative merit. Yet, presently, the odds tilt in favor of growth comfortably outpacing its counterpart in the market realm.

Are High Valuations Clearing the Stage for Value’s Resurgence?

According to Caruso: Can you hear the distant hoofbeats of value galloping back into the limelight? When markets swell under the weight of towering valuations, the tide often turns towards value stocks. Mega caps, currently perched on peak valuations, hint at an impending rise of the value phoenix from the ashes of overvaluation.

Moreover, during valuation-induced tremors, large-cap growth stocks teeter on the edge of volatility. A historical glance back at 2022 unfurls a tale of large-cap growth ETFs floundering while their free cash flow counterparts soared. As if choreographed, large-cap growth and free cash flow ETFs elegantly waltz in opposing directions, birthing an all-weather portfolio.

For those intrigued, consider the likes of VictoryShares Free Cash Flow ETF (VFLO) and the Pacer US Cash Cows 100 ETF (COWZ). Diversification beckons around the corner.

Exploring Pathways Beyond Traditional Value Offerings

Peters-Golden: Sticking to our value script, let’s entertain a moment of dissent. While the siren call of growth ETFs echoes loudly, a vanilla growth index might seem a tad uninspired amidst the impending rate-cut tsunami.

Enter the American Century U.S. Quality Growth ETF (QGRO), a shining beacon in the tumult. Tracking the American Century U.S. Quality Growth Index at a modest 29 bps, QGRO hunts for firms brimming with growth potential and sturdy fundamentals.

Diving deep, the index sieves through stocks based on quality, income, and growth metrics like sales, cash flow, and returns. It seeks equilibrium by blending high-octane growth stocks with the sturdy guardians of wealth creation. This balancing act morphs QGRO into an undercover acolyte of “value.”

With a notable mid-cap tilt, QGRO sprinkles diversification magic beyond the realm of the usual suspects. Boasting a 35% 12-month return, QGRO outpaced peers, painting a rosy picture for investors. Amidst the war between growth and value, hues of gray emerge, offering a tapestry of ETF offerings straddling both worlds. Yet, the hour seems to favor growth, with only the sagacious QGRO wielding the torch of fundamental research amidst the clamor for alpha.

In the enduring saga of growth versus value, certainties blur into the horizon. ETFs, humming varied tunes, present a melodic array of strategies for the discerning investor. While the scales may tip in growth’s favor, the melodic whispers of value await their turn to serenade the market.

For more news, information, and analysis, visit the Core Strategies Channel.

The opinions expressed are those of the author and not necessarily reflective of Nasdaq, Inc.