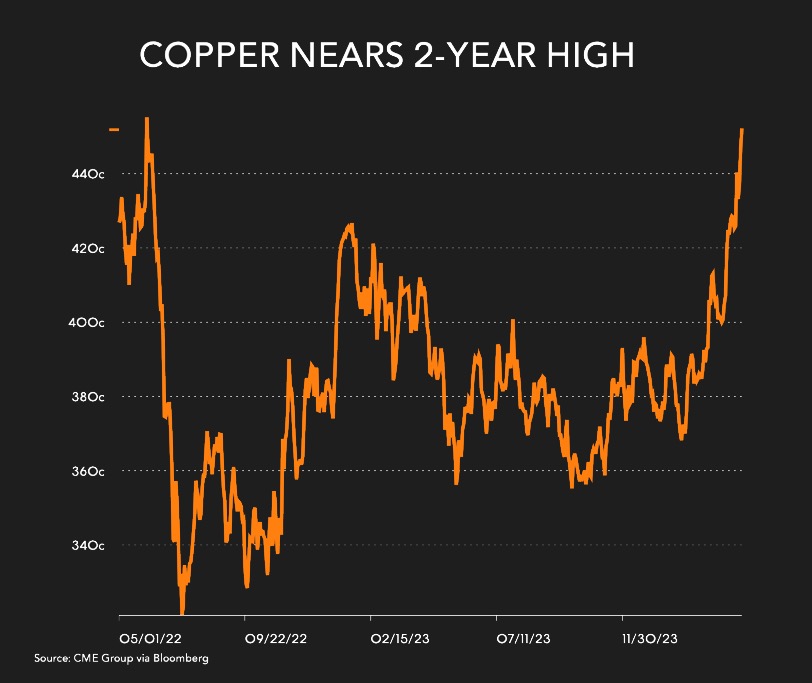

Copper’s momentum continues to build and the trend may not be short-term given the metal’s history during rate cuts. Additionally, this could provide even further tailwinds, keeping the window open for investors to get on the metal’s bandwagon.

The capital markets patiently await the Fed’s rate decisions. Additionally, the expectation of rate cuts has historically been a catalyst for higher commodity prices. Copper specifically can see pronounced moves toward the upside in a looser monetary environment.

“With the improvement in business cycle conditions, copper may be set up for continued success for several reasons,” a Sprott Insights report noted. “For one, it has historically performed well in expansionary economic phases.”

“Further, interest rate cuts in a non-recessionary environment have typically led to higher commodity prices. (See Figure 5),” the report added.

Figure 5. Rate Cuts Drive Commodity Prices

Traders Up the Ante on Copper Bets

The surge in copper’s price corroborates with large investors’ bullish bets on copper prices. Traders on the London Metal Exchange and the Chicago Mercantile Exchange are seeing record higher volume heading into long positions.

“The spectacular upward move over the last couple of weeks comes as so-called managed money build long positions – bets on higher prices in future – to the equivalent of more than 2 million tonnes on the London Metal Exchange, a new record,” Mining.com confirmed, noting that long positions on copper future contracts have not seen these levels since the start of 2018.

“In our view, this reflects the heavy inflows towards copper, and commodities as an asset class, a dynamic that many producers were keen to understand more about,” BMO Capital Markets said in the Mining.com report. “There is some confidence demand can improve further to backstop current price levels. But without this emerging soon the recent rally may prove vulnerable.”

If the trend persists, investors may want to get on board using funds like the Sprott Copper Miners ETF (COPP) for alternate exposure via miners. Accordingly, miners track the metal’s spot prices more closely. They exhibit high beta and at times, more pronounced moves in relation to the spot price. All in all, bullish retail traders may want to consider mining stocks.

“Notably, copper mining stocks have also provided further leverage to increases in the copper spot price,” the Sprott Insights report noted further. “Historically, there is a very strong correlation of 0.88 between copper mining stocks and the copper spot price. And mining stocks have typically almost doubled moves in the spot price as measured by a beta of 1.8.”

COPP seeks to provide investment results that correspond generally to the total return performance of the Nasdaq Sprott Copper Miners™ Index (NSCOPP™). It is designed to track the performance of a selection of global securities in the industry, including producers, developers, and explorers. COPP provides blanket exposure to the copper mining industry, focusing on large, mid, and small-cap mining companies.

Alternatively, investors who want to focus on even more aggressive growth prospects will want to consider the Sprott Junior Copper Miners ETF (COPJ). The fund seeks to provide investment results that track the total return performance of the Nasdaq Sprott Junior Copper Miners Index. The index incorporates mid, small, and micro-cap companies entrenched in copper-mining-related businesses.

For more news, information, and analysis, visit the Gold/Silver/Critical Materials Channel.

Read more on ETFTrends.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.