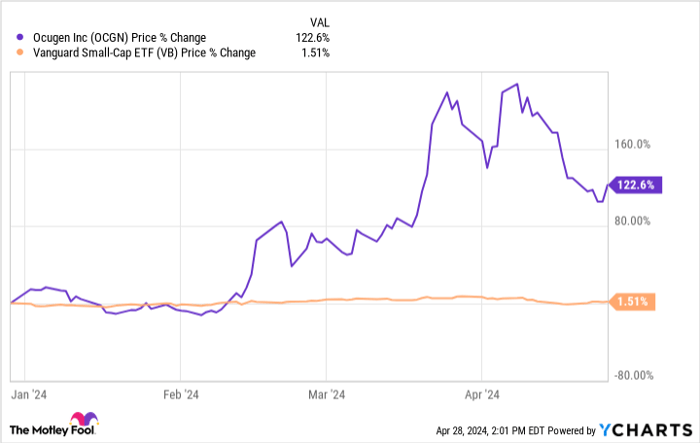

Since the start of the year, Ocugen (NASDAQ: OCGN) has been on fire. The biotech’s shares have gained an eye-popping 122%, far surpassing the performance of small-cap growth stocks this year. (See the following graph.) What’s fueling this rally? Is Ocugen’s stock still a strong buy? Let’s dig deeper to find answers to these questions.

OCGN data by YCharts

A promising eye gene therapy

At the heart of Ocugen’s ascent lies OCU400, an experimental gene therapy headed into late-stage testing for retinitis pigmentosa (RP), a cluster of rare, degenerative eye conditions that erode vision by gradually dismantling the retina’s cells.

This genetic affliction, affecting approximately 2 million individuals globally, is projected to reach a therapeutic market value of $21 billion by 2033.

Image Source: Getty Images.

Given their significant price points, the buzz surrounding ocular gene therapies is not without merit. For perspective, Roche‘s Luxturna, a similar treatment acquired for a hefty $4.8 billion, commands an $850,000 price tag for treating both eyes.

While not an exact parallel, Luxturna sheds light on the potential pricing strategy for OCU400, should it gain approval. If Ocugen aligns its pricing with Luxturna’s precedent, the sales figures for OCU400 could be nothing short of monumental, potentially elevating it to “megablockbuster” status with annual sales exceeding $5 billion.

Despite the optimism, a degree of caution remains prudent. Ocugen’s modest market capitalization of $329 million juxtaposed against the prospect of a “megablockbuster” product is tantalizing yet warrants scrutiny. Market size, unmet medical needs, and efficacy are not guaranteed harbingers of sales success.

The commercial triumph of a drug hinges on marketing prowess and, occasionally, sheer fortune, rendering OCU400 a potential catalyst for an acquisition rather than an organic value driver. In other words, OCU400 probably won’t reach its full potential without a big pharma company shepherding its commercial launch.

Is Ocugen stock still a buy?

Ocugen’s enticing risk-to-reward ratio has not gone unnoticed by Wall Street, with analysts projecting a substantial 350% upside potential based on the stock’s consensus price target. The commercial promise of OCU400 is palpable, yet the real gamble lies in the clinical outcomes.

Should the therapy yield positive late-stage results, Ocugen could become an attractive acquisition target, potentially commanding a significant buyout offer. However, the biopharmaceutical landscape is inherently risky, and Ocugen’s fate is tightly intertwined with its clinical successes.

Positive trial results could supercharge the company’s shares, but clinical studies are riddled with potential pitfalls — setbacks, negative results, and other unforeseen hurdles. A hiccup on any one of these fronts could take a massive toll on Ocugen’s stock price.

A safer way to gain exposure to Ocugen

So, for those with a penchant for risk and a hunger for unusual levels of growth, Ocugen’s stock might be a tantalizing option. Alternatively, investors seeking a more balanced approach might consider the Vanguard Health Care Index Fund ETF Shares, which includes Ocugen among its holdings at the time of this writing.

This diversified healthcare ETF offers a safer avenue to invest in high-growth clinical pharmas like Ocugen, mitigating the risk without promising the same explosive upside potential. In the volatile biotech space, such an ETF provides a shield against drastic value fluctuations, a level of security that Ocugen, with its high-risk profile, cannot guarantee on its own.

Should you invest $1,000 in Ocugen right now?

Before you buy stock in Ocugen, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ocugen wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of April 22, 2024

George Budwell has no position in any of the stocks mentioned. The Motley Fool recommends Roche. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.