Healthcare behemoth Centene Corporation’s Medicaid arm, along with its subsidiary WellCare for North Carolina, unveiled an innovative collaboration with Reinvestment Partners, an entity focusing on community development. Under this remarkable alliance, WellCare for North Carolina members will be integrated into the Eat Well Program and empowered with an $80 monthly prepaid credit card.

As Centene endeavors to ease the financial burden on eligible WellCare Medicaid beneficiaries, this initiative promises resounding benefits. Holders of the aforementioned card can utilize it to procure nutrient-rich fruits and vegetables. This strategic move ideally positions the company to curb swelling claim costs, given that insured individuals embracing healthy lifestyle choices are less susceptible to chronic ailments. As a part of the program, WellCare aims to recruit over 1,600 North Carolinians suffering from persistent and intricate health conditions.

The symbiotic collaboration is anticipated to trigger a purchase of fruits and vegetables amounting to a staggering $700,000. This intricate partnership underscores Centene’s steadfast commitment to elevate the wellness quotient of the North Carolinian populace. By emphasizing the pivotal role of dietary patterns and wholesome living practices in averting diseases, Centene keenly aims to promote robust health standards.

Voyaging into the future, Centene has charted out a robust trajectory to enrich its offerings, slated for rollout by 2024. The organization is poised to introduce the Wellcare Spendables debit card and unfurl an eclectic mix of new Dual Eligible Special Needs Plans along with 23 freshly curated plans. The forthcoming Wellcare Spendables card is engineered to dispense wholesome grocery options from national retailers, extended aid for rent/utility expenses, cost alleviation for vision, hearing, and dental care, in addition to over-the-counter products. Furthermore, the integration of telehealth across all plans is poised to confer gratuitous benefits upon members.

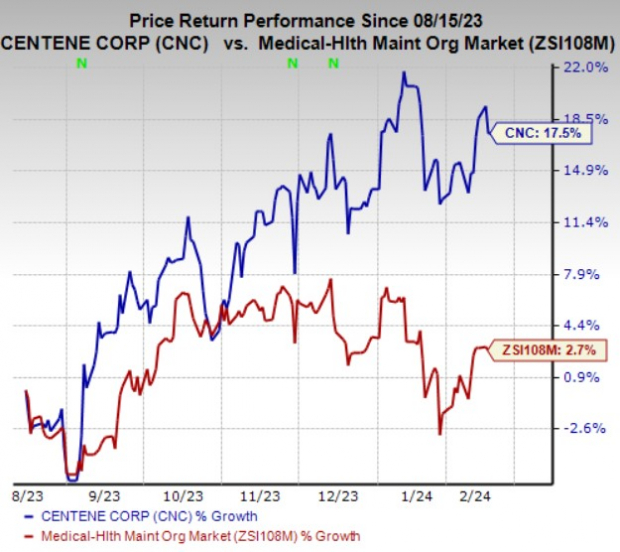

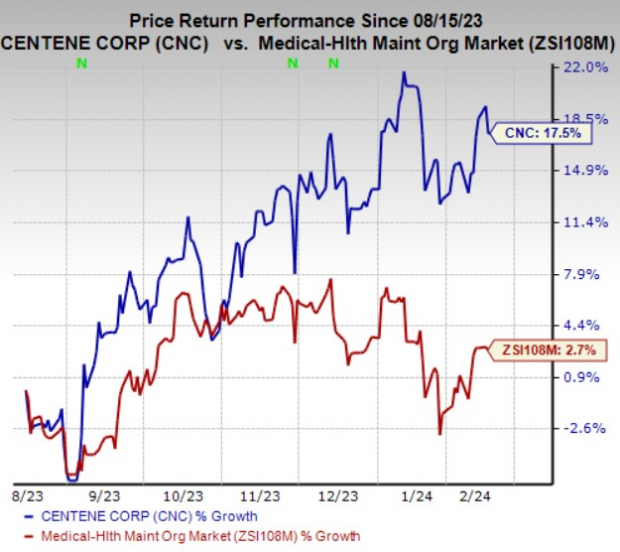

Centene’s stocks have surged by a handsome 17.5% during the most recent half-year period, outshining the industry’s modest 2.7% growth trajectory. Currently, CNC flaunts a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Exploring Other Growth Opportunities

Several other prominent players in the Medical domain also warrant consideration, including Amedisys, Inc. (AMED), The Cigna Group (CI), and Encompass Health Corporation (EHC). Each of these entities currently boasts a favorable Zacks Rank #2. For comprehensive insights, one can review the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Amedisys has surpassed the Zacks Consensus Estimate in three out of the last four quarters while registering a minor earnings miss on one occasion. The average positive surprise stands at a commendable 11.9%. Forecasts for AMED’s earnings and revenues for 2024 foretell an improvement of 2.2% and 3.8%, respectively, over the 2023 estimate.

Cigna exhibited a stellar earnings performance, surpassing the Zacks Consensus Estimate in each of the previous four quarters, which translates to an average surprise of 2.9%. Projections for CI’s 2024 earnings and revenues depict an ascent of 12.9% and 20.4% from the 2023 estimate. Notably, the consensus estimate for CI’s 2024 earnings has ascended by 0.2% over the past 30 days.

Encompass Health has consistently surpassed the Zacks Consensus Estimate in all of the last four quarters, yielding an average surprise of 20.1%. Projections for EHC’s 2024 earnings and revenues hint at an uptick of 8% and 9.5%, respectively, from the 2023 estimate. Impressively, the consensus estimate for EHC’s 2024 earnings has ascended by 2.9% over the past week.

Zacks Reveals ChatGPT “Sleeper” Stock

A lesser-known entity lies at the heart of the burgeoning Artificial Intelligence sector. By 2030, the AI industry is anticipated to wield an economic impact akin to the revolutionary advent of the internet and the iPhone, estimated at a colossal $15.7 trillion.

As a show of goodwill, Zacks has doled out a supplementary report spotlighting this explosive growth stock alongside four other equally compelling propositions.

Download Free ChatGPT Stock Report Right Now >>

Amedisys, Inc. (AMED) : Free Stock Analysis Report

Cigna Group (CI) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

Encompass Health Corporation (EHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.