Centrus Energy LEU is expected to register year-over-year improvement in both its top and bottom lines in its upcoming first-quarter 2024 results.

Q1 Estimates

The Zacks Consensus Estimate for LEU’s first-quarter sales is pegged at $72.7 million, suggesting 8.7% growth from the prior-year quarter’s reported figure. The consensus mark for earnings is pegged at 50 cents per share, indicating a year-over-year rise of 6.4%. Earnings estimates have remained unchanged in the past 30 days.

Q4 Performance

In the last reported quarter, Centrus Energy witnessed a solid 152% year-over-year improvement in earnings despite an 18% drop in revenues. The company beat the Zacks Consensus Estimate for both metrics.

LEU’s earnings have outpaced the consensus estimate in three of the trailing four quarters while matching on one occasion, the average surprise being 136.9%.

Centrus Energy Corp. Price and EPS Surprise

Centrus Energy Corp. price-eps-surprise | Centrus Energy Corp. Quote

Factors to Note

The fourth quarter of 2023 marked a milestone in the company’s history. On Oct 11, 2023, the company began production of High-Assay, Low-Enriched Uranium (HALEU) at its American Centrifuge Plant in Piketon, OH under its contract with the Department of Energy (DOE). HALEU is a high-performance nuclear fuel component that will be required to power several advanced reactor and fuel designs that are currently under development for commercial and government uses.

On Nov 7, 2023, LEU completed Phase 1 of the HALEU operation contract by delivering 20 kilograms of HALEU to DOE and transitioned to Phase 2. Per the company’s filing dated Apr 19, it has now delivered more than 100 kilograms of HALEU to the DOE.

Centrus operates two business segments, LEU, which supplies various components of nuclear fuel to commercial customers from its global network of suppliers, and Technical Solutions.

The LEU segment generates around 84% of the company’s revenues and involves the sale of enriched uranium to utilities that operate commercial nuclear power plants. The majority of these sales are for the enrichment component of Low-Enriched Uranium , which is measured in SWU. It also sells natural uranium hexafluoride (the raw material needed to produce LEU) and occasionally sells uranium concentrates and uranium conversion. Its order book extends to 2030, and as of Dec 31, 2023, its order book was approximately $1.0 billion. This is expected to be reflected in the company’s results. The LEU segment’s results are likely to showcase higher sales volumes of uranium and higher average prices of uranium. The segment’s cost of sales, however, is expected to have increased to reflect the higher volumes sold and elevated unit cost prices.

The Technical Solutions segment reflects technical, manufacturing, engineering and operations services offered to public and private sector customers, including engineering and testing activities as well as technical and resource support. Under a contract with the DOE, the Technical Solutions segment is currently deploying uranium enrichment and other capabilities necessary for the production of advanced nuclear fuel to meet the evolving needs of the global nuclear industry and the U.S. government. Revenues and costs for the segment in the first quarter are likely to have been higher year over year, attributed to the increased work under the HALEU Operation Contract.

What Our Zacks Model Indicates

Our proven model does not conclusively predict an earnings beat for Centrus Energy this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat.

You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Centrus Energy is 0.00%.

Zacks Rank: LEU currently carries a Zacks Rank of 3.

Price Performance

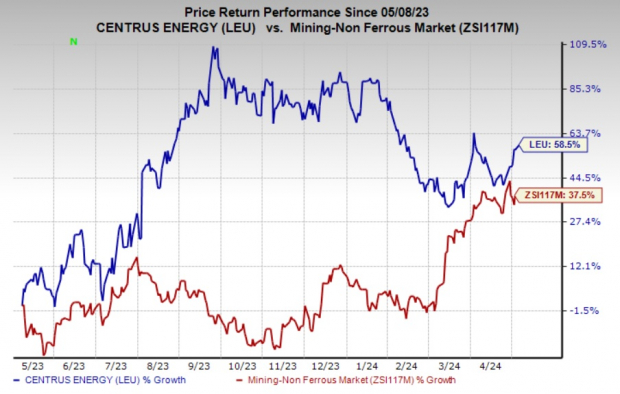

Centrus Energy’s shares have gained 58.5% in the past year compared with the industry’s 37.5% growth.

Image Source: Zacks Investment Research

Stocks to Consider

Here are some stocks with the right combination of elements to post an earnings beat in their upcoming releases.

Innospec Inc. IOSP, scheduled to release first-quarter 2024 earnings on May 9, has an Earnings ESP of +2.44% and a Zacks Rank of 2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for IOSP’s earnings is currently pegged at $1.64 per share. The estimate indicates year-over-year growth of 18.8%. IOSP’s earnings have outpaced the consensus estimate in each of the trailing four quarters, the average surprise being 10.5%.

SilverCrest Metals SILV, slated to release earnings on May 14, has an Earnings ESP of +14.92% and a Zacks Rank of 3 at present.

The Zacks Consensus Estimate for SILV’s first-quarter earnings is currently pegged at 12 cents per share. The figure suggests a decline of 33% from the year-ago quarter’s earnings. SilverCrest Metals’ earnings have outpaced the consensus estimate in each of the trailing four quarters, the average surprise being 24.5%.

Osisko Gold Royalties OR, expected to release first-quarter 2024 earnings soon, has an Earnings ESP of +2.33% and a Zacks Rank of 3 at present.

The Zacks Consensus Estimate for OR’s earnings is currently pegged at 11 cents per share. The figure suggests a 15.4% year-over-year decline. Osisko Gold’s earnings have surpassed the consensus estimate in three of the trailing four quarters while missing on one occasion, the average surprise being 8.9%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Where Will Stocks Go…

If Biden Wins? If Trump Wins?

The answers may surprise you.

Since 1950, even after negative midterm years, the market has never had a lower presidential election year. With voters energized and engaged, the market has been almost unrelentingly bullish no matter which party wins!

Now is the time to download Zacks’ free Special Report with 5 stocks that offer extreme upside for both Democrats and Republicans…

1. Medical manufacturer has gained +11,000% in the last 15 years.

2. Rental company is absolutely crushing its sector.

3. Energy powerhouse plans to grow its already large dividend by 25%.

4. Aerospace and defense standout just landed a potentially $80 billion contract.

5. Giant Chipmaker is building huge plants in the U.S.

Hurry, Download Special Report FREE >>

Innospec Inc. (IOSP) : Free Stock Analysis Report

Osisko Gold Royalties Ltd (OR) : Free Stock Analysis Report

Centrus Energy Corp. (LEU) : Free Stock Analysis Report

SilverCrest Metals Inc. (SILV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.