Chesapeake Utilities Corp. CPK just made a bold move! The company’s subsidiary, Sharp Energy, has successfully acquired the propane operating assets of J.T. Lee and Son’s in Cape Fear, NC, signaling a strategic expansion of their footprint in the state. As a result of this acquisition, Chesapeake Utilities Corp is now poised to offer cost savings and other synergistic benefits in the expanded Wilmington service area.

With this whopping deal, Sharp Energy has welcomed over 3,000 new consumers in North Carolina, adding an impressive distribution of about 800,000 gallons of propane annually. Not to forget, the bulk plant with 60,000 gallons of propane storage that is now part of their growing arsenal. This significant expansion not only allows the company to cater to more consumers but also offers considerable advantages through increased storage capacity and overlapping delivery regions.

Expansion in the Propane Business

It’s evident that Chesapeake Utilities has been on a roll, expanding its propane wholesale, retail, and AutoGas businesses through smart, growth strategies. By combining organic and inorganic growth paths, the company has effectively surged forward throughout the Southeast and the Mid-Atlantic. This recent acquisition is yet another step that further solidifies CPK’s position in the fiercely competitive U.S. propane market.

In fact, back in December 2022, Chesapeake Utilities’ subsidiary, Florida Public Utilities, also made headlines by acquiring the propane operating assets of Hernando Gas in Hernando, FL. This well-timed move greatly contributed to the company’s growing operating footprint in Florida.

Let’s not forget that Sharp Energy seized the opportunity and acquired Diversified Energy Company’s propane operating assets in December 2021, adding nearly 19,000 residential, commercial, and agricultural customers. The company has been on a relentless pursuit of growth, and with each acquisition, it has illuminated its path to success.

Potential for Growth

Propane’s demand as a clean and efficient energy source, especially in the residential and commercial sectors, is propelling the propane market to new heights. With its low carbon content, propane is swiftly emerging as an attractive alternative to fossil fuels like petro and diesel. The market for propane is booming due to its widespread availability, reasonable price, and superior dependability compared to other energy sources.

According to a Precedence Research report, the global propane market size was a whopping $82.44 billion in 2022 and is projected to hit around $122.61 billion by 2032, registering a formidable CAGR of 4.1% during 2023-2032. The residential category alone is anticipated to witness a remarkable CAGR of more than 5.2% between 2023 and 2032.

Price Performance

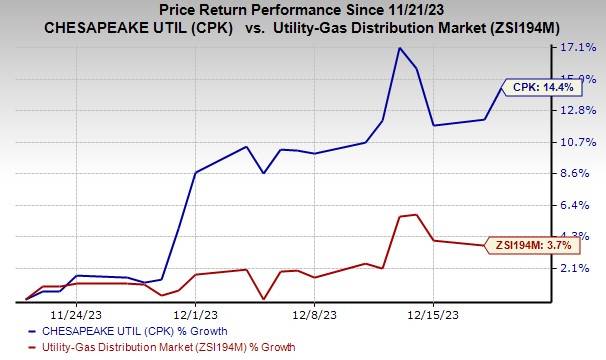

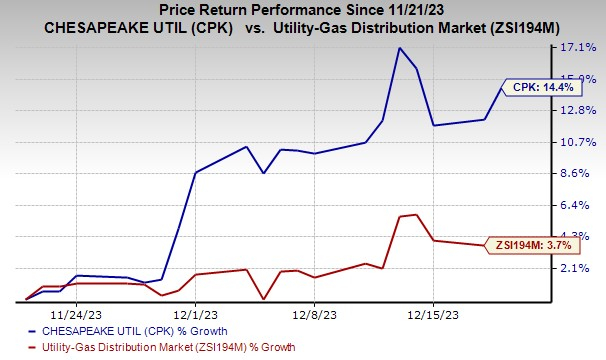

Chesapeake Utilities’ shares have been on fire, rising 14.4% in the past month compared to the modest 3.7% growth observed in the industry. This bullish growth undoubtedly underlines the company’s poise and strength in the market.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Now, here’s the real zinger – the company currently has a Zacks Rank #4 (Sell). However, before you get too disheartened, there are still better-ranked stocks from the same sector to consider! Keep an eye on Atmos Energy Corporation ATO, Sempra Energy SRE, and IDACORP, Inc. IDA, each boasting a Zacks Rank #2 (Buy) at present.

With Atmos Energy’s long-term (three- to five-year) earnings growth rate being an impressive 7.26%, and its ability to consistently deliver an average earnings surprise of 1.1% in the last four quarters, it’s definitely one to watch. And let’s not forget Sempra Energy, with a long-term earnings growth rate of 4.95% and an average earnings surprise of 9% in the last four quarters. IDACORP also shouldn’t be underestimated, with a long-term earnings growth rate of 4.11% and an average earnings surprise of 13.3% in the last four quarters.

Zacks Naming Top 10 Stocks for 2024

Ready to peek behind the curtain and get the early scoop on the 10 top picks for the entirety of 2024? If history is any indication, their performance could truly be a showstopper. From 2012 through November, 2023, the Zacks Top 10 Stocks gained a jaw-dropping +974.1%, almost tripling the S&P 500’s +340.1%! Now, the pressure’s on as Sheraz diligently sifts through 4,400 companies to cherry-pick the best 10 tickers to buy and hold in 2024. Ensure you don’t miss your chance to get in on these stocks when they debut on January 2.

Be the First to Discover New Top 10 Stocks >>

Sempra Energy (SRE) : Free Stock Analysis Report

IDACORP, Inc. (IDA) : Free Stock Analysis Report

Chesapeake Utilities Corporation (CPK) : Free Stock Analysis Report

Atmos Energy Corporation (ATO) : Free Stock Analysis Report

Read this article on Zacks.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.