Discover Financial Services DFS recently made waves in the financial world with the announcement of its acquisition by Capital One Financial Corporation COF in an all-stock deal valued at a staggering $35.3 billion. This monumental decision by the two industry giants has sent ripples of excitement and intrigue through the stock market, reshaping the landscape of the financial services sector for years to come.

A Transformative Deal

Spearheaded by this acquisition, Capital One will exchange 1.0192 of its shares for each DFS share, signifying a hefty 26.6% premium over DFS’s closing price of $110.49 on Feb 16, 2024. The completion of this historic transaction is anticipated by late 2024 or early 2025, contingent on regulatory and shareholder green lights as well as fulfillment of closing conditions. Once finalized, Discover Financial shareholders are poised to retain a sizable 40% ownership stake in the combined powerhouse, laying claim to a substantial portion of the future success and growth.

For Discover Financial, the acquisition comes at a time when it is wrestling to resuscitate its financial performance. The company witnessed a stark 59% year-over-year plunge in adjusted earnings during the fourth quarter of 2023, prompting a strategic shake-up. In this context, the union of the two entities is poised to unleash a prolific range of opportunities, capitalizing on synergistic franchises and capabilities, and painting a compelling picture of what the future holds for both companies.

Anticipation for Synergistic Revolution

Furthermore, the merging of Discover Financial with Capital One is expected to forge the path for substantial cost synergies, owed to the natural economy of scale that unfolds when two titans conjoin forces. In particular, the integration of their respective credit card businesses promises a trove of enhanced products through the cross-pollination of their varied expertise.

In a financial arena marked by relentless competition, Discover’s national direct savings bank is slated to fittingly complement Capital One Bank, fortifying the competitive edge of the collective behemoth in the cutthroat banking domain. Not least, the marriage of these two giants is expected to yield an impressive $1.5 billion in expense synergies by 2027, partially offset by strategic investments made in Discover Network, heralding a blueprint for prolonged success grounded in deliberate and strategic growth initiatives.

Price Performance and Future Fortunes

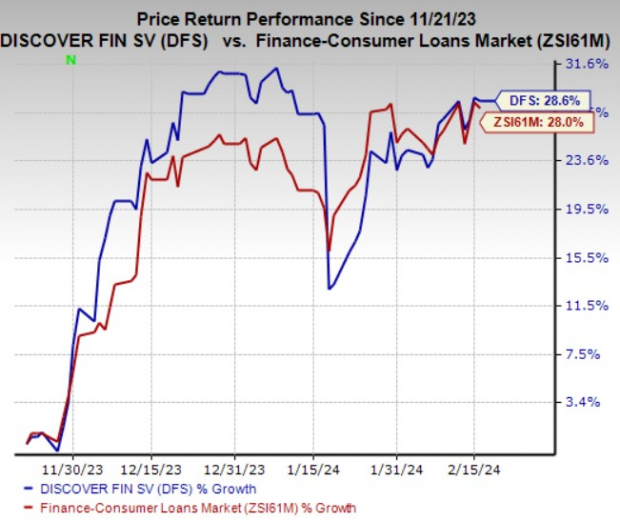

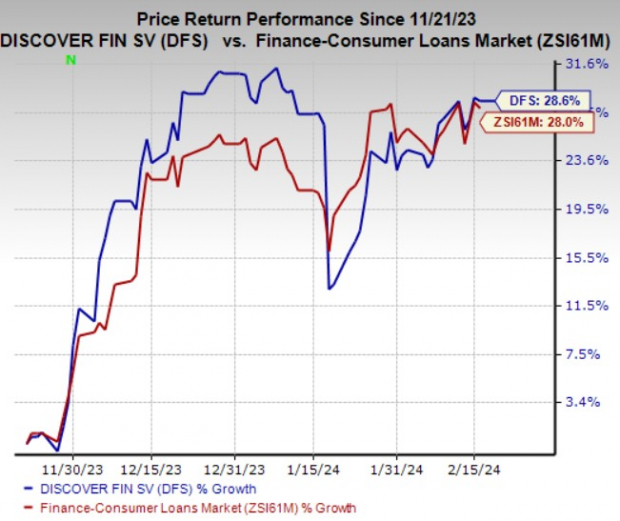

Discover Financial’s shares have surged by a commendable 28.6% in the past three months, outpacing the 28% rise of the broader industry, thereby underscoring the positive market sentiment and investor confidence in the impending merger and its potential for value creation.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Presently, Discover Financial holds a Zacks Rank #3 (Hold), standing as a solid indication of its current market standing and future trajectory. Meanwhile, among the stars of the Financial – Consumer Loans sector, EZCORP, Inc. EZPW and World Acceptance Corporation WRLD stand out as formidable contenders with a Zacks Rank #1 (Strong Buy).

Are these picks poised to hit the jackpot in the market, or is there more than meets the eye? With the financial year ahead chock-full of potential, the Zacks Consensus Estimate for EZCORP’s fiscal 2024 earnings projects an impressive year-over-year growth of 14.1%. Meanwhile, World Acceptance Corporation delivered a noteworthy four-quarter average earnings surprise of 59.8%, amplifying the excitement surrounding its projected year-over-year increases of 253.1% and 15.6% in fiscal 2023 and 2024 earnings, respectively.

For investors seeking to make their mark in the financial arena, the tantalizing lure of the composite powers of Discover Financial and Capital One looms large—offering a dynamic canvas of growth opportunities and sets the stage for a compelling narrative of potential gains and resounding victories.

The acquisition of Discover Financial by Capital One Financial Corporation is not only a game-changer but also a bold statement in the financial world. As the final pieces of regulatory approval fall in place, investors are poised to witness a seismic shift with far-reaching implications that extend beyond the mere realm of figures and projections.

The coming together of these two industry juggernauts is a confluence of calculated strategic vision and raw ambition, poised to redefine the contours of the financial services sector and resonate in the corridors of Wall Street, propelling the industry into uncharted territories where opportunities and fortunes await the intrepid and visionary.

This acquisition presents a compelling narrative of hope and potential, a surge of optimism, and a sense of anticipation that pervades the investor community. As the market eagerly awaits the unfolding of this exhilarating chapter, the echoes of synergistic potential and value creation fill the air, heralding the dawn of a new and transformative era in the financial world.

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.