Trinity Industries, Inc. (TRN) is navigating the turbulent waters of labor shortages and supply-chain disruptions. However, amidst this chaos, the company remains steadfast in its commitment to reward shareholders and strengthen its position in the market.

Trinity’s decision to hike its quarterly cash dividend by almost 8% is a testament to its dedication to shareholders. This mindful initiative ensures that the company is utilizing its resources effectively to enhance shareholder returns.

In the first nine months of 2023, TRN dispersed $64.7 million in dividend payments, showcasing its unwavering loyalty to investors. Rewarding shareholders translates into boosted investor confidence and a positive impact on the company’s bottom line.

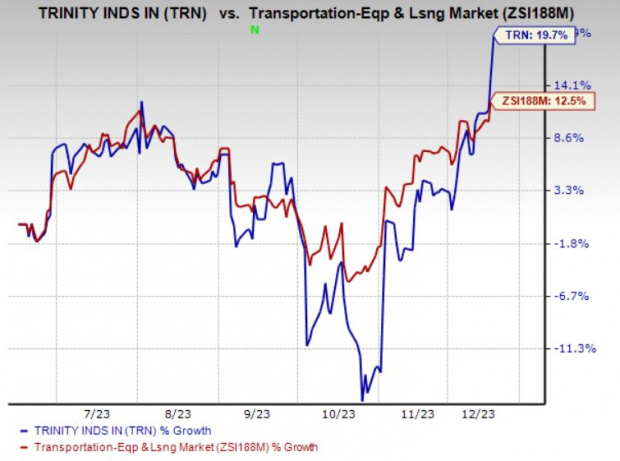

Despite the challenges, Trinity’s stock performance has been impressive, with a stellar gain of 19.7% over the last six months, overshadowing industry averages.

Image Source: Zacks Investment Research

The Rail Products Group has been a stronghold for Trinity, witnessing a 14.2% increase in segmental revenues in the third quarter. Higher delivery volumes and favorable railcar sales have been key contributors to this success.

On the other hand, the company has been battling labor and supply-chain challenges, which has impacted deliveries and margins at the Rail Products Group. As a result, Trinity revised its 2023 earnings per share outlook to a range of $1.2-$1.35, down from the previous forecast of $1.35-$1.45 per share.

Zacks Rank and Stocks to Consider

Trinity currently holds a Zacks Rank #3 (Hold).

For investors in the transportation sector, Wabtec Corporation (WAB) and SkyWest, Inc. (SKYW) are intriguing options. WAB has an enticing expected earnings growth rate of 22.02% for the current year, while SKYW’s fleet-modernization efforts have positioned it for significant gains.

SkyWest’s improved year-to-date performance of 202.1% and a trailing four-quarter earnings surprise of 32.57% are quite remarkable, indicating its potential for further growth.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s credited with a “watershed medical breakthrough” and is developing a bustling pipeline of other projects that could make a world of difference for patients suffering from diseases involving the liver, lungs, and blood. This is a timely investment that you can catch while it emerges from its bear market lows.

It could rival or surpass other recent Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Trinity Industries, Inc. (TRN) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

Westinghouse Air Brake Technologies Corporation (WAB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.