In a truncated and relatively serene week in terms of the earnings lineup, a few top-rated Zacks stocks are shining before their quarterly results.

With Microsoft MSFT and Netflix NFLX next week, 1ST Source SRCE and Fastenal FAST are two companies that deserve attention ahead of their fourth quarter reports on Thursday, January 18.

Fastenal Q4 Overview

Fastenal is one of the most attractive retailers currently, serving as a national wholesale distributor of industrial and construction supplies. Infrastructure and construction-related activities including homebuilding have continued to thrive, with Fastenal’s stock up +32% over the last year, easily surpassing the Zacks Building Products-Retail Markets’ +10% and the S&P 500’s +20%.

Image Source: Zacks Investment Research

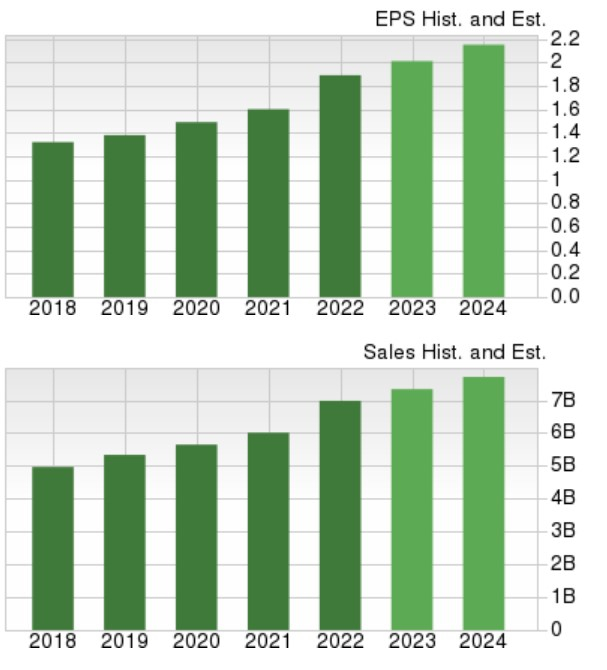

For the fourth quarter, Fastenal’s earnings are expected to rise 4% year over year to $0.45 a share with sales projected to increase by 3% to $1.75 billion. Overall, Fastenal is expected to close out fiscal 2023 with annual earnings up by 6% to $2.00 a share and total sales up by 5% to $7.34 billion. Furthermore, Fastenal is projected to achieve another 6% growth on its top and bottom lines in FY24. Fastenal also offers investors a generous 2.20% annual dividend yield.

Image Source: Zacks Investment Research

1st Source Q4 Overview

Ahead of its Q4 results, 1ST Source is a regional bank experiencing positive earnings estimate revisions with general banking branches throughout Indiana and Michigan.1ST Source’s stock is down -5% in the last year but looks attractive at a 12.3X forward earnings multiple, which is near the Zacks Banks-Midwest Industry average of 10.6X and well below the S&P 500’s 20X. 1ST Source’s 2.63% annual dividend yield also bolsters its more attractive valuation.

Image Source: Zacks Investment Research

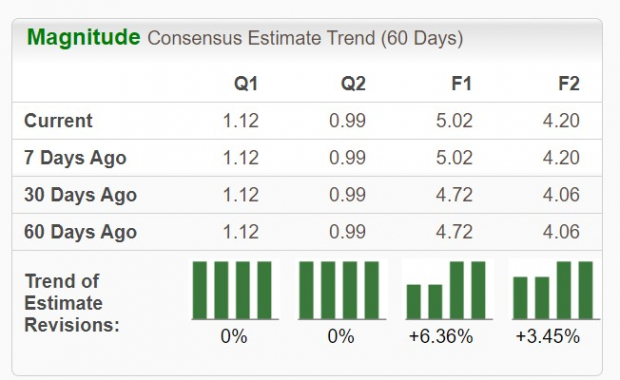

1ST Source’s stock appears to have already factored in Q4 earnings, forecasted to decrease by -10% YoY to $1.12 a share with sales expected to drop by -4% to $91.2 million. Despite this, annual earnings are still projected to rise 4% to $5.02 per share for FY23, then expected to dip to $4.20 a share in FY24.

However, over the last 60 days, FY24 earnings estimates are up 3% while FY23 EPS estimates have risen by 6%. Total sales are now slated to rise by 4% in FY23 and then decrease by -3% this year to $356.7 million, but 1ST Source’s price-to-sales ratio of 2.6X is nearing the optimum level of less than 2X.

Image Source: Zacks Investment Research

Key Takeaway

Fastenal and 1ST Source seem like two stocks that could rally if they post favorable Q4 results and guidance. Currently, 1ST Source’s stock possesses a Zacks Rank #1 (Strong Buy) in correlation with its attractive valuation and rising earnings estimates, while Fastenal’s stock carries a Zacks Rank #2 (Buy) and remains a very intriguing option for growth.