Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

Here are the key points:

- Total earnings for the 440 S&P 500 members that have reported Q1 results are up +5.0% from the same period last year on +4.2% higher revenues, with 78.0% beating EPS estimates and 60.9% beating revenue estimates.

- The earnings and revenue growth pace for these 440 index members represents a modest acceleration from what we had seen in other recent periods. The +5% earnings growth pace improves to +11.9% once the Energy sector and Bristol Myers’s one-time charge are accounted for.

- For 2024 Q2, S&P 500 earnings are expected to be up +9.2% from the same period last year on +4.5% higher revenues. Estimates have been increasing since the start of April, with the current +9.2% earnings growth pace up from +8.7% on April 3rd.

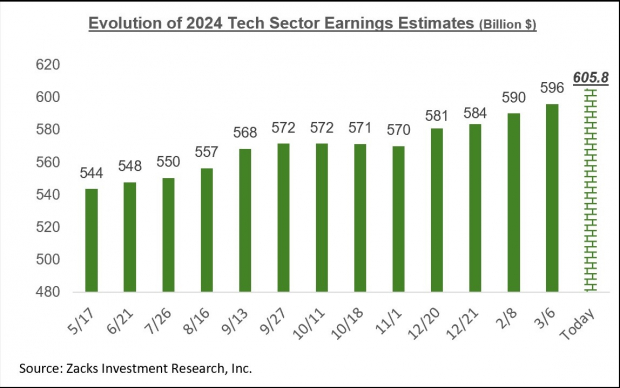

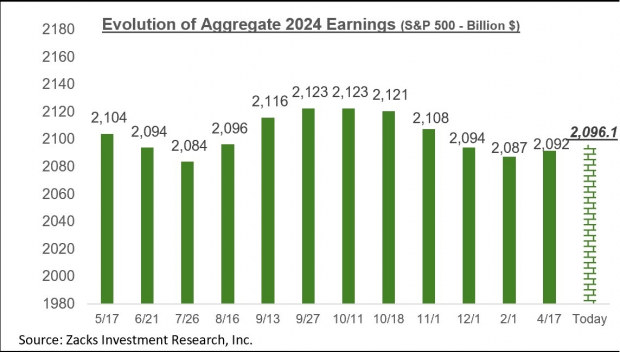

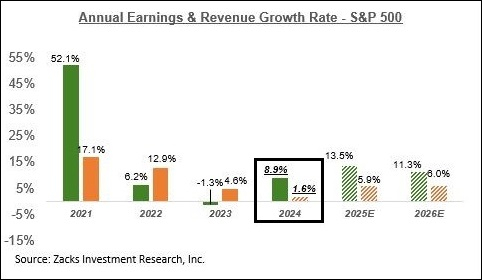

- Looking at the calendar year picture, total S&P 500 earnings are expected to grow by +8.9% this year after last year’s modest decline. Excluding the hefty Tech sector contribution, whose 2024 earnings are expected to be up +15.9%, earnings for the rest of the index would be up only +6.3%.

We have consistently flagged signs of improvement in the overall revisions trend in recent weeks, with estimates starting to go modestly up. We are seeing this trend for the current period (2024 Q2) as well as for full-year 2024 estimates.

This new development has roughly coincided with the start of the Q1 earnings season. That said, several sectors, including Tech and Retail, had already been enjoying positive estimate revisions for quite some time. At present, half of the 16 Zacks sectors have higher aggregate earnings estimates than expected at the start of the year.

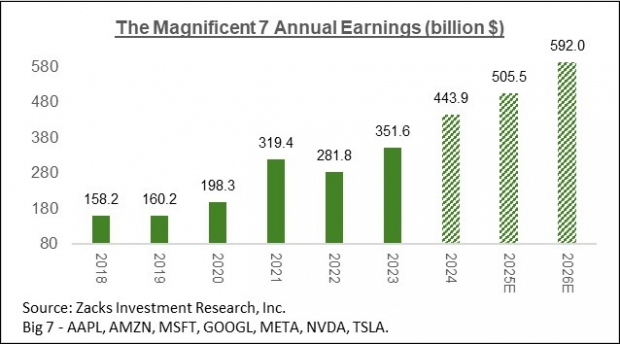

We have recently highlighted the favorable revisions trend for the Energy sector in this space. This week, we will discuss the evolving earnings outlook for the ‘Magnificent 7’ stocks.

The chart below shows aggregate earnings totals for the group on an annual basis.

Image Source: Zacks Investment Research

Please note that the $443.9 billion the group is currently expected to earn in 2024 is up from $438.1 billion last week and $428.2 billion the week prior to that.

We all know that the revisions trend for Tesla TSLA has been negative for a while now, while the same for Apple AAPL is also negative, though the magnitude of negative revisions for Apple is far less severe.

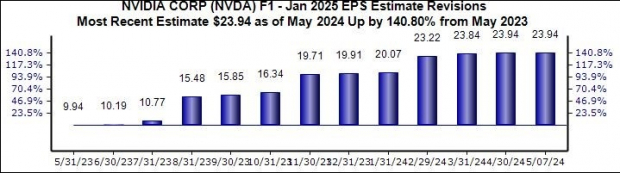

The revisions trend for the remaining five members of this group is positive enough to more than offset the Tesla and Apple effects. Of these five, Nvidia NVDA is in a league of its own, as the chart below shows.

Image Source: Zacks Investment Research

The chart below shows how the aggregate full-year earnings estimate for the sector has evolved over the past year.

Image Source: Zacks Investment Research

The chart below shows how S&P 500 aggregate earnings estimates for full-year 2024 have evolved.

Image Source: Zacks Investment Research

Below, we show the overall earnings picture for the S&P 500 index on an annual basis.

Image Source: Zacks Investment Research

A big part of this year’s earnings growth is expected to come from margins reversing last year’s declines and starting to expand again. The expectation is that aggregate net margins this year get back to the 2022 level, with the Tech sector driving most of the gains.

Top 5 Dividend Stocks for Your Retirement

Zacks targets 5 well-established companies with solid fundamentals and a history of raising dividends. More importantly, they have the resources and will to likely pay them in the future.

Click now for a Special Report packed with unconventional wisdom and insights you simply won’t get from your neighborhood financial planner.

See our Top 5 now – the report is FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.