Co-authored by Treading Softly

I’ve never been one to be known as highly emotional. Though I am surrounded by individuals in my life who are. My one daughter, for example, has every emotion at a ten, all the time. She’s either 10 out of 10 happy, 10 out of 10 sad, or 10 out of 10 angry. Because of this, she is extremely attuned to the emotional impacts of various media. It is not uncommon to find her listening to beautiful music or emotionally charged music and crying either because of the sadness contained in the song or because of the extreme joy contained within that song. She frequently has what she calls “happy tears,” which are just tears of joy under a different name.

I’m able to enjoy a different kind of period where I get tears of joy – every single time dividends arrive in my portfolio. Ok, maybe not physical tears, but inside that is the feeling I get.

Do you know the only thing that gives me pleasure? It’s to see my dividends coming in. – John D. Rockefeller

You see, as an income investor, my main focus when approaching the market is to get paid by that market. I have learned through the years of managing my portfolio that if you focus on what you can control the rest will take care of itself. I have focused on building my income by buying dividend-paying stocks. Whether the market is up or down, I can take actions that will increase the dividends I receive. Because of that, my total returns have grown over time.

Today, I want to take a look at two opportunities that pay income monthly. You can enjoy a strong income from them month after month after month, and every time that money arrives, you can cry tears of joy knowing that it’s going to come again next month as well, all while you think about all the different opportunities that you can take advantage of with them.

Let’s dive in.

Exploring Opportunity #1: EPR – Yield 7.3%

EPR Properties (EPR) is a real estate investment trust that specializes in experiential properties, such as entertainment, recreation, and leisure venues. In short, EPR owns places where you go to experience something. In a world where people were staying at home, that wasn’t the best place to be.

EPR was originally founded as a REIT for movie theaters. An asset class that historically has been extremely reliable and desirable for landlords. It is also a sector that still hasn’t recovered from COVID. EPR saw one of its largest tenants, Regal, in bankruptcy court last year.

The Regal bankruptcy was resolved and the lease renegotiated in an agreement that provides EPR with a lower fixed rent, but a higher percentage rent. It provides Regal with an immediate reduction in rent, but provides EPR with upside as the box office recovers.

Despite this setback last year, EPR saw FFO and AFFO climb throughout the year. Importantly, EPR’s dividend coverage improved with the payout ratio declining from 65% of AFFO in Q4 2022 to 56% in Q3. Source

It should be noted that EPR does have temporary cash flow which has benefited it. EPR has been collecting rent that was deferred in 2020 during COVID, and those collections are nearing an end. In 2023, those excess collections are estimated to be approximately $0.47/share. Source

Fortunately, EPR’s management provided guidance for 2023 with and without rent deferrals collected:

As we look forward to 2024, we don’t expect rent deferral collections to be significant. As a result, we can expect 2024 earnings to be starting at a base of $4.67 FFO as adjusted. Which puts the payout ratio for 2023 at approximately 70%. For the second half of 2023, we expect the payout ratio excluding the impact of deferral collections to be in the 66-68% range. Before COVID, EPR generally targeted a 70-80% payout ratio.

So is EPR likely to announce a dividend raise at earnings? That falls into the category of “definitely maybe”. On the one hand, the run-rate payout ratio is definitely low enough to justify a modest increase. At earnings, management suggested that they expected a 4% annual per/share FFO growth was a reasonable expectation over the long run. EPR is currently operating below its target leverage range of 5-5.5x, so in the near term, growth should continue to run above 4%. That should allow EPR to increase the dividend by about $0.01/month +- to maintain a payout ratio of 70% or below.

On the other hand, EPR might decide to maintain a conservative approach and keep retaining cash. There are some obvious risks. An eventual bankruptcy from AMC Entertainment (AMC) at this point should surprise nobody. Unlike Regal, EPR already renegotiated its leases with AMC in 2020. When it renegotiated the leases, EPR was well aware that bankruptcy was a very real possibility and structured the leases with an AMC bankruptcy filing in mind. Here is an exchange from the Q2 2020 earnings call:

Brian Hawthorne

Hi. Good morning. My first question in a bankruptcy scenario, how comfortable are you that the AMC Master Lease will stand up in court?

Greg Silvers

You know, I don’t think anybody can give you great assurances. But I can tell you that when we structured it, we used bankruptcy council, the latest court decisions that were out there to structure a transaction that we believe is the most formidable available.

There can be no guarantees, but EPR was able to get an overall favorable result from the Cineworld/Regal bankruptcy. It is

Strategies for Investors in EPR and XFLT

With the specter of AMC’s potential bankruptcy looming, the real estate investment firm EPR is poised to weather the storm, just as it did in the aftermath of Cineworld/Regal’s filing. While the impact on sentiment may be acute, actual earnings are likely to be unfazed, paving the way for a promising outlook in 2024.

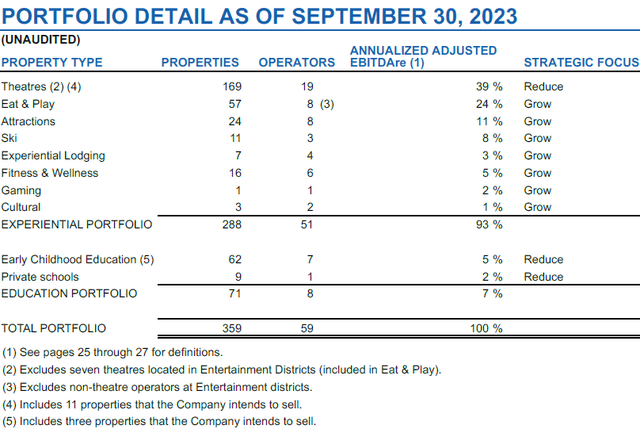

In a strategic move, EPR is strategically reducing its exposure to theaters and redirecting its focus toward expanding its non-theater business segment, demonstrating adeptness in adapting to the evolving market landscape.

Furthermore, EPR has earmarked 11 theater properties for sale, reflecting a proactive approach to streamlining its portfolio. The company is in a strong financial position with substantial liquidity to capitalize on growth opportunities without having utilized its $1 billion revolving line of credit.

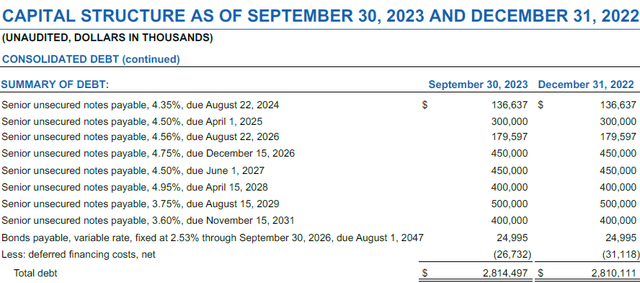

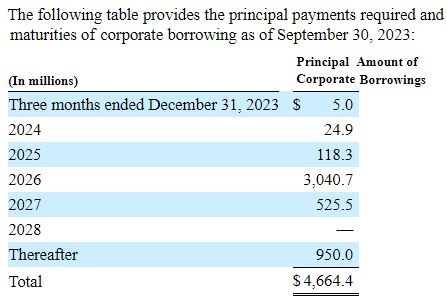

Enhancing its financial fortitude is EPR’s advantageous bond maturity schedule, with the next maturity not due until August 2024, amounting to a modest $136.6 million, a trifling fraction of its overall debt. Such fiscal prudence insulates EPR from undue financial strain and positions it favorably for sustained performance.

This conservative debt obligation is a testament to EPR’s deft handling of its financial liabilities, affording it the flexibility to consider cash repayment or refinancing at prevailing rates without exerting a material impact on its earnings.

Anticipating a positive trajectory, EPR is slated for modest FFO growth and potential dividend enhancement, underscoring the astute stewardship of its management in orchestrating measured expansion initiatives.

While the shadow of AMC’s prospective bankruptcy lingers, the overarching effect on EPR’s earnings is poised to be marginal, corroborating the resilience of the company’s dividend and financial standing, regardless of AMC’s course of action.

In light of these insights, consolidating positions in EPR at prevailing valuations presents a compelling opportunity for investors.

Unveiling XFLT – A 13.7% Yield

Leveraged loans via CLO equity funds have garnered significant attention owing to their exceptional income potential, with the S&P LSTA Leveraged Loan Index notably offering a historically high yield-to-maturity of 9.49%.

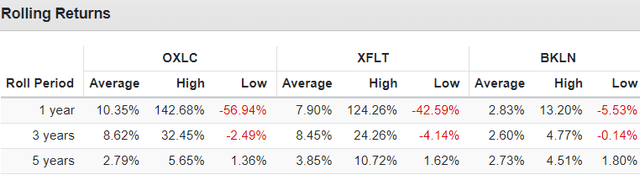

Amid inherent volatility, CLO equity positions have demonstrated considerable cash inflows, making Oxford Lane Capital (OXLC) a lucrative yet turbulent investment proposition in this space.

For those seeking a more stable alternative, Invesco Senior Loan ETF (BKLN) presents an opportunity with lower volatility, albeit at the expense of reduced yields and overall returns.

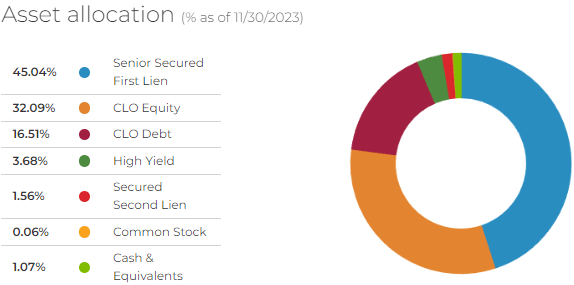

Enter XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT), a portfolio blending CLO debt, CLO equity, and direct loan ownership, providing a balanced stance between high yields and stability.

This diversified approach has culminated in XFLT showcasing lower volatility than pure CLO equity CEFs, evidenced by its swift restoration of distributions post-COVID and its current higher distribution vis-à-vis pre-pandemic levels.

Moreover, XFLT’s resilience is underscored by its comparatively stable income provision and a proactive portfolio expansion amid the market downturn, portraying strategic positioning to capitalize on future yield recoveries.

Offering a 13.7% yield, XFLT embodies a compelling proposition for investors, marrying robust income potential with measured volatility and the prospect of burgeoning distributions.

Parting Thoughts

In EPR and XFLT, investors stand to reap robust income rewards while having a stake in the everyday experiences of countless Americans — an endearing characteristic that underscores the relatability and resonance of these investment avenues.

As retirement beckons, the steady monthly income from such investments not only eases financial management but also injects a sense of tranquility, freeing individuals to savor pursuits they cherish, unencumbered by monetary preoccupations.

In the realm of income investing, EPR and XFLT represent not just financial astuteness but also a pathway to a more serene and fulfilling retirement, emblematic of the intrinsic allure of dependable income generation.

That’s the captivating allure of the Income Method — a blend of financial prudence and emotional tranquility that encapsulates the essence of these investment opportunities.