Enterprise Products Partners (NYSE:EPD) made a bold move last fall by deciding to leverage debt to seize opportunities for accelerated earnings growth. Unsurprisingly, Mr. Market reacted with a grimace, triggering a 10% slump in the stock price. While the price has since rebounded, the ascent mirrors the appreciation in some other midstream stocks.

Post the announcement, discontent among Enterprise shareholders surfaced in comments on various articles, reflecting a sense of injury caused by the company’s pivot. Conversely, echoing my sentiment, Julian Lin also advocates for shareholders to be appreciative of this strategic shift.

The following article delves into the historical context and the ripple effects on earnings growth triggered by this pivotal decision, aiming to complement Julian’s perspective.

Enterprise Products Partners in Brief

Enterprise enthralls with its captivating investor presentations, offering a treasure trove of insightful big-picture data. Each investor should diligently absorb and ponder over the invaluable information provided, which extends well beyond the realm of midstream energy. A majority of energy commentaries either overlook or counteract essential constituents of the global landscape; Enterprise’s presentations rectify this shortfall.

These presentations also furnish a plethora of intricate details about their operations, which are beyond the scope of this article to summarize.

However, here are some salient bullet points encapsulating crucial elements:

- Enterprise is a fully integrated midstream energy company.

- They garner fees by transporting Natural Gas Liquids (NGLs), Crude Oil, Natural Gas, Petrochemicals, and Refined Products.

- They possess 20 deepwater docks and operate numerous processing plants converting NGLs into essential raw materials for producing multiple plastics.

- Their average Return on Invested Capital (ROIC) in growth projects has been a stellar 12% over the past decade.

- They boast an A-level credit rating, unrivaled in the midstream space.

To gauge their global footprint, let’s analyze their cash flows. The payout ratio, defined as the ratio of all distributions to cash from operations adjusted to eliminate changes in working capital (denoted as ACfO below), has marginally decreased over the last decade:

The payout ratio exceeded 60%, occasionally touching 80% until 2018, and has remained below 60% since then.

Risks Associated with Investing in Enterprise

Perusing the investor presentation linked above and other associated sources illuminates that prophecies regarding global peak oil are merely delusions conceived by the technically inept. Arjun Murti also articulates compelling supplementary material on substack.

Nonetheless, the oil and gas sectors, like all commodities, adhere to cyclical patterns. Extended periods of subdued prices could prompt reduced volumes passing through Enterprise’s facilities for several years, a phenomenon witnessed previously.

Consequently, this could impede the growth of ACfO and potentially impact dividends. However, given the current industry landscape, I am skeptical about an imminent impact.

An improbable yet conceivable scenario is a dispute escalating among the Duncan family and their associates, who collectively own almost a third of Enterprise’s shares. This schism could prompt the conversion of Enterprise from an MLP to a C-Corp, inflicting substantial adverse consequences upon current shareholders.

Furthermore, in a flight of fancy, adverse political actions could transpire, detrimentally impacting the industry and disrupting volumes, at least temporarily. In due course, such consequences would prompt a reversal, in my assessment.

For numerous decades, the oil and gas saga has fixated on new leases and licenses. The halting of these rapidly instigates euphoria among politicians seeking public acclaim and can be just as swiftly reversed. History attests to this narrative.

Enterprise Cash Flows Unraveled

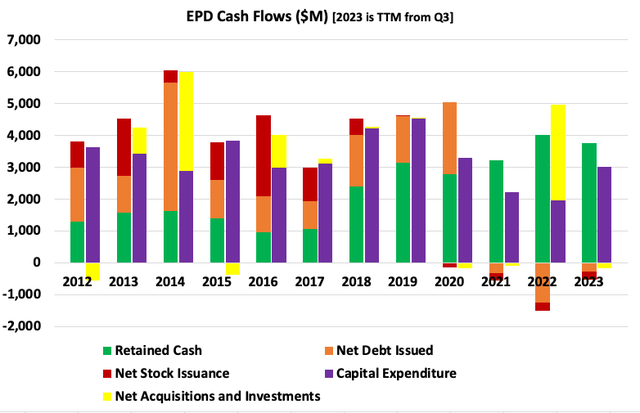

The overall cash flows reflect three phases in Enterprise’s business model:

From 2012 to 2017, Enterprise embraced a growth model that involved substantial capital infusion. The retained cash (ACfO minus distributions), denoted by green bars, languished below half of their capital expenditure.

Growth was financed through the issuance of fresh stock (red bars) complemented by new debt (orange bars). The combined corpus was comparable to ACfO, which, in turn, matched capital expenditure plus acquisitions.

The business model metamorphosed post-2016, with the curtailment and eventual cessation of stock issuance, and culminating, a few years later, with the initiation of buybacks. Favorable markets steered an upsurge in retained cash. The new debt maintained a neutral leverage position.

This model was fairly robust, as we shall elucidate further. However, in 2021, Enterprise halted the accumulation of new debt, precipitating net debt reduction. Why did this change transpire?

Striving for Self-Preservation

I rely on Michael Boyd and his Investing Group for insights and analysis related to energy investments. Michael frequently interacts with Enterprise management, offering invaluable insights into their strategic blueprint multiple times each year.