Flexsteel Industries (NASDAQ:FLXS) is a prominent furniture manufacturer and distributor, with a significant presence in over 2700 retail outlets and e-commerce channels across the United States. Under its umbrella, the company operates three core brands: Flexsteel, Charisma, and Homestyles, along with several sub-brands that cater to specialized markets. While most of its sales are driven by independent retailers, Flexsteel is actively strategizing to diversify its sales channels for future growth.

Flexsteel’s financial performance has been punctuated by volatility, as reflected in the erratic and predominantly lackluster stock price movements. Notably, the company’s investment in expansion has been relatively restrained, and it currently offers a dividend with a yield of 2.45%.

Historical Financial Turmoil

Historically, Flexsteel’s growth has been modest, with a compounded annual growth rate (CAGR) of 1.5% from FY2003 to the most recent trailing figures as of Q1/FY2024. The company has experienced fluctuating sales trends, including periods of both growth and decline. Particularly noteworthy is the sharp decline of 27.7% in revenues during FY2023, as consumer demand plummeted from its pandemic-induced peak to a level suppressed by reduced spending.

Before the pandemic, Flexsteel enjoyed several years of stable margins, boasting an average earnings before interest and taxes (EBIT) margin of 6.2% from FY2010 to FY2018. However, in FY2019, the company’s earnings nosedived into negative territory and have since oscillated, with the pandemic significantly disrupting industry dynamics. Currently, Flexsteel’s trailing EBIT margin stands at 2.4%, well below its pre-pandemic levels.

Robust Q2 Performance and Forward Guidance

In a mid-January report, Flexsteel revealed its preliminary Q2/FY2024 results from October to December. The company boasted a remarkable 7.5% sales growth amidst a challenging macroeconomic backdrop, coupled with impressive margin performance. Notably, its EBIT margin surged from 4.0% to 4.6% year-over-year, a feat made more impressive by the industry’s current struggles. For instance, competitors such as Bassett, Hooker Furnishings, and Ethan Allen Interiors have all faced substantial revenue declines during similar timeframes.

Buoyed by the robust Q2 performance, Flexsteel issued a bullish financial outlook, projecting a 3.6% revenue growth in FY2024, with an operating income of $17.7 million, representing a 4.3% margin for the year. This guidance for operating income more than doubles the preceding year’s figure of $7.8 million in FY2023.

Looking ahead to FY2025, Flexsteel predicts a revenue growth of 2% to 6% and an operating margin of 5.5% to 6.5%, signaling a return to more normalized market conditions. The company attributes these positive forecasts to a confluence of factors, such as enhanced productivity, cost savings, disciplined pricing, and improved product portfolio management, all of which have synergistically propelled its financial performance.

The subsequent 29% surge in the stock price and its continued upward trajectory post-announcement of the Q2 results attest to the investor community’s justified optimism regarding Flexsteel’s turnaround potential.

Ambitious Long-Term Targets

Looking beyond the FY2025 guidance, Flexsteel ambitiously aims for substantial earnings growth, as outlined in its January investor presentation. The company envisions long-term net sales of $750 million, including acquisitions, and an operating margin of 8%. While the revenue target could possibly be achieved through acquisitions, the aspiration of an 8% operating margin is considerably ambitious, considering that Flexsteel has not realized such a margin in any single year from FY2003 to the present. This target significantly surpasses the projected FY2025 outlook and appears contingent on substantial operational enhancements in the long run.

Flexsteel intends to actualize its improved financials by capitalizing on sales growth and persistently driving cost efficiencies. The company sees opportunities for growth by expanding its market reach beyond primary living areas, focusing on younger customer segments, bolstering its brand visibility, and augmenting alternate sales channels. The envisioned margin expansion hinges on achieving operating leverage through increased sales, securing higher margins on new products, and furthering cost optimization initiatives.

Despite the commendable Q2 results, the lofty earnings growth ambitions set forth by Flexsteel warrant a degree of skepticism. Given the company’s protracted history of earnings turbulence, it is rational to demand more concrete evidence before fully embracing these ambitious goals. Nevertheless, these aspirations hold profound allure for investors and offer substantial prospective upside in the future.

Stock Valuation: A Potentially Lucrative Proposition

In the wake of Flexsteel’s robust Q2 performance and unveiling of its earnings growth plans, the stock price has surged. Yet, with a price-to-earnings (P/E) multiple of 8.2 based on the mid-point of Flexsteel’s FY2025 outlook, the stock appears markedly undervalued.

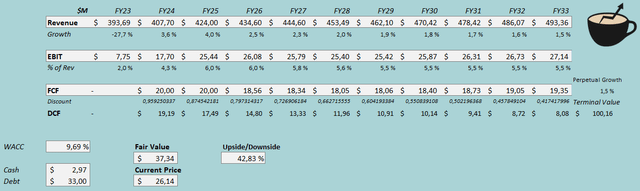

To underscore this undervaluation, I developed a discounted cash flow model to assess the stock’s intrinsic worth and potential.

Flexsteel’s Strong Financials Lead to Upbeat Outlook

In the DCF model, I factor in a scenario where Flexsteel achieves the outlook for FY2025 but has struggles in achieving the long-term growth plans. After FY2025, I estimate the growth to stay moderate at 2.5% in FY2026, and to slow down into the company’s historical long-term growth rate of just 1.5% in steps. For the EBIT margin, I estimate some deterioration from the FY2025 outlook’s middle point guidance of 6.0% – along with the poor sales growth, I estimate the margin to fall moderately to 5.5%. The company has quite a low maintenance CapEx and minimal investment needs with my growth estimates, making the cash flow conversion relatively good.

With the mentioned estimates along with a cost of capital of 9.69%, the DCF model estimates Flexsteel’s fair value at $37.34, around 43% above the stock price at the time of writing. The stock has significant upside to a scenario where Flexsteel’s long-term ambitions are far from being met; the market still prices in a very high amount of doubt. While I understand the doubt after just one quarter of very strong financials, I already believe that higher earnings should be priced in than the market seems to anticipate. My estimates estimate an average annual FCF of $18.9 million, around half of Flexsteel’s long-term ambition of $40 million.

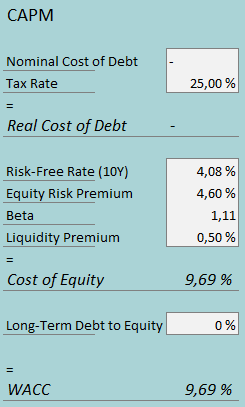

The used weighed average cost of capital is derived from a capital asset pricing model:

In Q1/FY2024, Flexsteel had $0.6 million in interest expenses due to the company’s remaining line of credit borrowings. As the company plans to pay off its interest-bearing debts in the next couple of quarters, though, I don’t estimate Flexsteel to have any debt as a form of financing in the long term. For the risk-free rate on the cost of equity side, I use the United States’ 10-year bond yield of 4.08%. The equity risk premium of 4.60% is Professor Aswath Damodaran’s latest estimate for the United States, made on the 5th of January.

Yahoo Finance estimates Flexsteel’s beta at a figure of 0.51. I don’t believe that the beta is very representative of Flexsteel’s sustainable risk level, so instead I use the average of Flexsteel and three other furnishing companies’ betas – Flexsteel’s beta of 0.51, Bassett’s beta of 1.65, Hooker Furnishings’ beta of 1.09, and Ethan Allen Interiors’ beta of 1.20 create an average of 1.11, which I use in the CAPM. Finally, I add a small liquidity premium of 0.5%, crafting a cost of equity and WACC of 9.69%.

Positive Prognosis Amid Market Doubt

Flexsteel reported very strong preliminary Q2 results, and outstandingly good FY2024 & FY2025 outlooks. In addition, the company reported high long-term earnings growth ambitions, leading the stock to skyrocket. While Flexsteel’s long-term earnings history is quite turbulent, and doesn’t fully support Flexsteel’s ambitions, I believe that the market still prices in a too high amount of doubt – in my baseline scenario where Flexsteel falls back into a pre-pandemic performance, the stock still has a very high amount of upside. The stock seems to have a good amount of room to continue the rally. Although the investment case could be strong enough for a strong buy rating, I only have a buy rating for the time being as the investment case is likely to have volatility with upcoming quarters.