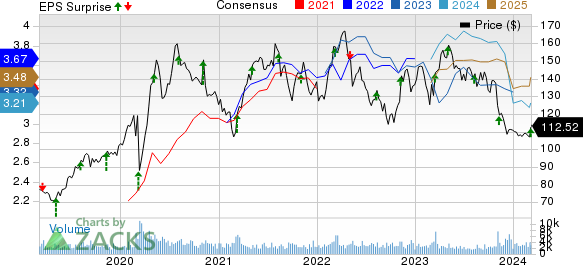

Franco-Nevada Corporation FNV posted adjusted earnings per share (EPS) of 90 cents for the final quarter of 2023, a notable 5% increase from the previous year. Surpassing the Zacks Consensus Estimate of 80 cents, the company showcased resilience in the face of challenging market dynamics.

Challenges and Triumphs

The reported quarter saw the company’s revenues at $303 million, marking a decline of 5.3% year-over-year. Lower gas, platinum group metals, and oil prices contributed to this downturn, somewhat offset by higher gold prices. Despite this setback, Franco-Nevada persisted with 78.7% of revenues streaming from Precious Metal assets, signaling a strong foothold in the market.

The sale of 119,581 Gold Equivalent Ounces (GEOs) from precious metal assets experienced a 7.8% dip in the reported quarter compared to the same period in the prior year. Reduced deliveries from Cobre Panama, Candelaria, and Stillwater were partially overshadowed by increased contributions from Antapaccay, MWS, and Hemlo.

In terms of adjusted EBITDA, the company reported a 3% year-over-year decline to $255 million in the same quarter, underscoring its efforts to navigate a challenging operational landscape with poise and prudence.

Financial Evolution

Diving into their financial position, Franco-Nevada ended 2023 with $1.4 billion in cash reserves, showing an increase from $1.2 billion at the close of 2022. Despite registering a slightly lower operating cash flow of $991 million in 2023 compared to $999.5 million in 2022, the company displayed financial fortitude and forward-thinking strategies.

With a debt-free status, the company leverages its free cash flow to bolster its portfolio and provide dividends. Currently harboring available capital of $2.4 billion, Franco-Nevada emerges as a prudent player in the financial terrain, showcasing fiscal resilience in a volatile market environment.

The Road Traveled

Reflecting on Franco-Nevada’s journey in 2023, the company unveiled an adjusted EPS of $3.56, a slight decline from $3.64 in the previous year. While sales experienced a 7.3% slump year-over-year to $1.22 billion, the company’s earnings outperformed the Zacks Consensus Estimate, underlining its ability to navigate challenges and sustain investor trust.

Looking forward, Franco-Nevada anticipates total GEOs to range between 480,000 and 540,000 in 2024. With precious metal assets contributing GEOs in the range of 360,000 to 400,000, the company projects an outlook marked by nuanced market dynamics and prepares to weather fluctuations in oil and gas prices.

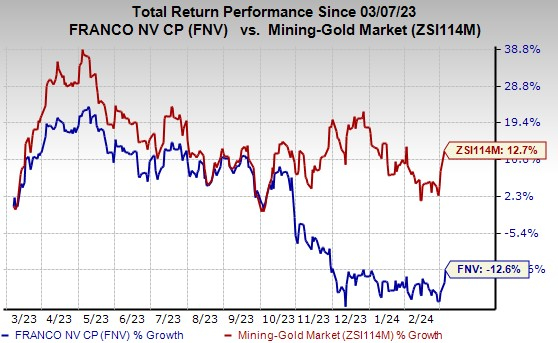

Amid a turbulent market backdrop, Franco-Nevada’s shares witnessed a 12.6% downturn in the past year, juxtaposed against the industry’s 12.7% growth. Despite this contraction, the company’s robust operational strategies and financial acumen position it well to steer through market fluctuations and emerge stronger in the long run.

Image Source: Zacks Investment Research

The Bright Future

While currently carrying a Zacks Rank #3 (Hold), Franco-Nevada stands out amidst other players in the basic materials space. Noteworthy stocks to consider include Ecolab Inc., Alpha Metallurgical Resources, Inc., and Carpenter Technology Corporation, each showcasing promising growth trajectories within the market’s dynamic landscape.

Diving into individual performances, Ecolab Inc., with an expected 22.7% increase in 2024 earnings, presents a compelling investment opportunity. Alpha Metallurgical Resources, Inc., and Carpenter Technology Corporation also unveil growth potential, making them viable candidates for investors seeking consistent returns in the market.

The prudent financial strategies beheld by these companies paint a picture of resilience and growth potential, offering investors a diverse array of options within the basic materials sector.