GE HealthCare Technologies Inc. GEHC has recently forged a strategic alliance with OSF HealthCare and Pointcore, Inc. to revolutionize clinical and operational efficiencies, standardize care delivery models, and enhance patient outcomes across OSF HealthCare. This partnership is poised to harness GE HealthCare’s groundbreaking technology and Pointcore’s expertise in handling non-clinical matters for hospitals and clinics.

It’s worth noting that OSF HealthCare is an integrated health system providing care for patients across Illinois and Michigan, while Pointcore is a healthcare management and non-clinical shared services company.

This significant collaboration is expected to bolster GE HealthCare’s position in numerous care areas, including nuclear medicine, oncology, and radiology, thereby giving a fillip to its Imaging business.

The Reasoning Behind the Alliance

The alliance is built on two crucial pillars, designed to deepen GE HealthCare, OSF HealthCare and Pointcore’s shared focus on a foundational alliance that encompasses investment in new technology systems, digital tools, resources, service and support across various care areas. This partnership will also usher in a new investment approach in innovation, employing advanced analytics to streamline capital management, allowing OSF HealthCare to reinvest in patient care.

In the wake of these accords, OSF HealthCare will become one of the first healthcare systems in the United States to implement GE HealthCare’s latest iteration of Digital Expert Access with remote scanning, a device that is the first FDA 510(k)-cleared apparatus to enable remote patient scanning on GE HealthCare Magnetic Resonance Imaging devices.

According to GE HealthCare’s management, the collaboration aims to improve access to quality care for all patients, regardless of their geographical location.

Industry Prospects

According to a report by Precedence Research, the global precision oncology market’s value reached $100.06 billion in 2022 and is anticipated to surpass $258.35 billion by 2032, at a CAGR of about 9.9%. Factors such as the increasing prevalence of cancer and the development of advanced technologies are projected to propel the market growth.

Given the market’s potential, the recent collaboration is expected to provide a significant impetus to GE HealthCare’s global business.

Recent Progress

This month, GE HealthCare unveiled a three-year collaboration with MedQuest Associates to enhance patient care by providing access to advanced technologies from GE HealthCare and the necessary infrastructure and resources from MedQuest to optimize multi-site outpatient imaging networks. Furthermore, GE HealthCare’s fourth-quarter 2023 results demonstrated a solid uptick in revenues, both on a reported and organic basis, with robust performance in its Imaging segment.

In January, GE HealthCare announced its latest innovation in electrophysiology (EP), the Prucka 3 with CardioLab EP Recording system, aimed at assisting clinicians in diagnosing and treating cardiac arrhythmias.

Price Performance

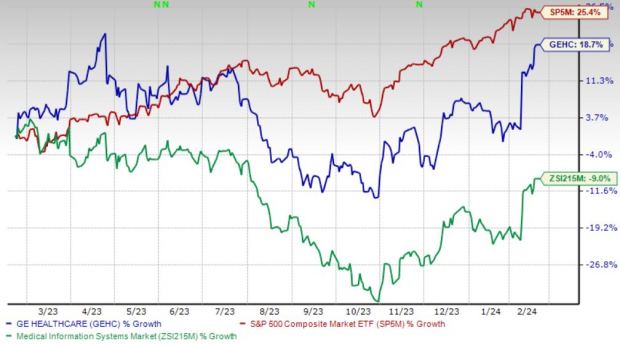

Over the past year, shares of GE HealthCare have surged 18.7%, outperforming the industry’s 8.9% decline. Meanwhile, the S&P 500 has witnessed 25.4% growth in the same period.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Presently, GE HealthCare holds a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space include DaVita Inc. DVA, Cardinal Health, Inc. CAH and Integer Holdings Corporation ITGR.

DaVita, carrying a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 12.1%. DVA’s earnings have surpassed estimates in each of the last four quarters, with an average surprise of 35.6%. DaVita’s shares have gained 47.1% compared with the industry’s 11.6% rise in the past year.

Cardinal Health, sporting a Zacks Rank of 2 (Buy) currently, possesses an estimated long-term growth rate of 15.9%. CAH’s earnings have exceeded estimates in each of the trailing four quarters, with an average surpass of 15.6%. Cardinal Health has gained 33.6% compared with the industry’s 11.3% rise in the past year.

Integer Holdings, holding a Zacks Rank of 2 currently, has an estimated long-term growth rate of 15%. ITGR’s earnings have outperformed estimates in each of the last four quarters, with an average surprise of 11.5%. Integer Holdings’ shares have rallied 34.9% compared with the industry’s 9.3% rise in the past year.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.