HC Wainwright Initiates ‘Buy’ Recommendation for Mural Oncology with Significant Upside Potential

Analyst Forecasts Point to Major Growth for Mural Oncology

On October 17, 2024, HC Wainwright & Co. launched coverage of Mural Oncology (NasdaqGM:MURA) with a strong Buy outlook.

The average one-year price target for Mural Oncology stands at $13.26/share as of September 25, 2024. Projections vary slightly, with estimates ranging from a low of $13.13 to a high of $13.65. This average indicates a substantial increase of 258.38% from the company’s most recent closing price of $3.70/share.

Explore our leaderboard featuring companies with the greatest potential for price target upside.

The forecasted annual revenue for Mural Oncology is projected at $0 million, while the anticipated annual non-GAAP EPS is -10.84.

Current Fund Sentiment Surrounding Mural Oncology

As of now, 130 funds or institutions hold positions in Mural Oncology. This marks a decrease of 38 owners or 22.62% since the last quarter. The average portfolio weight attributed to MURA by these funds is 0.04%, reflecting a small increase of 0.72%. In the past three months, total shares owned by institutions fell by 10.31% to 11,137K shares.

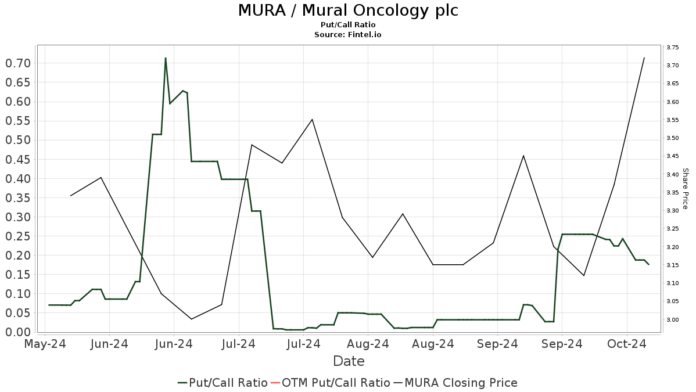

The put/call ratio for MURA stands at 0.18, signaling a bullish sentiment among investors.

Activity Among Other Shareholders

Armistice Capital currently holds 1,688K shares, which constitutes 9.91% ownership of the company. This indicates an increase from the 1,658K shares reported previously, though they reduced their portfolio allocation in MURA by 37.98% over the last quarter.

Solas Capital Management now possesses 1,269K shares, accounting for 7.45% ownership, up from 749K shares prior, representing a substantial increase of 40.98%. However, they cut their portfolio allocation by 7.51% during the same period.

Westfield Capital Management Co reduced their holdings significantly, now owning 743K shares or 4.36%. This is a sharp decrease from their previous 1,548K shares, translating to a 108.26% downturn in ownership. Their portfolio allocation in MURA dipped by 71.15% in the last quarter.

Alta Fundamental Advisers currently holds 720K shares, representing 4.23% ownership, down slightly from 723K shares, reflecting a decrease of 0.43% in the last quarter. Their portfolio share in MURA fell by 46.43%.

Newtyn Management retains 570K shares, which accounts for 3.35% ownership. They increased their holdings from 500K shares, marking an increase of 12.28%. Still, their portfolio allocation decreased by 31.00% over the past quarter.

Fintel is recognized as a leading research platform for investors, traders, financial advisors, and small hedge funds, providing a wealth of data on company fundamentals, analyst insights, ownership statistics, and market sentiment.

Discover more about investment opportunities.

This report originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.