Artificial intelligence (AI) is an incredible technology that is changing how business is conducted and how people search the internet. However, this isn’t happening without substantial input costs. Many big tech firms are investing millions (if not billions) of dollars into their computing infrastructure to support the rise of AI.

However, not all investors like this. If these companies spend on infrastructure, they’re posting smaller profits. That’s not music to the market’s ears, so when companies mention that, they can get hit. That’s exactly what happened to Meta Platforms (NASDAQ: META) after it reported first-quarter results. But the information companies like Meta give investors during their conference calls can be like gold, as the crumbs of all the conference calls reveal one clear winner.

Meta’s spending is going to ramp up soon

In Meta’s Q1 conference call, Susan Li, Meta’s CFO, discussed the company’s investment in AI infrastructure:

As we develop more advanced and compute-intensive recommendation models and scale capacity for our generative AI training and inference needs, we expect that having sufficient infrastructure capacity will be critical to realizing many of these opportunities. As a result, we expect that we will invest significantly more in infrastructure over the coming years.

Prior to that, she mentioned that Meta sees great opportunities in the various AI technologies it’s developing. This is a long-term investment, and with most investors in the market focused only on the short term, this announcement isn’t what they wanted.

As a result, Meta increased its 2024 capital expenditure costs to $35 billion to $40 billion from its previous $30 billion to $37 billion. It also stated that even though it hasn’t issued guidance for next year, it expects it to increase thanks to AI research.

Clearly, the infrastructure needed for AI buildout isn’t done yet. Another company shares the same sentiment.

Tesla officials mentioned in the company’s conference call with analysts that it has 35,000 H100 graphics processing units (GPUs; made by Nvidia (NASDAQ: NVDA)) up and running, but that number should increase to 85,000 by the end of the year.

Meta is also using Nvidia’s products, so it’s becoming clear who the real winner in all of this is: Nvidia.

Nvidia’s GPUs power the rise of AI

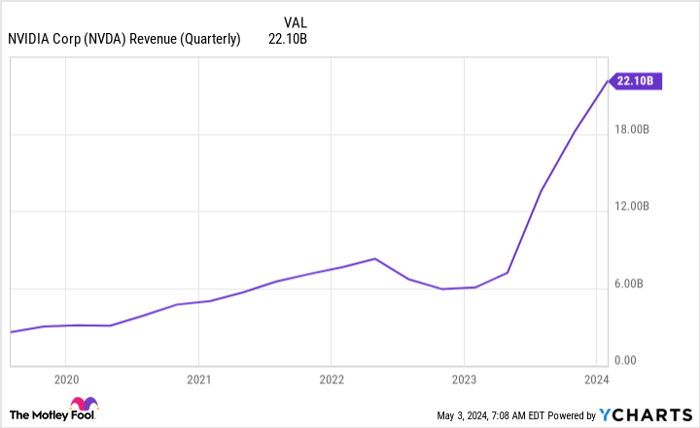

Nvidia is the market leader in GPUs and has a significant market share advantage over its competitors. Its growth has been nothing short of incredible over the past year. Announcements like Meta’s stating they will only accelerate their infrastructure buildout are a bullish sign for the company.

NVDA Revenue (Quarterly) data by YCharts.

Furthermore, the GPUs customers are installing now may be obsolete in five years, so there should be significant revenue in the future as older GPUs are cycled out. This gives credence to analyst firms like Precedence Research, which believes the global GPU market opportunity could be $773 billion by 2032. With Nvidia already holding a significant market share, it’s set to capture a large chunk of this opportunity.

This already helped transform Nvidia into one of the world’s most powerful companies, and it’s not set to relinquish that title soon. As more companies build out their AI products, Nvidia will be set to benefit.

But does that make the stock a buy?

Because Nvidia is still growing rapidly, using trailing metrics is unwise. So, we’ll look at its forward price-to-earnings (P/E) ratio.

NVDA PE Ratio (Forward) data by YCharts. PE = price to earnings.

At 34 times forward earnings, Nvidia is still a very expensive stock with many expectations baked into it. But if its growth rate continues for several years, this still could be a bargain price for the stock, as long as you’re willing to endure the volatility it brings.

If you can, it’s clear that the long-term opportunity for Nvidia’s primary product is still there, and the infrastructure needed to support the proliferation of AI is yet to be fully constructed.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $564,547!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 6, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Meta Platforms and Tesla. The Motley Fool has positions in and recommends Meta Platforms, Nvidia, and Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.