Meta Platforms (NASDAQ: META) stock has been on quite a run in 2024, with the stock up around 20% this year. Normally, investors would consider that a pretty good year, but up until a week ago, that figure was over 40%.

Thanks to a 10% plummet the day following its earnings report, Meta lost a lot of ground it had gained. But unlike some investors, I don’t think this news is a reason to sell; it’s one to buy.

Meta Platforms is still an advertising business at heart

Meta Platforms is probably better known by its former name, Facebook. Even though it changed its name a couple of years ago, Meta Platforms is still driven by its social media platforms: Facebook, Instagram, Threads, WhatsApp, and Messenger.

However, its name change signaled its shift into developing the metaverse and other cutting-edge products. And this other division, Reality Labs, has been quite a money pit for Meta. In the fourth quarter, Reality Labs saw its highest revenue total, adding $1 billion to the top line. Yet it lost $4.6 billion in operating income. Q1 wasn’t any better, with revenue of $440 million and an operating loss of $3.8 billion.

In 2022, Reality Labs’ expenditures seemed like a Mark Zuckerberg pet project, and many investors were frustrated that Meta was burning money in pursuit of unprofitable goals. In 2023, the company turned it around by cutting costs in this division, which boosted profits and made investors happy.

However, Meta looks like it’s about to repeat the same mistake.

Its forward-looking guidance raised the range of its 2024 capital expenditures (capex) “to accelerate our infrastructure investments to support our AI [artificial intelligence] roadmap.” Furthermore, management stated that capex will likely increase in years to come because of this aggressive AI roadmap.

That’s why Meta’s stock plummeted after earnings, as investors felt like they were reliving 2022 all over again. However, this time I think it’s different.

The stock is on sale thanks to investor pessimism

It’s obvious that artificial intelligence will become a much larger part of this world. For Meta to survive and thrive, it will need AI models to assist its advertising platform and integrate into other hardware projects it has going on.

The biggest example is Meta’s digital assistant AI glasses, which it collaborated with Ray-Ban (a subsidiary of EssilorLuxottica) to make. This AI assistant can see what you’re looking at (because of embedded cameras within the glasses) and answer questions. While this technology hasn’t hit the mainstream yet, it could change how society functions.

If even one of its Reality Labs products becomes a mainstream hit, Meta will have created a lucrative new revenue stream.

But if it doesn’t, the core business is still quite profitable.

In Q1, Meta’s overall revenue rose 27% due to the strength in its ad business. Thanks to various efficiency measures in 2023, operating margin also massively improved from 25% to 38%. The company also expects a strong Q2, with revenue expected to grow by around 18%.

Clearly, Meta is doing just fine as a business. Investors are just a bit worried that history will repeat itself with its latest round of AI investments. I’m not worried, as this technology actually has a more monetizable use case than the metaverse did.

Due to the stock drop, it’s also much cheaper than it was just a few days ago.

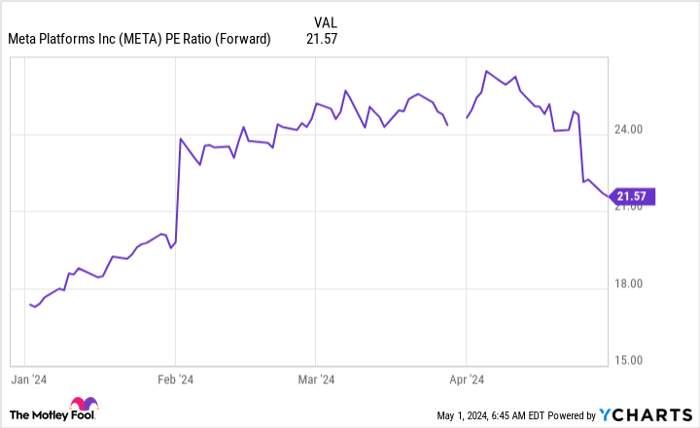

META PE Ratio (Forward) data by YCharts.

At just under 22 times sales, it’s fairly priced and nearly in line with the S&P 500‘s price tag of 20.8 times forward earnings.

I liked Meta’s stock even before the fall. Now that it’s much cheaper, I’m an even bigger fan, and will keep buying this long-term winner.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 3, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Meta Platforms. The Motley Fool has positions in and recommends Meta Platforms. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.