A Glimpse into Bruker Corporation’s Future

Bruker Corporation (BRKR) stands tall amidst the winds of market upheaval, driven by the promising potential of the Bruker Scientific Instruments (BSI) BioSpin and CALID groups. The BioSpin arm showcases resilience across various sectors, including the innovative IDS division, painting a picture of robust solvency. However, the company remains susceptible to macroeconomic headwinds and cut-throat competition, casting a shadow on its future performance.

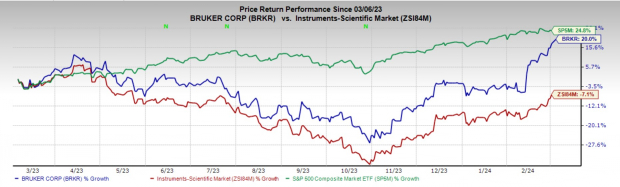

In the last year, this Zacks Rank #3 (Hold) entity soared by 20%, in stark contrast to the industry’s slump of 7.1%, and the S&P 500’s commendable 24.8% surge.

Finding Bright Spots Amid Challenges

BioSpin’s Enthralling Prospects: The offerings from Bruker BioSpin shine brightly in applications such as structural proteomics, drug discovery, and research in various scientific fields. These products empower users to unravel the intricacies of specific molecules like proteins, unraveling their structure, dynamics, and functionalities, along with characterizing mixtures accurately.

Image Source: Zacks Investment Research

In 2023, the BioSpin segment notched growth in biopharma, academia, government, industrial research, and the IDS division. The company’s contributions also bolstered advanced life and materials science research infrastructure in the United Kingdom. Notably, during the fourth quarter of 2023, Bruker deployed the first 1.2-gigahertz NMR in the United States at Ohio State University and a 1.1-gigahertz NMR at the University of Wisconsin at Madison.

Potential of the CALID Group: Bruker’s CALID Group reaps benefits from the steady expansion in mass spectrometry business, featuring the FT-IR, Near IR, and Raman molecular spectroscopy lines. In 2023, BRKR unveiled timsTOF Ultra, showcasing market-leading sensitivity and throughput with enriched peptide coverage, ensuring more precise quantitation in unbiased 4D single-cell cell lines and tissue proteomics.

Further, Bruker’s majority investment in the Swiss start-up, MIRO Analytical AG, complements the company’s gas-analysis spectroscopy portfolio in the Optics division with fast, compact, high-precision QCL multi-trace gas analyzers.

Rising Strong but Carrying Debt: As of Q4 2023, Bruker boasted $488.3 million in cash and equivalents, surpassing the $121.2 million in current maturities of long-term debt. This indicates a robust financial stance. Furthermore, total debt stood at $1.16 billion, slightly down from $1.20 billion in 2022.

Battling the Storms: Challenges Ahead

Impact of Macroeconomics: With a widespread footprint spanning the United States, Russia, and various European nations, Bruker confronts the uncertainties of the global economic landscape. Turbulence in financial markets worldwide poses risks to Bruker’s clients, potentially hindering their financing capabilities and capital spending initiatives. Such hurdles may lead to reduced sales volumes, impacting operational results and cash flows.

Economic woes also expose Bruker to heightened pricing and cost pressures, potentially denting operating margins and profitability. In Q4 2023, the company witnessed a 23.9% surge in cost of revenues year over year, dragging the gross margin down by 129 basis points.

Navigating Competition: Bruker faces fierce rivalry in an industry undergoing consolidation, with mounting competitive pressures across all markets. Established players vying with Bruker offer products with similar functionalities, with some having expanded market share via strategic mergers. The prospect of new entrants further intensifies the competitive landscape, adding to the company’s challenges.

Forecasting the Path Ahead

The Zacks Consensus Estimate for Bruker’s 2024 EPS witnessed a 0.4% uptick to $2.74 over the past 30 days. Revenue estimates for 2024 are pegged at $3.27 billion, implying a robust 10.3% surge from the prior year.

Exploring Alternatives in the Realm of Medical Stocks

Venturing into the broader medical landscape, investors might find solace in stocks like Cardinal Health (CAH), Stryker (SYK), and DaVita (DVA).

In Conclusion

Bruker Corporation’s journey ahead is filled with both promises and perils. As the company navigates the turbulent waters of the market, investors are urged to keenly observe how its strategic initiatives unfold in the face of macroeconomic challenges and mounting competition. While opportunities abound, the path ahead is laden with obstacles that the company must adeptly circumvent to emerge triumphantly in the realm of scientific innovation and medical technology.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

See New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Bruker Corporation (BRKR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.