ResMed Inc. RMD is set for substantial growth in the upcoming quarters, fueled by the global distribution of its cloud-connected platforms, AirSense10 and AirSense11. The company’s sturdy and sustained growth in the SaaS business evokes confidence. However, concerns loom over the mounting debt levels and competitive landscape.

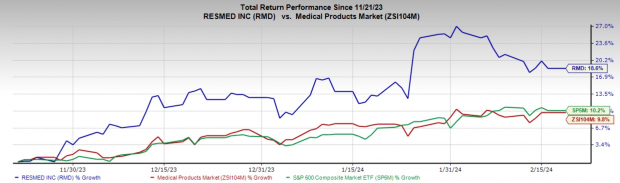

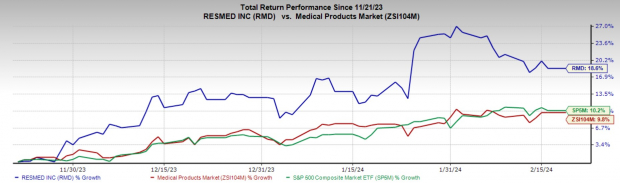

Over the last three months, this Zacks Rank #3 (Hold) stock has surged by 18.6% compared to the 9.8% rise of the industry and a 10.2% increase of the S&P 500 composite.

The esteemed medical device company boasts a market capitalization of $25.04 billion. Its earnings have exceeded estimates in three of the past four quarters with an average earnings surprise of 1.83%.

Bright Sides

Revival in Device Sales: ResMed’s heightened device sales continue to propel overall revenue growth, mirroring the ongoing wide availability of AirSense 10 and AirSense 11 sleep devices in meeting robust underlying global demand. The adoption rates of the myAir app by new patients set up on therapy with the AirSense 11 continue to be more than double that of AirSense 10. The patient utilization of a digital health platform like myAir is directly linked to higher adherence to therapy, which is directly related to better patient outcomes and increased resupply, ultimately driving better outcomes for the payer and the provider.

Potential in Digital Health: ResMed is advancing several digital health technology initiatives to enhance the value proposition for its connected healthcare ecosystem.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

In its latest development, ResMed is spearheading the market in digital health technology, with over 17 billion nights of medical data in the cloud and nearly 23.5 million cloud-connectable medical devices in 140 countries worldwide. The company is freeing this data to the cloud, unlocking value for patients, providers, physicians, payers, and entire healthcare systems.

Strategic Partnerships to Boost SaaS Business: The company consistently seeks strategic acquisitions to bolster SaaS revenues. The most recent addition to the portfolio, MEDIFOX DAN, continues to surpass the company’s initial expectations with an accelerated contribution. Investing in the leading German healthcare system aligns with ResMed’s vision of lower cost, lower acuity, and highest-quality outcome care for patients. As of the latest update at the end of fiscal Q2, ResMed’s SaaS business is currently reflecting robust contributions from MEDIFOX DAN in Germany and growth across Brightree and MatrixCare brands in the U.S. market.

Downsides

Rising Debt Level: The company’s high debt level is a cause for concern. As of Dec 31, 2023, long-term debt stood at $1.26 billion, whereas the cash and cash equivalents balance was only $210.2 million. A higher debt level leads to increased interest payments, posing the risk of default. At the end of the second quarter of fiscal 2024, the company’s times-interest-earned ratio was 19.7%, sequentially lower than the first-quarter fiscal 2024 ratio of 21.7%.

Competitive Landscape: The market for SDB products is highly competitive in terms of product price, features, and reliability. ResMed’s key competitors include Philips BV, DeVilbiss Healthcare, Fisher & Paykel Healthcare Corporation Limited, Apex Medical Corporation, BMC Medical Co. Ltd., and regional manufacturers. The gap between the company’s resources and those of its competitors may widen due to consolidation in the healthcare industry.

Trend in Estimates

The Zacks Consensus Estimate for RMD’s fiscal 2024 earnings per share (EPS) has decreased from $7.35 to $7.39 in the past 90 days.

The Zacks Consensus Estimate for the company’s fiscal 2024 revenues is projected to reach $4.65 billion, indicating a 10.0% increase from the year-ago reported figure.

Promising Picks

Some better-ranked stocks in the broader medical space include Stryker Corporation SYK, Cencora, Inc. COR, and Cardinal Health CAH.

Stryker, holding a Zacks Rank #2 (Buy), reported an adjusted EPS of $3.46 in the fourth quarter of 2023, surpassing the Zacks Consensus Estimate by 5.8%. Revenues of $5.8 billion exceeded the consensus estimate by 3.8%. Stryker has an estimated earnings growth rate of 11.5% for 2025 compared to the S&P 500’s 9.9%. The company’s earnings have surpassed estimates in each of the trailing four quarters, with an average of 5.1%.

Cencora, with a Zacks Rank #2, posted a first-quarter fiscal 2024 adjusted EPS of $3.28, exceeding the Zacks Consensus Estimate by 14.7%. Revenues of $72.3 billion also outpaced the Zacks Consensus Estimate by 5.1%. COR has an earnings yield of 5.75% compared to the industry’s 1.85%. The company’s earnings have surpassed estimates in each of the trailing four quarters, with an average surprise of 6.7%.

Cardinal Health, carrying a Zacks Rank #2, reported second-quarter fiscal 2024 adjusted earnings of $1.82, surpassing the Zacks Consensus Estimate by 16.7%. Revenues of $57.45 billion increased by 11.6% on a year-over-year basis and exceeded the Zacks Consensus Estimate by 1.1%. CAH has a long-term estimated earnings growth rate of 15.3% compared to the industry’s 11.8%. The company’s earnings have surpassed estimates in each of the trailing four quarters, with an average surprise of 15.6%.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.