Celebrating Research & Development

Embracing a journey of innovation, Ecolab Inc. (ECL) is reaping the rewards of its unwavering focus on research and development. The company’s recent performance in the fourth quarter of 2023 stands as a testament to this commitment. With a robust product portfolio at its helm, Ecolab is poised for future growth. Nonetheless, challenges loom on the horizon, marked by cost fluctuations and the looming specter of integration impediments.

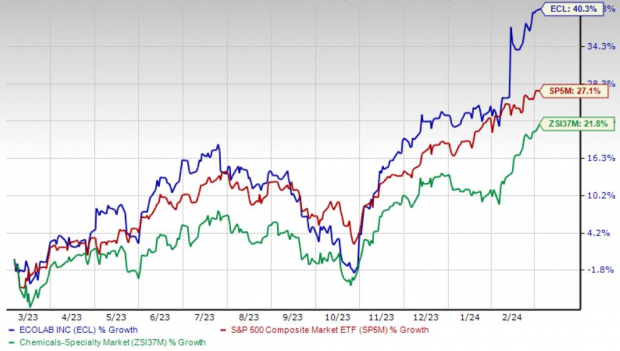

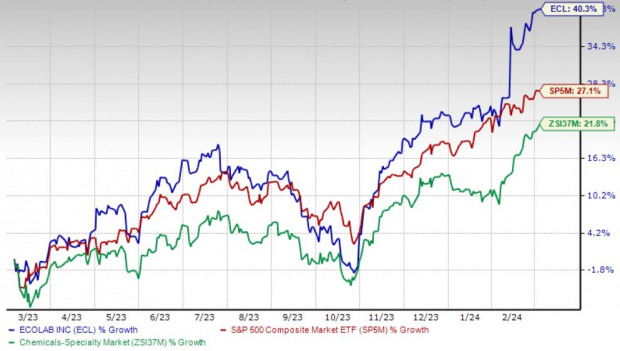

Over the past year, Ecolab stock has ascended by 40.3%, outstripping the industry’s climb of 21.8% and the S&P 500 Composite’s 27.1% surge.

Market Strength and Projections

Boasting a market capitalization of $64.49 billion, Ecolab envisions a 13.3% growth trajectory over the next five years. The company’s consistent outperformance is underscored by its earnings consistently surpassing the Zacks Consensus Estimate over the trailing four quarters.

Image Source: Zacks Investment Research

A Deeper Dive

Focus on R&D: Ecolab’s commitment to research and development is pivotal in crafting new products, enhancing existing ones, and staying ahead in the industry. Continuous innovation serves as a cornerstone in the quest to expand its customer base and solidify its competitive edge.

Product Portfolio: Optimism surges around Ecolab’s suite of cleaning, sanitizing, and pest elimination products. These offerings cater to a diverse range of sectors encompassing foodservice, healthcare, education, and industrial processes.

Strong Q4 Results: The company’s stellar performance in the fourth quarter of 2023 underscores a robust uptick in top and bottom-line figures across various segments. Noteworthy pricing momentum, coupled with a rich pipeline of cutting-edge technologies, sets a promising trajectory for growth.

Challenges Ahead

Cost Fluctuations: Volatility in raw material prices poses a notable risk to Ecolab’s operations. The company remains susceptible to adverse impacts on its consolidated results if raw material costs escalate beyond control.

Possibility of Unsuccessful Integration: Ecolab’s pursuit of acquiring complementary businesses opens the door to integration risks. A misstep in assimilating new entities could potentially mar the company’s operational efficiency and financial performance.

Estimate Trend

Gaining momentum, Ecolab witnesses a positive trend in estimate revisions for 2024. The Zacks Consensus Estimate for 2024 earnings has escalated by 6.5% in the past 90 days.

The projected first-quarter 2024 revenues stand at $3.75 billion, reflecting a promising 5% growth from the previous year’s figures.

Other Top Picks in the Industry

Among other notable contenders in the medical domain are DaVita Inc. (DVA), Cardinal Health, Inc. (CAH), and Cencora, Inc. (COR).

DaVita, holding a Zacks Rank #1 (Strong Buy), boasts a commendable long-term growth rate projection of 12.1%. The company’s stellar track record in consistently surpassing earnings estimates underscores its robust performance.

Cardinal Health, with a Zacks Rank of 1, anticipates a long-term growth rate of 14.2%. The company’s consistent earnings beat streak exemplifies stability and growth potential in the industry.

Cencora, assigned a Zacks Rank of 2, eyes a long-term growth rate of 9.8%. The company’s earnings resilience over the past four quarters highlights a promising trajectory for growth.

In a landscape filled with promising prospects, Ecolab (ECL) stands out as a beacon of innovation and growth. As investors navigate through the market dynamics, Ecolab’s strategic focus on R&D, diverse product portfolio, and robust performance paint a tantalizing picture of future potential.

Interested in exploring more top picks for investment opportunities? Dive into Zacks Investment Research to unveil the gems that can shape your investment journey.