Masimo Corporation MASI is well-poised for growth in the coming quarters, courtesy of its research and development (R&D) efforts. The optimism, led by a solid preliminary fourth-quarter 2023 performance and a few regulatory approvals, is expected to contribute further. However, concerns regarding overdependence on its Signal Extraction Technology (SET) unit and macroeconomic factors persist.

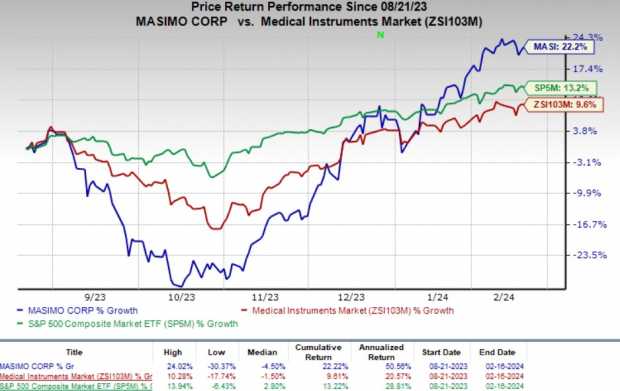

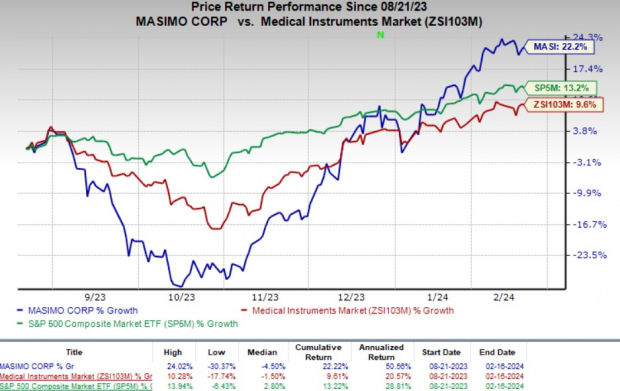

Over the past six months, this currently Zacks Rank #1 (Strong Buy) company’s shares have risen 22.2% compared with the industry’s 9.6% growth. The S&P 500 has witnessed 13.2% rise in the said time frame.

A Strong Performer

The renowned global provider of non-invasive monitoring systems has a market capitalization of $7.12 billion. The company projects 2.2% growth for 2024 revenues. Masimo’s earnings yield of 2.6% compares favorably with the industry’s negative yield.

Image Source: Zacks Investment Research

Let’s delve deeper.

Evidence of Growth

Regulatory Approvals: Masimo has been receiving regulatory approvals for its products over the past few months, thereby raising our optimism. Last month, the company announced the receipt of the FDA’s clearance for Stork for prescription use with healthy and sick infants aged 0-18 months.

The FDA approved Masimo SET-powered MightySat Medical Pulse Oximeter to be sold over-the-counter without prescription, last month. In December, Masmo received the FDA clearance for Stork for prescription use with healthy and sick infants aged 0-18 months. In November, Masimo announced the receipt of the FDA’s 510(k) clearance for over-the-counter and prescription use of the Masimo W1 medical watch.

Research and Product Development: We are upbeat about MASI’s ongoing R&D efforts, which it believes are essential to its success. Its R&D efforts focus on continuing to enhance its technical expertise toward its existing product portfolios and expanding its technological leadership in each of the markets, among others. Additionally, the company continues to collaborate with Cercacor on R&D activities related to advancing rainbow technology and other technologies.

Glimpse of Success

Strong fourth-quarter Preliminary Results: Masimo’s preliminary fourth-quarter 2023 results buoy optimism. Per management, its healthcare business is transitioning away from COVID-era conditions. Also, management is beginning to see customer behavior and sensor purchasing patterns reverting to the pre-pandemic growth trend line.

Risks to Consider

Overdependence on Masimo SET: Masimo currently derives the majority of its revenues from its primary product offerings like the Masimo SET platform, Masimo rainbow SET platform and related products. Thus, the company’s business is highly dependent on the continued success and market acceptance of its primary product offerings.

Macroeconomic Concerns: Masimo’s consumer products are generally considered non-essential and discretionary. As such, many of these products can be especially sensitive to general downturns in the economy. Negative macroeconomic conditions such as high inflation, recession and decreasing consumer confidence can adversely impact the demand for these products, which could affect Masimo’s business.

Industry Analysis

MAS has been witnessing a positive estimate revision trend for 2024. In the past 60 days, the Zacks Consensus Estimate for its earnings per share has moved south by 4.2% to $3.45.

The Zacks Consensus Estimate for the company’s first-quarter 2024 revenues is pegged at $508.1 million, indicating a 10.1% decline from the year-ago quarter’s reported number.

Promising Stocks

Some other top-ranked stocks in the broader medical space are Edward Lifesciences EW, Asensus Surgical ASXC and Integer Holdings Corporation ITGR.

Edward Lifesciences’ shares have risen 12.6% in the past year compared with the industry’s 3.7% growth.

Asensus Surgical’s shares have lost 64% in the past year against the industry’s 3.7% growth.

Integer Holdings’ shares have risen 44.8% in the past year compared with the industry’s 3.7% growth.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Edwards Lifesciences Corporation (EW) : Free Stock Analysis Report

Masimo Corporation (MASI) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

Asensus Surgical, Inc. (ASXC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.