Glaukos Corporation GKOS is positioned for growth, supported by favorable clinical trial results and a robust product pipeline. Nevertheless, intense competition remains a point of concern.

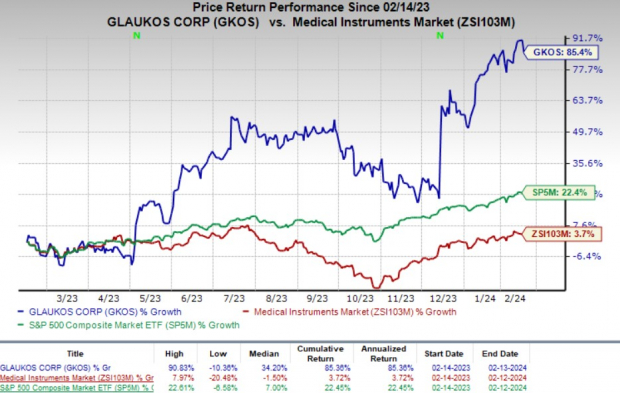

Over the past year, shares of this currently Zacks Rank #3 (Hold) company have surged by 85.3%. In comparison, the S&P 500 Index has climbed by 22.4% during the same period, while the industry has witnessed a mere 3.7% growth.

With a market capitalization of $4.7 billion, Glaukos is a prominent ophthalmic medical technology and pharmaceutical company. It anticipates an earnings growth of 8.8% for 2024 and projects a continuation of its robust revenue performance.

Image Source: Zacks Investment Research

The company has reported an average four-quarter earnings surprise of 5.72%.

Positive Catalysts

Glaukos’ sales rebounded in 2023 after a declining trend in 2022, reflecting an improving macro environment and the introduction of several new products in recent quarters. Continued strong demand across international Glaucoma and Corneal Health franchises will be the major top-line driver in 2024.

Furthermore, the commercial launch of iStent infinite in 2023 is bolstering the U.S. glaucoma franchise, which is expected to drive growth in the forthcoming quarters. The company’s heightened revenue outlook on its third-quarter earnings call bodes well for the future.

The new local coverage determinations proposed in June 2023 are likely to have a positive impact on the iStent business in 2024 by excluding certain ophthalmic goniotomy and canaloplasty procedures from coverage.

Glaukos has introduced several products such as iPrime, iAccess, and iStent in recent quarters, which have contributed to the company’s revenue growth. Additionally, in December, Glaukos received FDA approval for another product, iDose TR, designed for reducing intraocular pressure in patients with ocular hypertension or open-angle glaucoma. These products are expected to sustain the growth momentum in 2024.

Earlier this month, Glaukos announced preliminary revenue results for the fourth quarter of 2023. The company estimates net sales to exceed $81 million, implying year-over-year growth of at least 13.7%. Revenues for the entire year are estimated to surpass $313 million. GKOS anticipates a 13-16.5% growth in the top line for 2024.

Challenges Faced by GKOS

Despite the optimistic outlook, Glaukos faces stiff competition from medical companies, academic and research institutions, as well as others in the development of new drugs, therapies, medical devices, or surgical procedures to treat glaucoma. This intense competition continues to impact the company’s overall performance.

Furthermore, the significant reduction in physician payment rates by the U.S. Centers for Medicare & Medicaid Services in 2022 resulted in lower U.S. Glaucoma sales volume in the year. The impact persisted in 2023 due to the absence of significant changes in payment rates, adversely affecting sales in the fourth quarter.

Estimate Trend

The bottom-line estimate for GKOS is pegged at a loss of $2.01 per share for 2024, which reflects an 8.8% narrowing from the previous year’s reported loss. The Zacks Consensus Estimate for 2024 revenues stands at $355.2 million, indicating a growth of 13.3% from the previous year.

Final Takeaway

Despite its challenges, Glaukos stands out as a potential investment prospect. However, it is essential for investors to balance the company’s growth prospects with the intensified competition it faces.

For investors seeking alternatives, some better-ranked stocks in the broader medical space include Edward Lifesciences (EW), Asensus Surgical (ASXC), and Integer Holdings Corporation (ITGR).

Edward Lifesciences currently carries a Zacks Rank #2 (Buy) and has an estimated long-term growth rate of 7.2%. EW’s earnings have surpassed estimates in two of the trailing four quarters and met estimates twice, delivering an average surprise of 0.80%. Additionally, Edward Lifesciences’ shares have risen by 12.6% in the past year compared with the industry’s 3.7% growth.

Asensus Surgical, carrying a Zacks Rank of 2 at present, has an estimated growth rate of 40.6% for 2024. ASXC’s earnings surpassed estimates in one of the trailing four quarters, missed estimates in two quarters, and met estimates once, delivering an average negative surprise of 6.70%. However, Asensus Surgical’s shares have declined by 64% in the past year against the industry’s 3.7% growth.

Integer Holdings, with a Zacks Rank of 2 at present, has an estimated long-term growth rate of 15%. ITGR’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 11.9%. Furthermore, Integer Holdings’ shares have risen by 44.8% in the past year compared with the industry’s 3.7% growth.

Even with its competition, Glaukos (GKOS) is a strong contender for your investment portfolio. Amidst the evolving landscape and ever-changing markets, it’s important to consider the weight of the competition and the potential for growth.

It’s always good to have options. For those with a taste for comparative analysis, better-ranked stocks in the broader medical space include Edward Lifesciences (EW), Asensus Surgical (ASXC), and Integer Holdings Corporation (ITGR).

The insights shared in this editorial represent the author’s views and opinions and not necessarily those of Nasdaq, Inc.