Horace Mann Educators Corporation

The shareholders of Horace Mann Educators Corporation (HMN) are set to reap the rewards of the company’s recent decision to increase its quarterly dividend by 3.1%. This move will see the insurer bump its payout to 34 cents per share, up from the previous 33 cents. To partake in this enhanced dividend, investors on record as of March 16 will receive the revised payout come March 29.

With an annualized payout of $1.36 per share following this adjustment, Horace Mann’s new dividend will yield an impressive 3.8%. This dividend yield surpasses the industry average of 2.5% and promises a more lucrative return for investors. The commitment to maintaining a steady dividend payout is evident in the company’s 16th consecutive yearly hike, supporting its reputation for operational excellence and a dedication to delivering value to its shareholders.

Strategic Growth Initiatives

Horace Mann’s strategic initiatives, including product design tailored to the K-12 educator market, annuity reinsurance agreements, diversified investment portfolios, and cost-saving measures, are all contributing to the robust performance that underpins the dividend increase. The company’s focus on maximizing opportunities in various sectors underscores its commitment to steady growth and value creation for shareholders.

Anticipating a doubly impressive earnings per share (EPS) range of $3.00-$3.30 in 2024, Horace Mann remains steadfast in its goal to elevate shareholder value. This optimism helps fortify the company’s position as a strong contender in the insurance sector, reflecting positively on its strategic approach and operational efficiency.

Beyond dividend adjustments, Horace Mann is actively engaged in share buyback programs to further enhance shareholder returns. With $34.9 million earmarked for share repurchases as of December 31, 2023, the company continues to demonstrate its commitment to bolstering shareholder value through various strategic initiatives.

The company’s prudent financial management, combined with its operational prowess, positions Horace Mann to generate significant capital that can be channeled into shareholder-friendly activities and strategic investments, thereby fueling its growth trajectory. Horace Mann’s robust financial standing and operational efficiency are key factors propelling its growth and enabling it to deliver on its promise of increased shareholder value.

Looking ahead, with an annual projected excess capital of $50 million, Horace Mann is poised to maintain its double-digit core return on equity (ROE) by 2025, signalling a positive outlook for the company’s core earnings per share.

Market Performance and Future Outlook

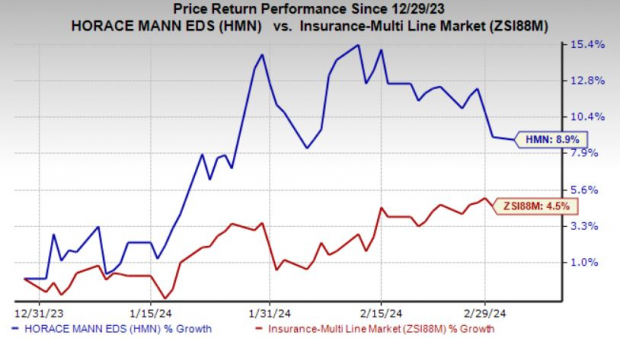

Horace Mann’s shares have surged by 8.9% year-to-date, outperforming the industry average increase of 2.5%. This positive market performance is a testament to the company’s transformational initiatives, profitability campaigns, and targeted market strategies. These efforts are poised to not only sustain but amplify the upward trajectory of Horace Mann’s share value in the foreseeable future.

As Horace Mann forges ahead with its growth strategies and commitment to shareholder value, investors can expect to witness sustained market outperformance and continued growth in the company’s financial metrics. The recent divident hike is just one more step in the company’s journey towards delivering enhanced value to its stakeholders.

Image Source: Zacks Investment Research