As we delve into the depths of the ETF universe at ETF Channel, an intriguing revelation awaits – the SPDR S&P 600 Small Cap Growth ETF (Symbol: SLYG) has piqued the curiosity of analysts. Whispering winds of forecasts suggest a flourishing future, with an implied analyst target price of $93.01 per unit.

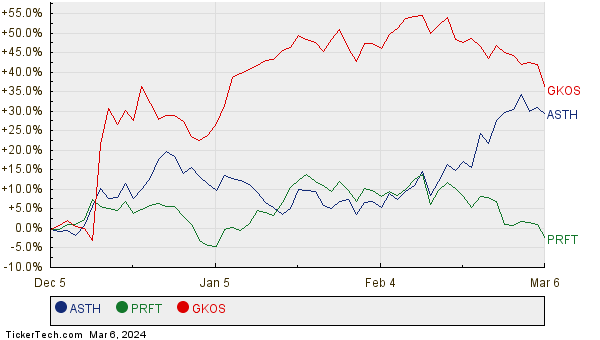

With SLYG dancing near $84.35 per unit in recent trades, analysts start to see visions of a 10.27% upside potential shimmering through. Among the constituents of SLYG, three illustrious names stand out like blooming flowers – Astrana Health Inc (Symbol: ASTH), Perficient Inc (Symbol: PRFT), and Glaukos Corp (Symbol: GKOS) – all seemingly destined to rise according to the whispers. Against a backdrop of recent prices, ASTH’s analyst target of $51.33/share towers 18.77% above the $43.22/share recent quote. Meanwhile, PRFT anticipates a flight to $73.14/share, a dazzling 18.30% soar from the current $61.83/share. Across the garden, GKOS flutters towards a target of $99.42/share, a captivating 17.92% crescendo from the $84.31/share recent display. Let us navigate through the historical ebbs and flows of ASTH, PRFT, and GKOS in the chart below, painting a vivid picture of their past performance:

Laying out the bouquets of analyst target prices in a delicately arranged table, we find the following blossoms of potential:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR S&P 600 Small Cap Growth ETF | SLYG | $84.35 | $93.01 | 10.27% |

| Astrana Health Inc | ASTH | $43.22 | $51.33 | 18.77% |

| Perficient Inc | PRFT | $61.83 | $73.14 | 18.30% |

| Glaukos Corp | GKOS | $84.31 | $99.42 | 17.92% |

Peering into the crystal ball of financial analysis, we encounter a whiff of skepticism – are these analyst forecasts rooted in realism or spiraling with wishful thinking? Might they be lagging behind, unaware of the latest whispers in the corridors of companies and industries? A lofty target in comparison to the current trading price often portends a rosy outlook, yet it could also hint at future downgrades should these targets become outdated relics of the past. To unwrap these mysteries, investors are beckoned to embark on their own odyssey of research and discovery.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Come Take a Stroll Through History:

BDGE Historical Stock Prices

Institutional Holders of FLQM

PIRS market cap history

Embrace the author’s reflections and musings, for they are but one perspective, fluttering like a butterfly and not binding the beholder to concurrence, much like Nasdaq, Inc.