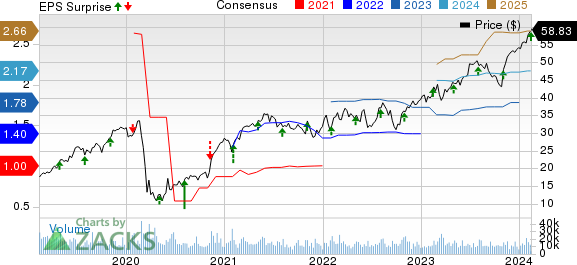

Howmet Aerospace Inc.’s (HWM) fourth-quarter 2023 financial report has sparked enthusiasm, beating expectations and showing significant growth. The aerospace giant’s adjusted earnings of 53 cents per share surpassed the Zacks Consensus Estimate of 46 cents, marking a 39.5% improvement compared to the previous year.

Moreover, Howmet’s total revenues of $1.73 billion outperformed the consensus estimate of $1.65 billion, reflecting a remarkable 14.4% increase year over year. The surge in revenues was propelled by an upturn in the commercial aerospace market, signifying a strong resurgence in the industry.

Positive Performance in Key Segments

The Engine Products segment recorded a revenue increase of 16%, attributing to growth across commercial aerospace, defense aerospace, industrial gas turbine, and oil and gas markets. Likewise, revenues from the Fastening Systems segment skyrocketed by 26% due to the expansion in the commercial aerospace market, including the recovery of emerging wide-body aircraft and the commercial transportation sector.

Additionally, the Engineered Structures segment observed a 6% revenue surge, driven by growth in the commercial aerospace market. The Forged Wheels segment experienced a 3% increase in revenues, largely due to the upswing in the commercial transportation market.

Stable Margin Profile and Financial Position

Despite increased costs of goods sold and selling, general, administrative, and other expenses, Howmet’s adjusted EBITDA surged by 23.6% year over year, demonstrating a robust margin increase of 170 basis points to 23.6%. The company’s operating income also witnessed a substantial rise of 48.2% compared to the previous year. Furthermore, a decline in net interest expenses indicated a favorable financial position.

Robust Cash Flow & Optimistic Outlook

Howmet’s strong cash flow from operating activities in 2023, totaling $901 million, exemplifies the company’s financial resilience and efficient capital management. The company has forecasted a positive outlook for the first quarter of 2024, with anticipated revenues of $1.73-$1.75 billion and a mid-point adjusted earnings per share above the consensus estimate.

For the entire year of 2024, Howmet predicts revenues of $7.0-$7.2 billion, adjusted EBITDA of $1.60-$1.67 billion, and a free cash flow ranging from $700-$770 million, highlighting its bullish long-term prospects.

Comparison with Other Industry Players

Amid a vibrant market environment, Howmet’s stellar performance is further accentuated when compared to other industry peers. The company’s robust financial results exhibit its robust position in the aerospace and engineering sector, contributing to overall industry growth and stability.