Roadblocks and Optimism for 2024

This year is predicted to bring a much-needed upturn for the semiconductor industry, following a period of dwindling inventories in vital markets such as computing, smartphones, and industrial sectors during the latter half of 2023. The World Semiconductor Trade Statistics (WSTS), a key data provider to the Semiconductor Industry Association (SIA), anticipates a robust 13.1% growth in semiconductor demand this year, driven by a remarkable 40% surge in memory requirements.

The industry’s analog/mixed signal group, however, might face some turbulence, as several players have deepened their involvement in the auto and industrial sectors, characterized by long-term design wins. These markets are currently exerting downward pressure on the industry, despite promising growth prospects over the next decade, attributed to the adoption of disruptive technologies such as AI-ML, EVs, smart cities, and IoT.

Industry Dynamics

Semiconductor technology powers our devices, enabling them to process, store, and retrieve data, and execute our commands accurately. This technology covers analog (enabling real-world data capture and measurement), digital (processing machine-readable information), and mixed signal (enabling conversion between analog and digital signals). These components are utilized in various markets, including consumer electronics, industrial, automotive, medical, communications, and IoT.

The industry is cyclical and sensitive to price changes, with players often targeting multiple markets to balance individual market seasonality or concentrating on specific core markets where they have unique technology and relationships.

Major Industry Trends

Market Expansion: The semiconductor market is poised for a resurgence, with Gartner projecting a 16.8% growth in 2024, driven by improved memory demand and growth in the analog/mixed signal segment. While PC and smartphone markets are on the path to recovery, the industrial and automotive sectors face inventory adjustments and macro-related uncertainties. AI, IoT, cloud technologies, and sustainability considerations are expected to be driving forces, despite challenges related to China.

Industry Challenges: Certain key end markets for analog/mixed signal chips, such as automotive and industrial, are anticipated to experience a slowdown in 2024, influenced by macroeconomic situations and other factors. Manufacturing contraction and prevailing uncertainties highlight the challenges in the industrial market.

Operational Challenges: Continued operating challenges are foreseen, which could lead semiconductor manufacturers to trim production, consequently reducing utilization rates. Additionally, ongoing fab construction and capacity expansion may impact pricing dynamics.

Geopolitical Concerns: Geopolitical tensions pose a significant risk to semiconductor players due to the global distribution of the supply chain. The strained relations between the U.S. and China and potential conflicts, particularly around Taiwan, could disrupt the semiconductor sector. Furthermore, efforts to rebalance the semiconductor supply chain for strategic ends are creating uncertainty.

Zacks Industry Rank Indicators

The Zacks Semiconductor – Analog and Mixed industry is currently positioned within the lowest 11% of Zacks-classified industries, denoted by a Zacks Industry Rank #223 within the broader Computer and Technology sector. This ranking reflects persisting challenges and uncertainties within the semiconductor market.

Semiconductor Industry Struggles Amid Bleak Outlook

Why has the Zacks Industry Rank predicted that the semiconductor industry is on shaky ground? What caused its earning outlook to decline so significantly over the past year? These are pressing questions confronting investors as they analyze the current state of the industry.

The Industry’s Stock Market Performance: A Comparison

It is clear that the Semiconductor – Analog and Mixed industry’s stock market performance continues to lag behind that of the broader Zacks Computer and Technology sector, as well as the S&P 500. Over the past year, the industry has only gained 6.1%, in stark contrast to the broader sector’s increase of 42.3% and the S&P 500’s 21.1% growth.

Image Source: Zacks Investment Research

Valuation: A Premium to S&P 500 and Discount to the Tech Sector

Examining the industry’s current valuation, we see that it is trading at a 23.2X forward 12-month price-to-earnings (P/E) ratio, holding a premium to the S&P 500’s 20.6X and a discount to the broader computer and technology sector’s 26.1X. However, this figure also represents a premium to its median level of 18.9X over the past year, indicating a complex valuation picture within the industry.

The industry has seen fluctuations within the range of 15.9X and 23.3X multiples over the past year, showcasing the volatility of its valuation.

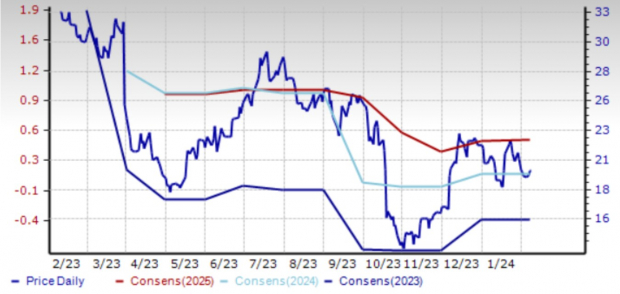

A few stocks emerge as potential options for portfolio consideration amidst the industry’s uncertain tide. For instance, Semtech Corporation (SMTC) has displayed resilience despite its downward trajectory, showcasing strength even after a 39.7% dip over the past year.

Image Source: Zacks Investment Research

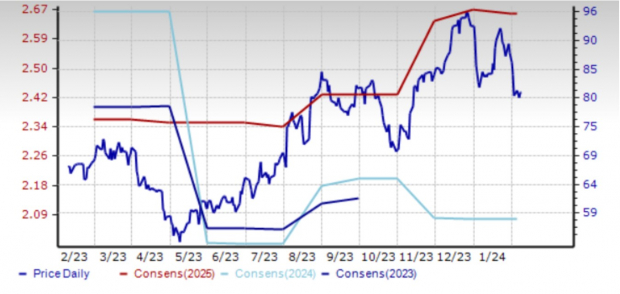

Another noteworthy stock is MACOM Technology Solutions (MTSI) which, despite its 19.9% surge over the past year, has captivated investor interest amidst the broader industry struggle.

Image Source: Zacks Investment Research

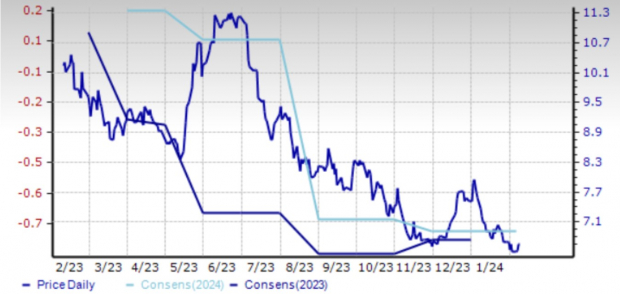

Furthermore, Magnachip Semiconductor Corporation (MX) has navigated a challenging year, marked by a 34.8% decline in its shares, hinting at potential for revival amidst the industry’s choppy waters.

Image Source: Zacks Investment Research

Opportunities Amidst Industry Volatility

The industry’s current predicament offers a glimpse into the complexity and resilience of semiconductor stocks amid challenging circumstances. As broader macro concerns impede growth, companies like MACOM Technology Solutions (MTSI) are focusing on high-frequency, high-power, and high-data rate applications as a strategic move to fortify their market position in the coming quarters.

Similarly, Magnachip Semiconductor Corporation (MX) remains steadfast as it navigates through inventory rebalancing and softness in certain segments, laying the groundwork for long-term growth through new product innovation and design win momentum. These companies are exemplars of the industry’s tenacity despite encountering a stormy market landscape.

Zacks Names #1 Semiconductor Stock

Amidst the industry turbulence, there are indications of opportunities arising for investors. As the semiconductor industry continues to weather the storm, certain stocks have exhibited promising potential, positioning themselves to cater to the burgeoning demand for Artificial Intelligence, Machine Learning, and Internet of Things. The projected escalation of global semiconductor manufacturing from $452 billion in 2021 to $803 billion by 2028 is an encouraging sign for investors seeking opportunities within this space.

See This Stock Now for Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Semtech Corporation (SMTC) : Free Stock Analysis Report

MACOM Technology Solutions Holdings, Inc. (MTSI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.