Interactive Brokers Group, Inc. (IBKR) is facing formidable challenges, with a constant surge in non-interest expenses and a heavy reliance on overseas revenues, posing significant risks in the face of precarious global economic conditions. Despite this, the company continues to benefit from meager compensation costs, the development of in-house software, and a consistent rise in customers from emerging markets, all of which bolster its revenue streams.

Damage from Rising Costs

The past five years have seen Interactive Brokers’ expenses spike at a compound annual growth rate (CAGR) of 10.4%, and the trend has persisted into the first nine months of 2023. The escalation is primarily attributed to increased execution, clearing, and distribution fees. It comes as no surprise that the company’s ongoing investments in its franchises, new services, and technological upgrades are poised to keep overall costs at elevated levels. Projections suggest that the company’s total non-interest expenses will maintain a CAGR of 10.9% by 2025.

Overseas Perils

Interactive Brokers’ geographical diversification has its drawbacks, with nearly 30% of its total net revenues hailing from international operations. Owing to a confluence of regulatory and political uncertainties, currency exchange fluctuations, and the varying performance of local economies, the company’s financials face significant headwinds. It is estimated that international revenues will continue to account for 30% of total net revenues (GAAP) in 2023.

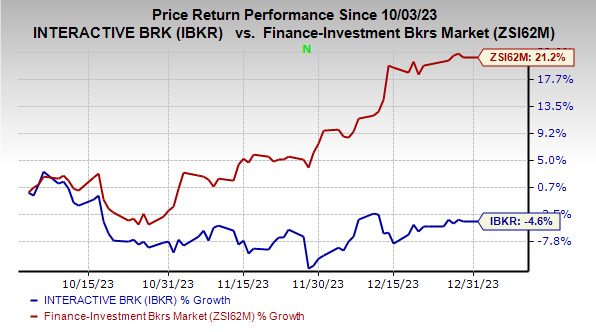

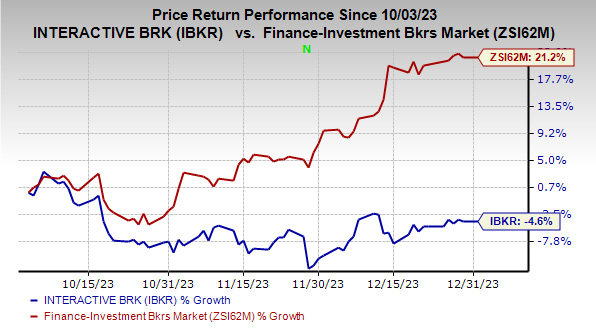

Over the last three months, the company’s shares have plummeted by 4.6%, in stark contrast to the industry’s formidable 21.2% surge, earning it a Zacks Rank #4 (Sell) status.

Image Source: Zacks Investment Research

However, Interactive Brokers boasts a commendable track record of organic growth, evident from its total net revenues’ CAGR of 12.5% over the past five years. This momentum has persisted into the first three quarters of 2023, and with the solid DART (Daily Average Revenue Trades) numbers, the company is poised for further improvement in its net revenues. Projections indicate that total net revenues (GAAP) are likely to witness a CAGR of 13.1% in the three years leading up to 2025.

Furthermore, the company maintains a remarkably low level of compensation expenses relative to net revenues, standing at 12.2% in the first nine months of 2023, owing to its technological prowess. It is anticipated that the compensation expenses for 2023 will amount to 12.5% of total net revenues (GAAP).

Stocks to Consider

Not everything in the finance world is bleak, as evidenced by the better-ranked finance stocks such as BrightSphere Investment Group (BSIG) and Prospect Capital (PSEC).

BrightSphere’s current-year earnings estimates have witnessed a 5.1% upward revision over the past 60 days, with the stock gaining 3.3% over the last three months. BSIG currently holds a Zacks Rank #2 (Buy).

Meanwhile, Prospect Capital’s current-year earnings estimates have seen an 8.1% uptick over the past 60 days, with the company’s shares appreciating by 1.3% over the last three months. Currently, PSEC boasts a Zacks Rank of 1 (Strong Buy).

If investors are looking for a silver lining, they can explore the full list of today’s Zacks #1 Rank stocks here.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. Be among the first to see these just-released stocks with enormous potential.

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

Prospect Capital Corporation (PSEC) : Free Stock Analysis Report

BrightSphere Investment Group Inc. (BSIG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.