Apple (NASDAQ: AAPL) has long been viewed as one of the largest growth stocks in the world. But the growth is slowing. In fact, it’s been virtually nonexistent for a couple of years now.

With iPhone sales declining and Apple facing intense competition, it’s fair to consider if it is best to stop viewing Apple as a growth stock and reclassify it as a premium dividend-paying, blue-chip company. Let’s find out if that reclassification would make Apple overvalued relative to other opportunities.

Image source: Getty Images.

The growth stock premium

Growth stocks tend to fetch premium valuations relative to the market since they are expected to achieve much higher earnings in the future. Investors are willing to pay up for the stock today in the hopes that the growth narrative will play out.

Virtually every company was once a growth stock. Take Coca-Cola, for example, which we view today as a stodgy beverage company, although it pioneered the global distribution of soft drinks. Or McDonald’s, which started as a fast-service burger stand but is now one of the best examples of the franchise business model at scale.

Today, these companies mainly reward shareholders through dividends and buybacks. Their earnings grow modestly each year, and there’s no reason to think growth will take off anytime soon, given limited market opportunities. In this vein, it makes sense that these companies don’t fetch sky-high multiples relative to the market.

Apple is overdue for an earnings spike

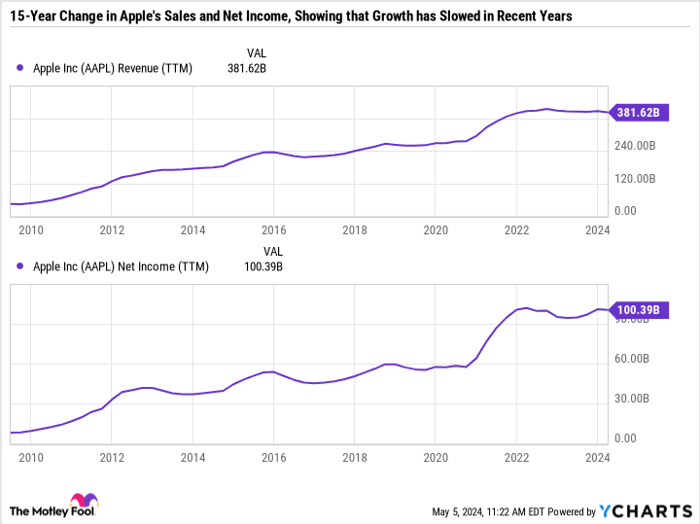

Over the last three years, Apple’s trailing 12-month revenue is up just 9.9% and its net income is up 15.7%. This slowing growth period is even more apparent if we look back over the last 15 years.

AAPL Revenue (TTM) data by YCharts

Apple has seen multiple periods of flattish growth, followed by some sharp upticks. The biggest spike came in 2020 and 2021 as investors flocked to goods purchases when services were unavailable during the pandemic.

Some investors hope that the lack of growth is simply due to the upgrade cycle. Historically, Apple has made annual upgrades to the iPhone, with a more substantial upgrade every few years. However, as my colleague Rick Munarriz points out, the three-year cycle is broken and Apple hasn’t had that much-needed spike in sales to drive earnings growth.

This upgrade cycle could be delayed because products are lasting longer, and the last upgrade period was inflated by a surge in demand. But until that happens, it’s easy to point to increased competition and a lack of innovation as reasons why Apple no longer deserves to be classified as a growth stock. In short, Apple is in “prove it” mode.

A reasonable valuation

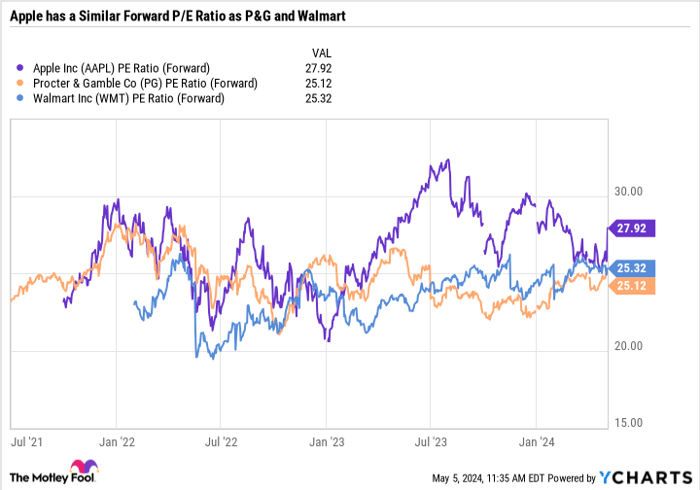

The good news is that Apple is already priced similarly to many other dividend-paying, blue-chip companies.

Procter & Gamble and Walmart are two industry-leading, historically low-growth companies with over 50 consecutive years of dividend increases — making them both Dividend Kings. Both companies have an element of recession resilience, given their emphasis on consumer staples products and their ability to achieve good results no matter the economic cycle.

Despite being “safe stocks,” P&G and Walmart don’t necessarily have high yields. P&G yields just 2.5%, and Walmart is an even lower 1.4%. Still, both companies have over a 25-forward price-to-earnings (P/E) ratio, whereas Apple has a 27.9 forward P/E.

AAPL PE Ratio (Forward) data by YCharts

The glass half-empty outlook on Apple is that its growth is slowing, and it doesn’t deserve a premium growth stock valuation. But its current multiple suggests it isn’t overvalued.

Apple is still a textbook example of vertical integration at its best. The rise of the company’s services segment has helped Apple retain high operating margins despite much higher revenue. Services help extract more value from existing customers without requiring product upgrades.

Despite its slow growth, Apple can still reward shareholders with aggressive buybacks and dividends. It just announced its 12th consecutive dividend increase and a $110 billion stock repurchase program.

If Apple were not to do any buybacks and focused its entire capital return program on the dividend, it would yield 3.5% — which is more than if P&G and Walmart poured their entire capital return programs into the dividend.

Apple is an even better value if we consider the size of its cash, cash equivalents, and marketable securities position, which reached a whopping $162.3 billion as of the recent quarter.

Apple is a good pick in today’s market

Apple is already being valued similarly to industry-leading dividend stocks. The market is discounting the potential upside of the next iPhone upgrade cycle, which could be fueled by iPhones with artificial intelligence chips. The Apple Vision Pro or another new product could also catch on.

In sum, Apple’s risk/potential reward profile seems like a good opportunity right now, especially given that the market is no longer valuing it as a growth stock/. But there’s still plenty of potential growth left in the tank.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $564,547!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 6, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.