Electric vehicle (EV) maker Rivian Automotive RIVN made its blockbuster market debut in 2021. In fact, it was the largest IPO of the year, capitalizing on the excitement surrounding green vehicles. Within a mere week of its debut, the stock rocketed 120% from its IPO price of $78/share, closing at a record high of $172.01 on Nov 16, 2021. At its peak, the market cap of the company exceeded $150 billion—outstripping even legacy automakers like General Motors GM and Ford F.

Fast forward to the present, Rivian is trading at around $10/share, valued at roughly $10 billion. So, what led to this steep decline, and does it signal an opportune moment for investors? Well, the company is indeed facing challenging times now but are the long-term prospects healthy? As Rivian prepares to unveil its first-quarter 2024 results on May 7, investors are scrutinizing the company’s performance and potential.

Behind the Precipitous Plunge

Backed by Amazon AMZN and Ford, Rivian was excessively overvalued from the very beginning. Back in 2020 and 2021, investors were piling up these EV startups, with little regard to underlying fundamentals and were ready to pay huge premiums. Eventually, the bubble burst, and Rivian had to come off its premium valuations. But it isn’t just that.

When Rivian made its public debut, it targeted to produce 50,000 vehicles in 2022. However, due to supply chain disruptions, it eventually revised this forecast down to 25,000 vehicles and narrowly missed that target by producing 24,337 vehicles for the year. Consequently, Ford liquidated most of its Rivian shares throughout 2022. In 2023, Rivian experienced some relief from its supply chain constraints and managed to produce 57,232 vehicles.

Early last month, RIVN provided an update on its first-quarter 2024 delivery and production numbers. It manufactured 13,980 vehicles and sold 13,588. That compares unfavorably with fourth-quarter 2023 production and delivery numbers of 17,541 and 13,972, respectively.

The company reaffirmed its guidance to build around 57,000 vehicles this year. Now, that reflects zero growth in production on a yearly basis, which is concerning.

Of late, Rivian is under pressure given the weakness in the broader EV market. Demand is lower than expected, competition is intensifying and there is uncertainty in the macro environment. With inflation being hotter than expected, uncertainty over the timing of the first rate cut remains. So, the cost of vehicle financing is high, and the company’s offerings (including R1S SUV and R1T pickup) start at around $70,000 and can go up to around $90,000, which is quite expensive. On top of that, the firm is incurring high manufacturing costs, which is leading to high and persistent losses. None of this is going unnoticed by investors.

With the EV hype subsiding and reality setting in, Rivian, like many other EV startups, is facing inevitable correction. Given the dip, should you buy Rivian now?

Key Considerations Before Betting on RIVN

In the fourth quarter of 2023, Rivian incurred a gross loss of $43,000 per vehicle, highlighting significant manufacturing inefficiencies. This huge mismatch between product costs and sales revenues is concerning.

Moreover, the planned shutdown in the second quarter of 2024, aimed at implementing technology and design changes to improve manufacturing efficiency, poses further short-term cost challenges. While Rivian anticipates these costs to be temporary, clarity on the expected cost savings from these changes is essential for investors before rushing to buy the stock.

Although the introduction of technology changes in 2023 has reduced material costs for commercial vans, Rivian’s success in leveraging this advantage remains uncertain. In the last quarter, low deliveries of these vans resulted in low margins. The company needs to sell more of these vans to improve gross profit margin.

Rivian had secured a significant order for vans from Amazon in 2019. It is committed to Amazon’s goal of deploying 100,000 electric vehicles by 2030, with more than 10,000 already in operation. But despite the end of the exclusivity part of that deal, Rivian hasn’t been able to secure as many deals as investors were probably hoping for. Rivian’s ability to capitalize on this market segment has been limited, with only one major deal confirmed with AT&T.

Additionally, it should be noted that Rivian boasts a production capacity of 200,000 units and aims to make only 57,000 vehicles this year. This underutilization underscores subdued demand, particularly given its high-priced vehicles. As it is, EV demand is not growing as rapidly as the industry participants had expected earlier. The slowing growth compounded by the increasingly crowded EV market leaves limited room for opportunities for all players in the sector.

In 2023, Rivian reported a loss from operations of $5.74 billion, indicating a slight improvement from a loss of $6.85 billion in 2022. However, the magnitude of these losses suggests a pressing need for accelerated progress.

Adding to these woes is Rivian’s financial position. Ending 2023 with just $10.47 billion in total liquidity and generating a negative free cash flow of $5.89 billion, the company faces liquidity concerns. With substantial operational losses, there is a looming risk of depleting half of its remaining liquidity this year as it grapples with production scalability and financial sustainability.

Capital expenditure for 2024 is estimated to be $1.75 billion, up from $1.02 billion in 2023 amid expanded investments in production facilities, next-generation technologies and the ongoing development of its go-to-market operations.

With its production rate decreasing, the company has begun lowering prices on its basic R1T and R1S models to entice more customers in a sluggish EV market. These challenges may hinder the company’s aim to achieve a positive gross margin by the fourth quarter of 2024.

Providing some ray of hope is the company’s plans to roll out its new R2, R3, and R3X vehicles over the next three years. The R2 is a cheaper SUV (expected to start at around $45,000) that should commence production in late 2026, while the R3 and R3X are sportier models that will likely arrive in late 2026 or early 2027.

Rivian anticipates to incur $2.7 billion loss before interest taxes, depreciation and amortization in 2024, narrower than $3.9 billion in 2023. While it is prioritizing the expansion of go-to-market infrastructure and the development of R2, the company expects that to be partly offset by cost optimization efforts, including the integration of new engineering technology, negotiated supplier cost reductions and improved operating expense efficiency.

Ahead of its earnings release, let’s take a look at the company’s valuation metrics and its revenue and EPS estimates.

Valuation

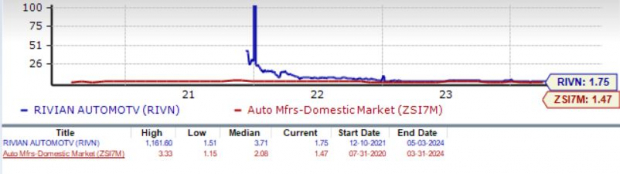

RIVN is currently trading at a forward sales multiple of 1.75, well below its median of 3.71 over the last five years. But it has lots to prove now. The underlying fundamentals aren’t strong enough currently despite the stock coming off its historically high valuations. As such, the stock has a Value Score of F.

Image Source: Zacks Investment Research

What Zacks Estimates & Model Indicate

The consensus estimate for RIVN’s first-quarter 2024 loss is pegged at $1.13 per share currently, deteriorating from a loss of $1.06, 90 days ago. The company had incurred a loss of $1.25 per share in the year-ago quarter. Revenues for the quarter are projected to be $1.15 billion, indicating an upside of 73% from the year-ago reported figure.

For full-year 2024, the consensus mark for loss per share has widened by 1 cent in the past seven days to $3.97 per share. The company had reported a loss per share of $4.88 in 2023. For the full year, the revenue estimates imply 7.6% growth.

Image Source: Zacks Investment Research

Our quantitative model suggests that the combination of the following two key elements — a positive Earnings ESP and a Zacks Rank #3 (Hold) or better — increases the odds of a positive earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

An earnings beat is not certain for Rivian as it carries a Zacks Rank #3 and has an Earnings ESP of -0.52%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Final Thoughts

Before considering an investment in Rivian, it’s crucial to await management’s commentary on the company’s cost-cutting efforts and operational progress. Investors should pay close attention to whether Rivian reaffirms its positive GPU per vehicle expectation and its advancements in developing lower-priced models. Additionally, insight into the company’s delivery growth projections for the upcoming year will be pivotal.

Despite any perceived discount in Rivian’s current valuation, the company continues to grapple with challenges such as weak EV demand, manufacturing inefficiencies and cash burn. Therefore, it would be best to exercise patience and await clearer signals post first-quarter earnings before contemplating an entry into the stock.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

See Stocks Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Rivian Automotive, Inc. (RIVN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.