Jefferies Starts Coverage of Equity LifeStyle Properties with Cautious Optimism

Analysts Project a Modest Price Increase

Fintel reports that on October 17, 2024, Jefferies initiated coverage of Equity LifeStyle Properties (NYSE:ELS) with a Hold recommendation.

Analyst Price Forecast Suggests 4.98% Upside

As of September 25, 2024, the average one-year price target for Equity LifeStyle Properties stands at $73.64 per share. This prediction varies, with estimates ranging from a low of $66.66 to a high of $86.10. The average price target signifies a potential increase of 4.98% from its most recent closing price of $70.14 per share.

See our leaderboard of companies with the largest price target upside.

The anticipated annual revenue for Equity LifeStyle Properties is projected to reach $1,604 million, reflecting a growth of 5.69%. The expected annual non-GAAP earnings per share (EPS) is estimated at 1.68.

Institutional Interest in Equity LifeStyle Properties

What is the Fund Sentiment?

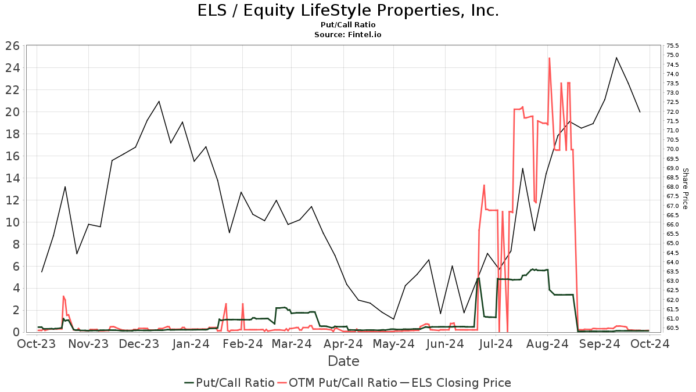

A total of 1,065 funds or institutions have reported their holdings in Equity LifeStyle Properties, marking an increase of 34 owners or 3.30% from the previous quarter. The average portfolio allocation for these funds dedicated to ELS is 0.37%, which is an uptick of 4.04%. Institutions increased their total ownership in the last three months by 3.53%, now holding 204,955K shares.  The put/call ratio stands at 0.27, suggesting a bullish outlook among investors.

The put/call ratio stands at 0.27, suggesting a bullish outlook among investors.

What are Other Shareholders Doing?

Aristotle Capital Management holds 10,692K shares, equating to 5.73% ownership of the company. In its last filing, the firm reported holding 10,987K shares, indicating a decrease of 2.77%, although it raised its investment in ELS by 2.57% over the past quarter.

Price T Rowe Associates owns 9,671K shares, translating to 5.19% ownership. In its previous report, it held 9,574K shares, marking a 1.01% increase, but reduced its overall stake in ELS by 0.26% last quarter.

The Vanguard Real Estate Index Fund Investor Shares (VGSIX) has 7,096K shares, accounting for 3.80% ownership. The firm reported a decrease from 7,233K shares previously, reflecting a drop of 1.93% in portfolio allocation over the last quarter.

The iShares Core S&P Mid-Cap ETF (IJH) has 5,801K shares, representing 3.11% ownership and showing a slight reduction from 5,804K shares, or 0.05%. However, it did increase its proportionate stake in ELS by 3.47% over the last quarter.

Additionally, the Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) currently holds 5,319K shares, constituting 2.85% ownership. This is up from 5,268K shares, demonstrating an increase of 0.96%, though it decreased its investment share by 0.70% over the last quarter.

About Equity Lifestyle Properties

Equity Lifestyle Properties Background Information

(This description is provided by the company.)

Equity Lifestyle Properties Inc. is a self-administered, self-managed real estate investment trust (REIT) based in Chicago. As of January 25, 2021, the company owns or has an interest in 423 quality properties across 33 states and British Columbia, totaling 161,229 sites.

Fintel is a comprehensive investing research platform for individual investors, traders, financial advisors, and small hedge funds. Our extensive data, which spans global markets, includes fundamentals, analyst reports, ownership information, fund sentiment, and more. Fintel also features exclusive stock recommendations based on sophisticated, backtested quantitative models.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.