Adventurous spirits and savvy vacationers are always on the lookout for unique opportunities to explore the world. However, among the various options the vacation industry has to offer, the timeshare sector often remains an overlooked gem. Timeshares – properties with multiple joint owners – strive to make vacation destinations more accessible and affordable, allowing individuals to purchase the rights to use a property at specific times rather than owning it outright.

The appeal of timeshare stocks is not lost on millennials, who are embracing this vacation model at a rate surpassing other age groups. With their relatively young age and increasing stake in the timeshare market, millennials are carving a path toward sustained long-term profits for the industry, positioning it for robust growth over the coming decades.

Despite the current lackluster performance of many timeshare stocks that has led to discounts in their share prices, analyst Aaron Hecht from JMP sees long-term potential in the sector. According to Hecht, the shares have factored in any near-term headwinds, and any additional weakness in consumer activity would likely result in pent-up demand that can be capitalized on as economic conditions improve. Hecht’s bullish sentiment reflects an opportune time to accumulate shares, backed by a sound future and a favorable low price.

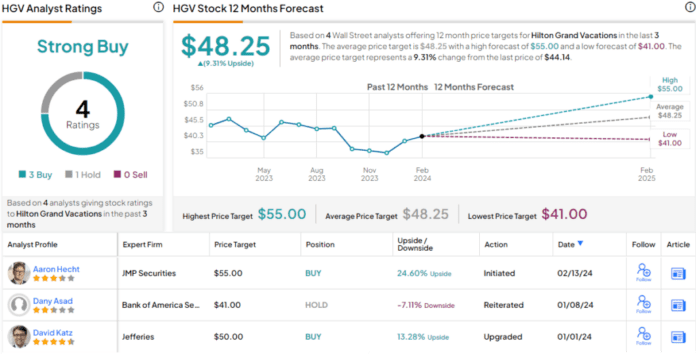

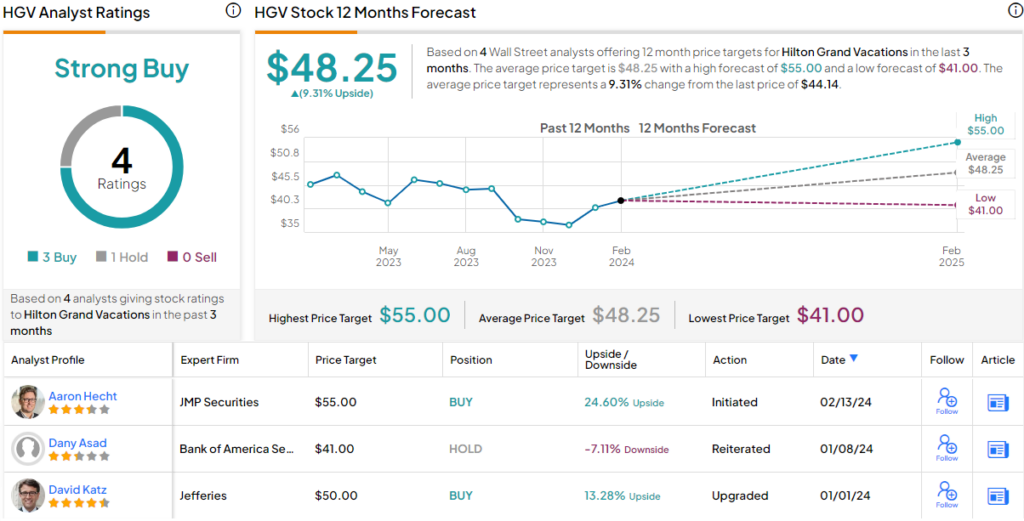

Hilton Grand Vacations (HGV)

One prominent name in the timeshare industry is Hilton Grand Vacations – a company that emerged as an independent entity in 2017, following a spin-off from the renowned Hilton hotel group. With operations across 16 US states and an international footprint covering destinations in Canada, the UK, Europe, Japan, Mexico, and the Caribbean, Hilton Grand Vacations offers a portfolio of over 200 locations to roughly 700,000 timeshare owners.

The company provides a diversified array of amenities, catering to a wide range of vacation preferences. Last year, Hilton Grand faced setbacks due to the Maui wildfires, impacting its Hawaii properties. It also acquired Bluegreen Vacations in a $1.5 billion deal, further expanding its portfolio. Despite a 9% revenue drop in Q3, Hilton Grand’s non-GAAP earnings per share exceeded expectations, demonstrating resilience in challenging conditions.

JMP analyst Aaron Hecht remains optimistic about HGV’s potential, praising its solid asset portfolio and favorable EBITDA margin. He has initiated coverage with an Outperform (Buy) rating and a price target of $55, implying a 24.5% upside potential. The street consensus also reflects a Strong Buy rating, signaling confidence in the company’s future prospects.

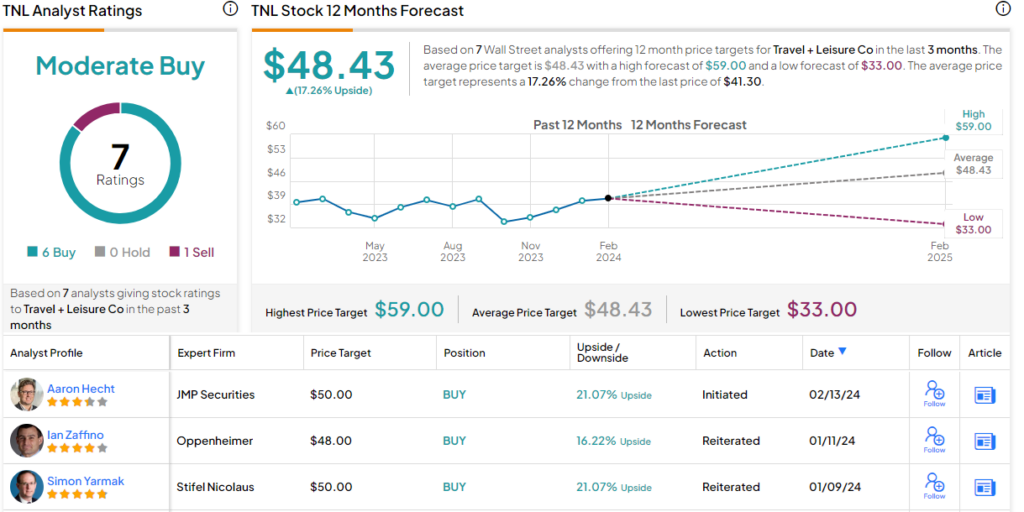

Travel + Leisure Company (TNL)

Based in Orlando, Florida, Travel + Leisure Company specializes in the development, sale, and management of timeshare properties in prime vacation destinations. Through brands like Margaritaville, Worldmark, and Wyndham, the company serves over 816,000 owners and enjoys a steady upward trend in revenue and earnings. Additionally, its timeshare exchange business, facilitated via RCI, boasts over 3.5 million members and generated over $170 million in revenue during the last reported quarter.

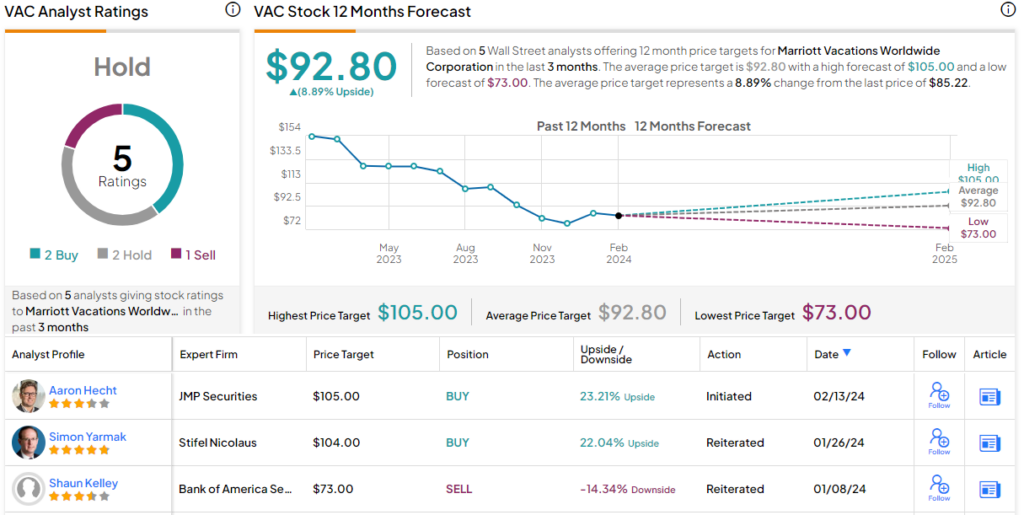

Marriott Vacations Worldwide (VAC)

Marriott Vacations Worldwide stands as a prominent player in the timeshare industry, offering vacation experiences across a myriad of prime destinations. With its diverse portfolio and strong operational performance, the company has solidified its position in the market. Boasting over 12,000 properties across 100 countries, the company’s diverse offerings encompass beachfront villas, mountain lodges, and urban retreats, appealing to the varying tastes of vacationers seeking memorable experiences.

Examination of Financial Reports Reveals Captivating Data

The Titan Company: A Steady Ship in Choppy Waters

The recent quarterly report by The Titan Company unveiled an enticing top line figure of $986 million, showcasing a 5% year-over-year gain which exceeded estimates by $14.3 million. Moreover, the company’s bottom line, reported as a non-GAAP EPS of $1.54, exceeded the forecast by 8 cents per share. These results were received as robust and were further complemented by the company’s steadfast commitment to delivering generous capital returns.

The bright spot for return-focused investors is the company’s share buyback program, demonstrating an aggressive approach by repurchasing $65 million worth of stock in Q3. At the close of the quarter, the company still had a substantial $210 million remaining in its buyback authorization. Additionally, investors were pleased by the recurring common share dividend, recently disbursed at 45 cents per share on December 29. With an annualized payment of $1.80 per common share, the forward yield stands at an impressive 4.35% – a buoyant rate that effectively outpaces inflation.

One financial expert, Hecht, expressed an affirmative outlook on the company’s shares, anticipating continued stock repurchases and lauding the robust earnings from RCI that provide insulation from the macro impact on VOI sales. Hecht’s enthusiasm was palpable as he noted the stock’s modest current valuation at 6.5x 2025E adj. EBITDA as compared to its long-term historical average of 7.8x.

Looking ahead, Hecht has assigned an Outperform (Buy) rating on TNL stock, coupled with a $50 price target, suggesting a noteworthy 21% gain within the one-year timeframe. This rating reflects the consensus reached by 7 recent analyst reviews, with 6 advocating a Buy and only 1 suggesting a Sell. The current trading price of $41.30 seems poised to ascend, as it aligns with the $48.43 average price target, indicating a potential 12-month gain of 17%.

Marriott Vacations Worldwide: A Storied Resilience Amidst Market Fluctuations

Marriott Vacations Worldwide, a subsidiary of the renowned hotel brand Marriott, is a prominent player in the timeshare industry, boasting an extensive portfolio of nearly 120 resort and vacation destinations, and over 18,500 available villas for timeshare purchase. The company’s offerings cater to a diverse clientele, spanning from affordable to opulent, with locations in various regions worldwide, encompassing the US, the Caribbean, Europe, and even Australia.

Despite the formidable scale of its operations, the company encountered challenges in the form of last year’s Maui wildfires, which inflicted a noticeable dent in its revenues. The third quarter of 2023 witnessed a 3.3% downturn in the top-line figures, amounting to $1.19 billion, and non-GAAP earnings came in at $1.20 per diluted share, missing estimates by 94 cents per share. Consequently, the stock has endured a downturn of approximately 43% over the last 12 months, with the upcoming 4Q23 results poised to shed further light on the company’s trajectory.

Notwithstanding these short-term headwinds, analyst Hecht remains resolute in his optimism for Marriott Vacations. He asserts that the depressed share price presents an opportune investment, particularly given the company’s strong brand affiliation and quality customer base. Furthermore, Hecht underscores the current stock valuation, noting that it currently trades at 5.6x 2025E adj. EBITDA, a considerable markdown from its long-term historical average of 10.0x. The market’s undervaluation of the company instills confidence in its potential for outperformance over the next 12-14 months.

Hecht has bestowed an Outperform (Buy) rating on VAC stock, and set an ambitious price target of $105, projecting an impressive one-year upside potential of 23%. However, the broader investor sentiment appears more measured, yielding a Moderate Buy consensus rating based on 5 recent reviews, comprising 2 Buy ratings, 2 Holds, and 1 Sell. Presently priced at $85.22, the stock’s $92.80 average price target suggestively forecasts a 9% appreciation in the upcoming year.

To discover compelling stock opportunities at attractive valuations, consider exploring TipRanks’ Best Stocks to Buy, a comprehensive tool that amalgamates all of TipRanks’ equity insights. However, it is imperative to emphasize that the opinions expressed in this article are exclusively those of the featured analysts, intended for informational purposes solely. It is essential to conduct thorough personal analysis before making investment decisions.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.