Labcorp, also known as Laboratory Corporation of America Holdings (LH), recently unveiled its financial results for the fourth quarter of 2023, painting a mixed picture for investors. While the company reported adjusted earnings and revenues exceeding expectations, its margins suffered a setback.

Robust Earnings Performance

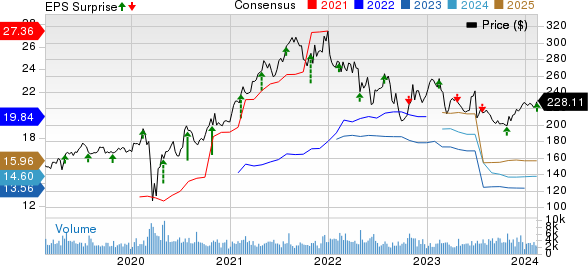

LH reported adjusted earnings per share (EPS) of $3.30 in Q4 2023, representing an 8.2% increase from the same period last year. However, on a GAAP basis, the company recorded a net loss of $1.95 per share compared to an EPS of 42 cents in the year-ago quarter.

For the full year, adjusted earnings were $13.56 per share, marking an 18.6% decline from the previous year. Despite the year-over-year drop, it managed to beat the Zacks Consensus Estimate.

Revenues Exceed Estimates

In the fourth quarter, Labcorp generated revenues of $3.03 billion, reflecting a 3.4% increase compared to the same period in the prior year. The growth can be attributed to organic revenue, acquisitions, and foreign currency translation. For the full year, the company’s total revenues amounted to $12.16 billion, up 2.5% from the previous year.

Segment Performance

The company’s Diagnostics Laboratories reported a 2.6% increase in revenues, with organic revenues up 0.8%. The total volumes saw a 2.4% increase, driven by both acquisition volumes and organic volumes. Labcorp’s Biopharma Laboratory Services witnessed a 7.1% climb in revenues, primarily propelled by organic growth.

Margin Contraction and Cash Position

However, Labcorp’s gross margin contracted, declining by 16 basis points to 27.1% in the fourth quarter. The adjusted operating income also fell by 15.8% year over year, while the adjusted operating margin shrank by 219 basis points.

On a positive note, the company’s cash position strengthened, with cash and cash equivalents reaching $536.8 million by the end of 2023. Long-term debt saw a reduction, dropping to $4.05 billion from $5.04 billion in the previous year.

2024 Outlook

Labcorp provided its 2024 guidance, forecasting growth in its enterprise revenues and the Diagnostics Laboratories and Biopharma Laboratory Services segments. The company also projected its full-year adjusted EPS and cash flow from continued operations for 2024.

Positive Momentum and Setbacks

Despite its strong performance in several areas, Labcorp faced challenges due to the reduction in COVID-19 testing revenues and the contraction of margins. It also highlighted its execution of strategic initiatives, including new partnerships and advanced test launches, signaling positive momentum.

Analyst Assessment

Currently carrying a Zacks Rank #3 (Hold), Labcorp’s performance has attracted attention from analysts and investors. Comparatively, some other stocks in the medical space, such as Stryker Corporation (SYK), Cencora, Inc. (COR), and Cardinal Health (CAH) have been identified as potential opportunities for investment.