Moof/Image Source via Getty Images

Lincoln Electric Holdings’ (NASDAQ:LECO) stock skyrocketed on Thursday, surging as much as 7.7% to reach a historic peak of $249.28 per share. This remarkable ascent comes in the wake of the welding equipment manufacturer’s exceptional fourth-quarter results, which surpassed all expectations.

The company reported a net income of $156.6 million, equivalent to $2.70 per share, in the three-month period ending December 31, marking a substantial increase from $109.1 million, or $1.87 per share, from the previous year.

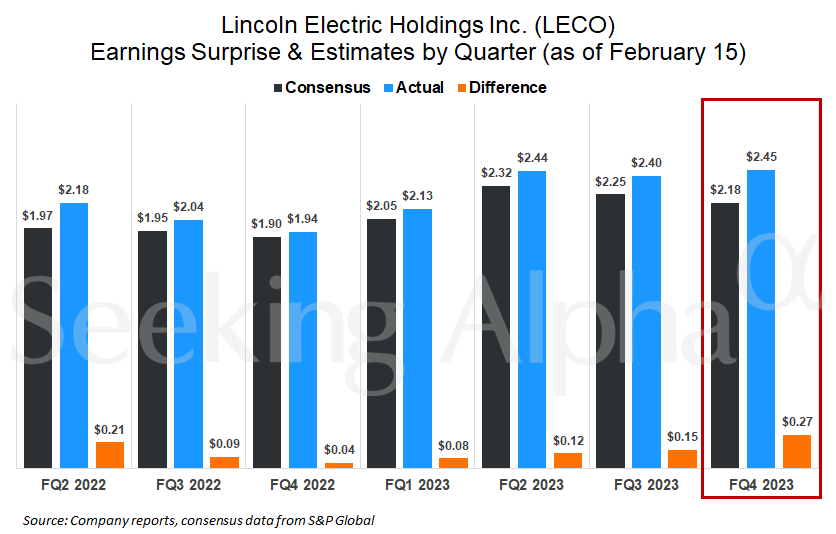

Adjusted net income, excluding special items, amounted to $142 million, or $2.45 per share, exceeding the average estimate of $2.18 among Wall Street analysts.

Notably, revenue surged by 14% from the previous year, reaching $1.06 billion, thus surpassing the consensus estimate of $1.03 billion.

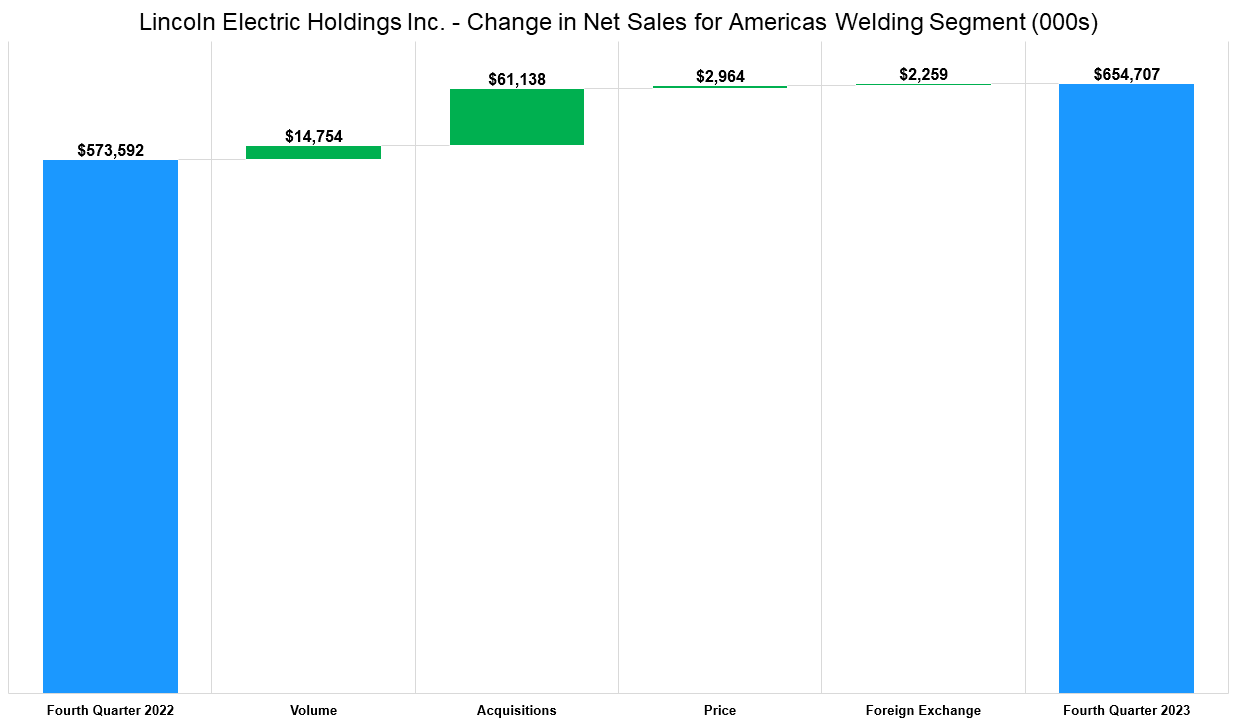

Sales for its Americas Welding segment expanded by 14%, reaching $654.7 million.

Operating income witnessed exponential growth, expanding to $204 million, or 19% of sales, in the quarter, as compared to $141.5 million, or 15% of sales, from the prior year.

Steven Hedlund, president and chief executive of Lincoln (LECO), gave an optimistic outlook, stating, “We finished the year with good momentum across most end markets. Looking ahead, we will continue to advance the business by focusing on our customers, bringing innovative products to market, and driving operational excellence.”