Masimo Corporation MASI and UCHealth have joined forces in a strategic partnership aimed at elevating the standard of patient care by harnessing the latest telehealth and virtual care technologies.

The alliance seeks to capitalize on the unique expertise of both entities and align efforts to enhance patient outcomes, reduce healthcare costs, and transform the delivery of care within and beyond hospital walls. Notably, the emphasis lies on harnessing technology-driven care including virtual and remote care options.

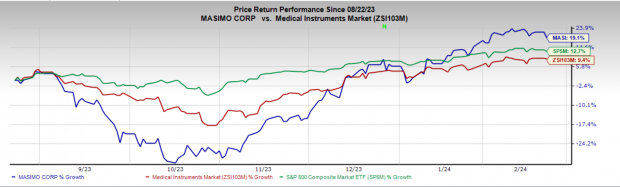

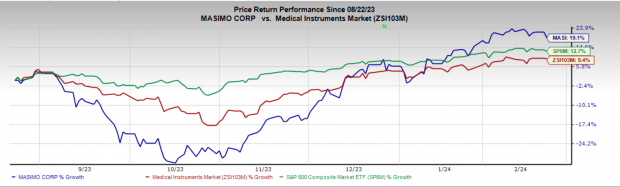

Price Performance

Over the past six months, MASI’s shares have surged by 19.1%, outperforming the industry’s increase of 9.4%. Concurrently, the S&P 500 has advanced by 12.7% during the same period.

Image Source: Zacks Investment Research

More on the News

Masimo, a multinational medical technology company, specializes in the development and production of a wide array of advanced sensors, patient monitors, automation, and connectivity solutions, among other cutting-edge monitoring technologies.

UCHealth, a non-profit healthcare organization, is renowned for delivering exceptional medical care coupled with a superior patient experience. The organization manages 14 acute-care hospitals, employs 33,000 professionals, and houses hundreds of clinicians across Western Nebraska, Southern Wyoming, and Colorado.

The collaboration between Masimo and UCHealth is poised to provide state-of-the-art virtual care and remote monitoring options facilitated by advanced analytics, patient flow management, and enterprise patient monitoring systems.

This partnership enables Masimo to leverage its virtual care technologies to complement UCHealth’s expertise in evidence-based clinical workflow technology. Additionally, the companies are set to collaborate on forward-thinking provider-to-provider and direct-to-consumer services to introduce virtual healthcare services, with a focus on managing chronic and episodic care.

Industry Prospects

According to a Grand View Research report, the global telehealth market size stood at $101.2 billion in 2023 and is projected to expand by 24.3% from 2024 to 2030.

The growth of this market is driven by technological advancements, including improved Internet connectivity and the widespread adoption of smartphones, which are making healthcare services more accessible and convenient for patients. Furthermore, the upsurge in demand for remote healthcare services, particularly in the wake of the COVID-19 pandemic, has led to an increased need for virtual consultations and remote monitoring.

Given the substantial potential of the telehealth services market, Masimo’s collaboration with UCHealth is poised to propel its business and generate additional revenues.

Notable Developments

Masimo recently announced the FDA clearance of its Masimo SET-powered MightySat Medical Pulse Oximeter, available over-the-counter (OTC) to consumers without a prescription. It is the first FDA-approved medical fingertip pulse oximeter that customers can directly obtain without a formal prescription.

In December 2023, Masimo received FDA clearance for Stork, targeting prescription use with healthy and sick infants aged 0-18 months. Stork, Masimo’s innovative baby monitoring system, utilizes advanced sensor technology already employed in hospital monitoring.

In November 2023, Masimo solidified a collaborative agreement with GE HealthCare, aiming to integrate Masimo SET pulse oximetry into GE HealthCare’s Portrait Mobile wireless and wearable patient monitoring solution.

Masimo Corporation Price

Masimo Corporation price | Masimo Corporation Quote

Zacks Rank & Other Stocks to Consider

At present, MASI carries a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks to consider in the broader medical space are Universal Health Services UHS, Integer Holdings Corporation ITGR, and Elevance Health, Inc ELV.

Universal Health Services, holding a Zacks Rank #2 (Buy), has an estimated growth rate of 4.4% for 2024. UHS has outperformed earnings estimates in each of the last four quarters, with an average surprise of 5.47%. Additionally, UHS’s shares have surged by 1.9% in the past six months against the industry’s 5% decline.

Currently holding a Zacks Rank of 2, Integer Holdings has an estimated long-term growth rate of 15.8%. ITGR has exceeded earnings estimates in each of the past four quarters, with an average surprise of 11.9%. Furthermore, ITGR’s shares have soared by 43.5% in the past year, outperforming the industry’s 3.7% decline.

Elevance Health, with a Zacks Rank of 2, reported fourth-quarter 2023 adjusted earnings per share of $5.62, surpassing the Zacks Consensus Estimate by 1.3%. Notably, the company also exceeded revenue estimates, with revenues of $42.45 billion, beating the consensus mark by 1.5%. Elevance Health is anticipated to achieve a long-term estimated growth rate of 12%, and its earnings have outperformed estimates in all of the last four quarters, with an average surprise of 3.1%.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2023. Previous recommendations have soared +143.0%, +175.9%, +498.3%, and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.