Shares of Meta Platforms (NASDAQ: META) fell over 10% following its first-quarter earnings report despite some pretty solid numbers from the social media giant.

In fact, there were a lot of really of good things to come out of Meta’s report. So let’s look at why the stock fell, why its overall results were strong, and why this may be a great buying opportunity for investors.

Why Meta’s stock fell

There were two main reasons that Meta’s stock fell following its earnings. The first was that its second-quarter revenue guidance was considered a bit light versus expectations. The company projected that its Q2 revenue would come in between $36.5 billion and $39.0 billion. Analysts were expecting Q2 revenue of $38.3 billion, so the midpoint of its forecast was just below that at $37.75 billion. This is minor in the grand scheme of determining whether to invest in Meta.

The second reason behind the sell-off can be attributed to the company raising its expense expectations for the full year. Meta now anticipates that full-year expenses will come in between $96 billion and $99 billion, up from a prior outlook of between $94 billion and $99 billion, due to higher infrastructure and legal costs. The company also increased its full-year capital expenditure (capex) budget from a range of $30 billion to $37 billion to a new outlook of $35 billion to $40 billion.

Meta said that the increased capex will be used to build out the infrastructure to support its artificial intelligence (AI) roadmap. It also said it expects capex will increase next year, as well.

Investors have been skeptical of Meta’s investments in its Reality Labs segment, which is developing the so-called metaverse. The segment lost $3.8 billion in Q1. Investors have wanted the company to cut back on spending in money-losing ventures, so the increase in capex did not sit well, even if it will largely be directed toward AI.

A strong start to the year

Despite the drop in Meta’s stock, the company’s first-quarter results actually showed that 2024 was off to a strong start for the company. Revenue climbed 27%, with ad impressions up 20% and average price per ad up 6%. Daily active users, meanwhile, rose 7% to 3.24 billion in March.

The company also kept its expenses in check; they rose just 6%. Along with its strong revenue growth, this led to net income more than doubling. Meta also produced an outstanding $12.5 billion in free cash flow, which was up from $6.9 billion a year ago.

Overall, this was a great quarter that showed some very strong growth for a company of Meta’s size.

Image source: Getty Images.

AI and the metaverse

Looking forward, Meta is looking for AI to play a big role in the company. It already has several AI services, including Meta AI, which allows users to ask any questions across its apps. Meta AI also has some unique features, such as the ability to create animation from still images. The company said that the initial rollout of Meta AI is going well and that tens of millions of people have tried the AI assistant with good reviews. Meta has also developed creator AIs to help creators and fans to interact, as well as business AI for things such as customer support and coding help.

The company will employ a playbook similar to what it has used with its social media offerings and other features, which is that it will build and scale them out before monetizing, or profiting from, them. The company has typically done this through adding advertising. In the meantime, there will be capex costs and energy expenses associated with scaling up the infrastructure to run these AI applications.

Meta also noted on itsearnings callthat it was starting to see its efforts in AI and the metaverse start to converge. It said fashionable AI glasses are an ideal device for an AI assistant because the AI assistant can see and hear what you are experiencing. The company said it just launched Meta AI with vision on its glasses this week. That said, CEO Mark Zuckerberg said he doesn’t believe the metaverse will become mainstream until full holographic displays are developed.

Betting on the future

Meta turned in a great first quarter, but the stock sold off as investors continued to focus on the company’s spending on future projects. This is a bit short-sighted, as Meta has a great history of building and scaling products before successfully monetizing them and making them highly profitable. This is what you want to see from a growth company.

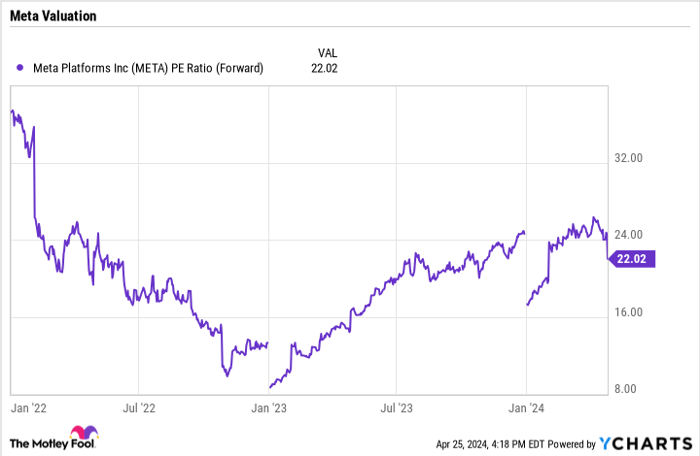

META PE Ratio (Forward) data by YCharts

After its recent drop, the stock carries a forward P/E ratio of only 22 times for a company that just grew its revenue by 27% and doubled its net income in Q1. That’s an attractive price for a company that has a huge AI opportunity in front of it whose core businesses are growing strongly. So yes, this is a great time to jump in and buy Meta’s stock on this dip.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of April 22, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.