Mondelez International, Inc. MDLZ is likely to deliver a top-and-bottom-line decline when it reports first-quarter 2024 earnings on Apr 30. The Zacks Consensus Estimate for revenues is pegged at $9.15 billion, which suggests a drop of 0.2% from the prior-year quarter’s reported figure.

The consensus mark for quarterly earnings has remained unchanged in the past 30 days at 88 cents per share. This indicates a decline of 1.1% from the year-ago quarter’s reported figure. MDLZ has a trailing four-quarter earnings surprise of 8.6%, on average.

Factors to Note

Mondelez has been battling cost inflation for a while now. For 2024, Mondelez expects inflation to increase by a high single digit due to escalated cocoa and sugar prices as well as higher labor costs. On its fourth-quarterearnings call management stated that it is closely monitoring various immediate concerns, including ongoing inflation, evolving consumer behaviors, geopolitical complexities and the escalation in cocoa prices, among others. These aspects raise concerns for the quarter under review.

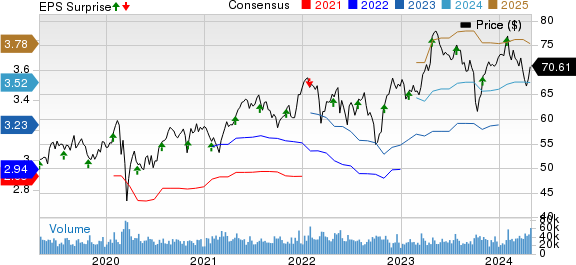

Mondelez International, Inc. Price, Consensus and EPS Surprise

Mondelez International, Inc. price-consensus-eps-surprise-chart | Mondelez International, Inc. Quote

However, continuous reinvestments in its brands and capabilities — along with impressive portfolio reshaping efforts — place Mondelez well for growth. A focus on core categories such as chocolate, biscuits and baked snacks, efforts to enhance brand appeal, operational efficiency, cost management initiatives and pricing endeavors also work well for Mondelez.

As consumers prefer snacking over traditional meals, the company’s core categories — chocolates and biscuits — have historically depicted resilience to economic downturns and pricing actions. In the fourth quarter, the biscuit and chocolate categories registered sales growth of 5.5% and 11.2%, respectively. Management has been focused on expanding its chocolate, biscuit and baked snacks categories as they present opportunities for solid growth and profitability.

Our model suggests organic revenue growth of 2.6% for the first quarter of 2024 on a 3.3% increase in pricing.

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for Mondelez this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here.

Mondelez has an Earnings ESP of -1.13% and carries a Zacks Rank #4 (Sell). You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With the Favorable Combination

Here are three companies worth considering as our model shows that these have the correct combination to beat on earnings this time:

The Hershey Company HSY has an Earnings ESP of +1.42% and a Zacks Rank #3. The company is likely to witness top-line growth when it reports first-quarter 2024 results. The Zacks Consensus Estimate for Hershey’s quarterly revenues is pegged at $3.12 billion, which suggests a rise of 4.5% from the figure reported in the prior-year quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Hershey’s quarterly EPS has declined by a penny in the past seven days to $2.72, which calls for a decrease of 8.1% from the year-ago quarter’s level. HSY has a trailing four-quarter earnings surprise of 6.5%, on average.

Church & Dwight CHD currently has an Earnings ESP of +1.00% and a Zacks Rank of 3. The company is likely to register top-line and bottom-line increases when it reports first-quarter 2024 numbers. The Zacks Consensus Estimate for Church & Dwight’s quarterly revenues is pegged at $1.49 billion, which implies growth of 4.3% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for Church & Dwight’s quarterly earnings of 86 cents suggests a rise of 1.2% from the year-ago quarter’s levels. CHD has a trailing four-quarter earnings surprise of 9.7%, on average.

Coty COTY currently has an Earnings ESP of +4.23% and a Zacks Rank #3. The company is expected to register top-line growth when it reports third-quarter fiscal 2024 numbers. The Zacks Consensus Estimate for COTY’s quarterly revenues is pegged at $1.37 billion, which indicates an increase of 6.6% from the prior-year quarter’s reported figure.

The Zacks Consensus Estimate for COTY’s quarterly earnings has been unchanged at 6 cents in the past 30 days, which calls for a 68.4% decline from the year-ago quarter’s reported number. COTY delivered an earnings beat of 115.3%, on average, in the trailing four quarters.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

Hershey Company (The) (HSY) : Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

Mondelez International, Inc. (MDLZ) : Free Stock Analysis Report

Coty (COTY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.