$15.7 trillion. That’s the amount PwC, one of the “big four” accounting firms, predicts that artificial intelligence (AI) could add to the global economy annually by 2030. Such a significant boost is rare, and the technology has potential that could rival the revolutionary impact of the internet’s arrival.

Nvidia (NASDAQ: NVDA) is leading the charge in this AI transformation. The company has gained a notable share of the rapidly expanding market, adding over $3 trillion in market capitalization since the AI boom began in late 2022. Nvidia’s current market cap stands just under $3.4 trillion, making it a mere $190 billion away from surpassing Apple (currently valued at $3.57 trillion) as the most valuable company globally.

Will Nvidia manage to move ahead of the tech giant?

Blackwell Chips Poised to Transform Nvidia

Nvidia owes its industry leadership to its advanced technology. The company controls around 90% of the AI chip market, thanks to its consistently faster and more efficient chips. This dominance translates to Nvidia’s net income from AI chips being about 25 times that of its nearest rival, Advanced Micro Devices.

Understanding the fragility of its position, Nvidia is committed to annual upgrades of its chips, a demanding pace compared to the usual 2-3 years. Currently, the company’s Hopper chips are in high demand; Elon Musk recently ordered 100,000 to create the world’s fastest supercomputer. Meanwhile, Nvidia’s upcoming Blackwell chips are set to start shipping soon.

CEO Jensen Huang described the demand for Blackwell chips as “insane,” and some reports indicate they are already sold out for the next year. To meet this demand, Nvidia is collaborating with Foxconn to construct the largest Blackwell production facility in Mexico. Analysts at Morgan Stanley project that Blackwell could generate an additional $10 billion in revenue before the end of this year. Although this estimate exceeds Nvidia’s own guidance, it clearly highlights the strong demand in the market.

Apple Faces Challenges Amidst Growth

Apple is seeing growth, particularly in its services sector, and Wall Street retains an optimistic outlook. However, reports indicate sluggish sales for its latest iPhone model, raising concerns. Sales in China, a crucial market, seem to be declining, and Apple is counting on the integration of AI features, branded as Apple Intelligence, to encourage iPhone upgrades and drive sales. Whether these new features will entice consumers remains to be seen.

The company’s upcoming earnings report later this month will be telling. Investors hope Apple has successfully boosted iPhone sales while continuing to develop its service segment, which includes offerings like Apple TV, Apple Music, and the App Store.

Nvidia is Likely to Surpass Apple

Considering the exciting rollout of Nvidia’s Blackwell chips, alongside the strong demand seen last year leading to significant sales growth, it seems probable that Nvidia’s share price will climb faster than Apple’s, positioning it as the next leader in market capitalization.

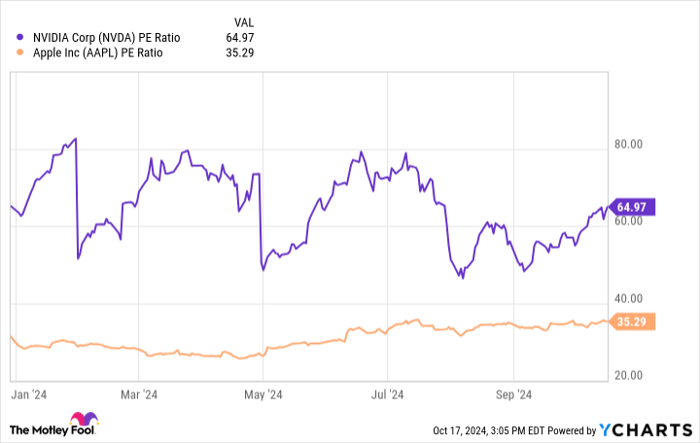

However, the valuation of these stocks must also be taken into account. Examining their price-to-earnings ratios (P/E) provides insight.

NVDA PE Ratio data by YCharts

Nvidia is currently trading at a premium, which suggests that investors are expecting robust growth. If the company cannot sustain its remarkable growth rate, its stock price may decline. However, signs point to continued growth in Nvidia’s future, indicating the necessity for a different metric to assess its stock potential.

The PEG ratio, which reflects a company’s P/E in relation to its expected growth rate, is more relevant here. Stocks with a PEG ratio of 1 or lower are generally seen as undervalued. Nvidia’s PEG ratio sits at 1.1, while Apple’s is at 2.4, suggesting Nvidia may be the better choice for value right now. If Nvidia sustains its growth trajectory, its premium valuation will be justified, posing challenges for Apple in maintaining its spot at the top.

A Second Chance to Invest

Feeling like you missed out on investing in some of the most successful stocks? You might want to pay attention now.

Occasionally, our expert team issues a “Double Down” stock recommendation for companies anticipated to climb. If you think you missed your chance, now could be the ideal time to invest before values rise further. The statistics back this up:

- Amazon: $1,000 invested in 2010 would be worth $21,285!*

- Apple: $1,000 invested in 2008 would be worth $44,456!*

- Netflix: $1,000 invested in 2004 would be worth $411,959!*

At this moment, we are announcing “Double Down” alerts for three outstanding companies. There may not be another opportunity like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, and Nvidia. The Motley Fool has a disclosure policy.

The views expressed in this article are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.