Oil Prices Plunge After Israeli Assurance on Iranian Targets

Oil prices fell sharply on Tuesday, dropping over 5% in the morning trading in New York, mainly due to a decrease in geopolitical tensions in the Middle East. Israeli Prime Minister Benjamin Netanyahu reported that Iran’s crude oil infrastructure would not be targeted in any potential retaliatory strikes, leading to this downturn.

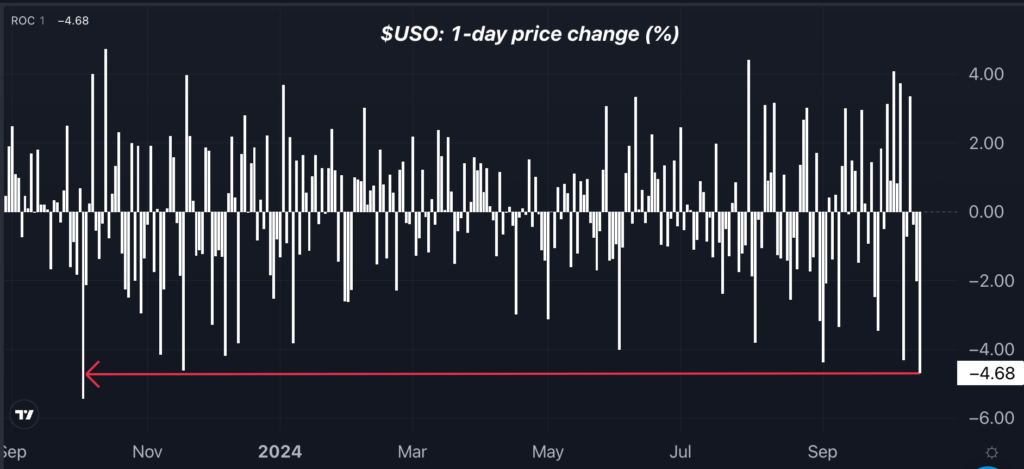

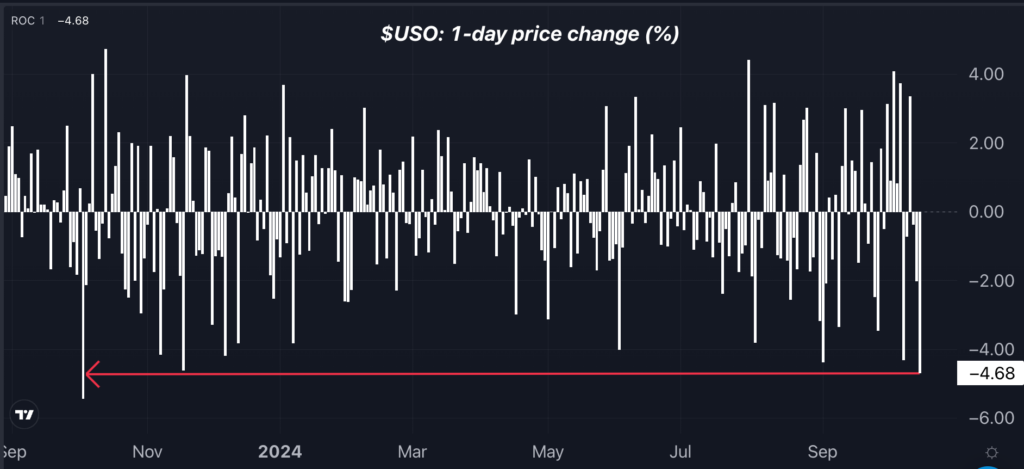

West Texas Intermediate (WTI) crude, the U.S. benchmark tracked by the United States Oil Fund USO, plummeted to $70 per barrel by 10 a.m. ET, marking the largest one-day drop in over a year.

This selloff followed a report from The Washington Post on Monday claiming that Netanyahu had assured the Biden administration Israel would not target Iranian oil and nuclear facilities in military actions. These assurances suggest a limited potential for conflict, easing concerns about major disruptions in the global oil supply.

Previously, market analysts cautioned that an Israeli attack on Iranian oil infrastructure could cause crude prices to soar by $20 per barrel, raising worries that Tehran would retaliate by targeting oil facilities throughout the Gulf region and consequently sparking an energy crisis.

Crude Prices Plummet as Concerns Over Middle East Supply Shrink

Energy Stocks Decline as Airlines and Cruise Lines Rally

The market reaction was immediate: U.S. energy stocks experienced significant declines, while airlines and cruise lines, which are sensitive to fuel prices, enjoyed a rise in stock prices.

The energy sector was one of the day’s biggest losers. The Energy Select Sector SPDR Fund XLE fell by 2.8%, marking its worst performance since late April. Companies like APA Corporation APA, Diamondback Energy, Inc. FANG, and Valero Energy Corporation VLO saw drops of around 4%.

Firms focusing on upstream exploration and production faced even harsher losses. The SPDR S&P Oil & Gas Exploration & Production ETF XOP dropped 3.1%. Companies like Talos Energy Inc. TALO, Kosmos Energy Ltd. KOS, and Crescent Energy Company CRGY all fell over 4%.

Downstream oil service providers also experienced declines; the VanEck Oil Services ETF OIH fell by 3.6%. Major oilfield services firms like Schlumberger N.V. SLB and Halliburton Company HAL saw drops of approximately 3%, while Transocean Ltd. RIG underperformed with a 5% decline.

Airlines and Cruise Lines Shine Amid Lower Fuel Costs

On the other hand, sectors benefiting from lower fuel prices saw favorable results. Airlines and cruise lines emerged as the best performers in the S&P 500, buoyed by the reduced oil prices.

Norwegian Cruise Line Holdings Ltd. NCLH surged 4.3%, while Carnival Corp. CCL jumped 5.3%.

Goldman Sachs recently raised its price target on Royal Caribbean Cruises Ltd. RCL from $195 to $220, citing strong anticipated earnings. Similarly, NCLH saw its target increase from $22 to $24.

In the airline sector, American Airlines Group Inc. AAL grew by 3.5%, United Airlines Holdings Inc. UAL rose 1.2%, reaching its highest price since February 2020, and Southwest Airlines Co. LUV climbed 1.3%.

Read Next:

Photo via Shutterstock.

Market News and Data brought to you by Benzinga APIs