A tumultuous journey through the rocky terrain of the oil market has left many investors feeling queasy. The price of crude oil plummeted from $95 to $69 in just two months, causing pessimism to spread like wildfire. However, while others see a risky venture, I see an opportunity sparkling with potential returns.

Unless a full-blown recession is imminent, the strong demand for oil coupled with limited supply is likely to rejuvenate the market and lend support to oil prices.

The allure of this trade becomes even more irresistible with oil stocks offering tempting deals, diving into the realm of deep value, thus providing investors a safety net against potential losses. So, what are you longing for? Let’s dive into the ocean of oil stocks with high Zacks Ranks and generous dividend yields.

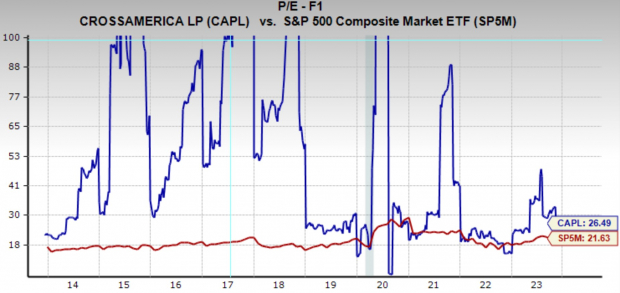

Image Source: Zacks Investment Research

CrossAmerica Partners

CrossAmerica Partners CAPL revs its engines as a leading US wholesale distributor of motor fuels, along with operating convenience stores and owning and leasing real estate used in retail distribution of motor fuels. Covering 34 states, they fuel approximately 1,800 locations and own or lease about 1,100 sites. Moreover, CAPL owns 7 convenience store brands spread across 10 states, offering food, essentials, and car washes at over 250 locations.

Established in 2012, the Partnership boasts strong ties with major oil brands including Exxon, Mobil, BP, Shell, Valero, Citgo, Marathon, and Phillips 66. CrossAmerica Partners dominates as one of ExxonMobil’s largest U.S. distributors by fuel volume, and nestles in the top 10 for other brands. Their convenience stores are also home to renowned national brands like Dunkin’, Subway, and Arby’s.

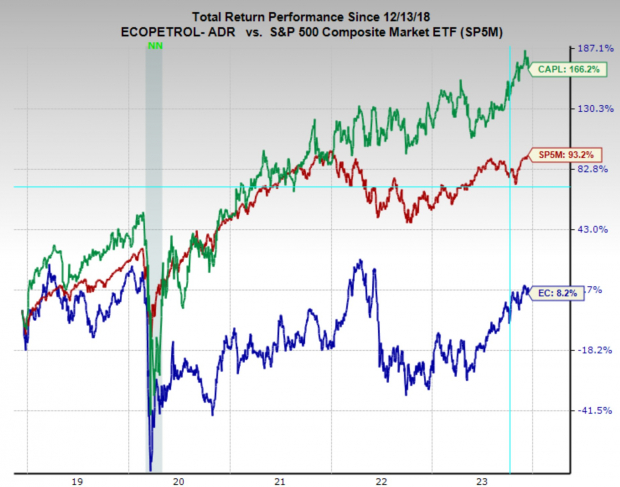

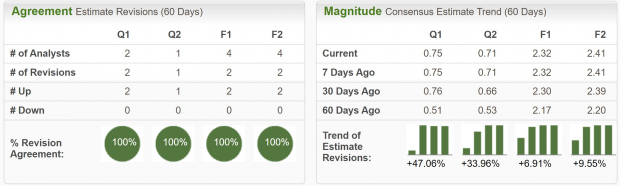

CrossAmerica Partners has experienced a delightful uptick in its earnings estimates, clinching a Zacks Rank #1 (Strong Buy) rating. The current quarter earnings estimates have surged by 47%, while FY23 and FY24 have sprouted by 25% and 19% respectively.

As part of the Oil and Gas – Refining and Marketing – Master Limited Partnerships, CAPL lounges in the Top 6% (16 out of 251) of the Zacks Industry Rank.

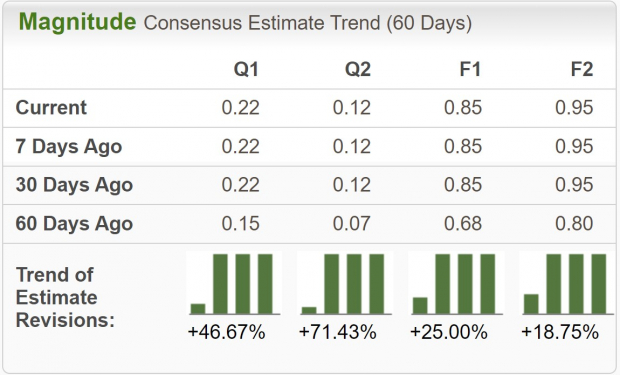

Image Source: Zacks Investment Research

Currently, CAPL is hustling at a one-year forward earnings multiple of 26.5x, slightly higher than the broader market average, yet below its 10-year median of 33.5x. Additionally, the company sweetens the deal with an annual dividend yield of 9.3%, offering investors a generous income stream.

Image Source: Zacks Investment Research

Ecopetrol

Ecopetrol EC stirs the pot as a Colombia-based petroleum company, focusing on opportunities primarily within the eastern Llanos Basin of Colombia, alongside other areas in Colombia and northern Peru. Their operations encompass the extraction, collection, treatment, storage, and pumping or compression of hydrocarbons.

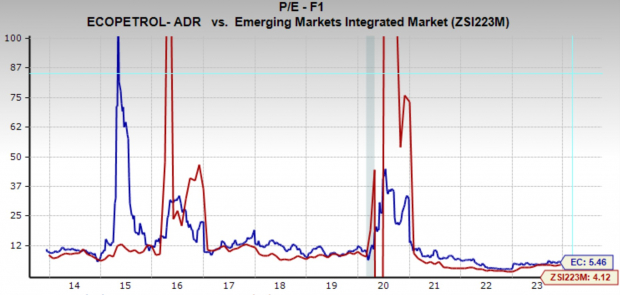

Ecopetrol has savored a boost in its earnings estimates, bagging a Zacks Rank #1 (Strong Buy) rating. The current quarter earnings estimates have soared by 47%, while FY23 has soared by 7%.

EC also snuggles in the Top 1% (3 out of 251) of the Zacks Industry Rank, dazzling as part of the Oil and Gas – Integrated – Emerging markets industry.

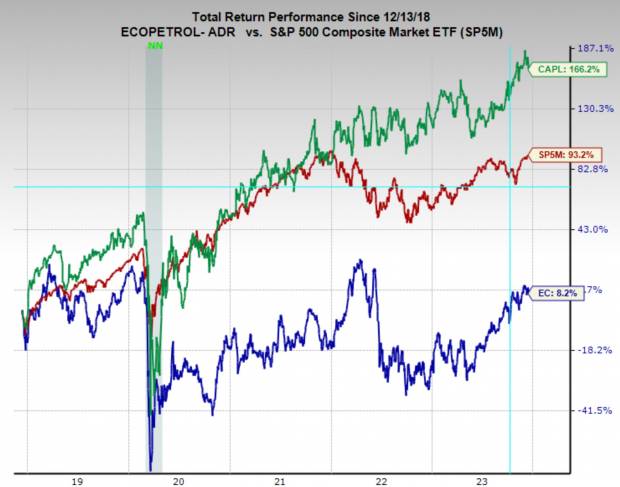

Image Source: Zacks Investment Research

Ecopetrol, with a one-year forward earnings multiple of 5.5x, flirts just above the industry average and lounges well below its 10-year median of 10.7x. Moreover, it drapes itself in one of the highest dividend yields in the industry at 16.1%.

Image Source: Zacks Investment Research

Bottom Line

Although the oil market sentiment is scraping the bottom of the barrel, for contrarian investors, it should serve as a clarion call for uncovering opportunities.

4 Oil Stocks with Massive Upsides

The world’s insatiable hunger for oil is driving producers to their limits. Despite the recent dip in oil prices, companies that fuel the world with “black gold” are set to unearth colossal profits.

Envisioning the untapped potential, Zacks Investment Research has unfurled a compelling report, Oil Market on Fire, unfurling 4 unexpected oil and gas stocks poised for astronomical gains in the upcoming weeks and months. Are you ready to seize this golden opportunity?

Doors are open to grab your free report and seize the moment.

Ecopetrol S.A. (EC) : Free Stock Analysis Report

CrossAmerica Partners LP (CAPL) : Free Stock Analysis Report

Discover more about this article on Zacks.com here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.