The Ongoing Investment Journey

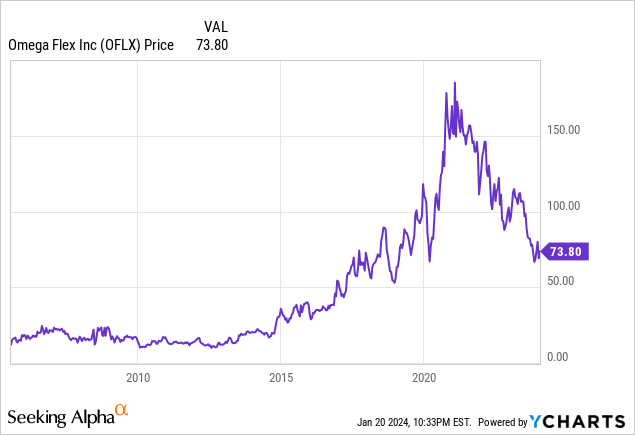

In August 2023, a narrative on Omega Flex (NASDAQ:OFLX) unveiled a stark decrease in residential construction projects and a challenging macroeconomic landscape. The result was a substantial volume reduction in 2022 and H1 2023, causing a ripple effect with a notable revenue decline, particularly in Q2 2023. The squeeze on margins was further exacerbated by inflationary pressures. Yet, despite these headwinds, the company demonstrated a slow but steady expansion in its product offerings, leading to consistent revenue growth over the years. The slump in share price by 56% reflected the impact of inflationary pressures, supply chain complications, and a more stringent financing environment, all of which were tied to the prevailing macroeconomic context.

Despite the challenges, Omega Flex remained highly profitable, boasting a robust balance sheet. This positioning made it an attractive prospect for conservative dividend investors. Nonetheless, the noticeable high valuation and market volatility meant a cautious approach was necessary.

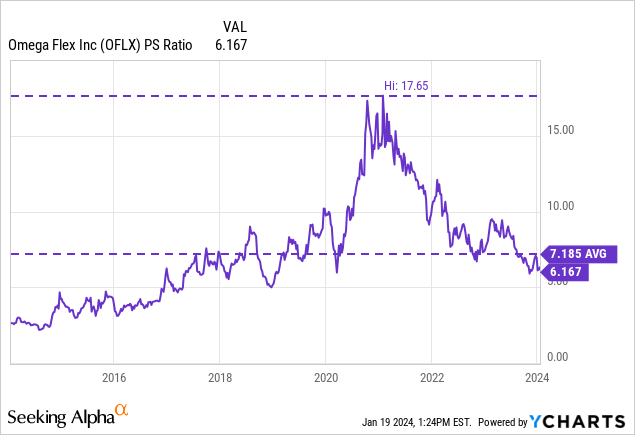

Since then, the share price has taken a further 8.74% dip, resulting in a total return of -8.01% due to dividends. In contrast, the S&P 500 delivered a positive 9.84%, compounding the company’s headwinds. However, Q3 2023 brought a glimmer of hope as the company posted a net income of $5.6 million, an improvement from $4.6 million in Q2. Notably, key ratios such as P/S and P/E showed positive shifts, while the dividend yield also saw an uptick. Despite these positive indicators, careful consideration is advised for interested investors, given the lingering high valuation within the sector.

Unpacking the Company Overview

Established in 1975, Omega Flex is a leading manufacturer of flexible metal hoses, also known as corrugated tubing, utilized across numerous industries and by consumers to transport liquids and gases. Notably, insiders command a significant 38.75% stake in the company, offering a reassuring signal to investors. The company’s timeless products, exceptional profit margins, and minimal need for innovation, coupled with its robust balance sheet, make it a compelling addition to any conservative, dividend-focused portfolio. Moreover, the company’s plan to extend its market beyond North America presents substantial growth prospects in the long term.

The recent downturn in share price positions Omega Flex as an appealing investment opportunity. However, a prudent approach is still recommended, given the potential for further downside.

Presently, shares are priced at $73.80, reflecting an 8.74% decline since August 2023 and a substantial 60.49% drop from the all-time high of $186.80 in February 2021. This sharp decline mirrors the end of two robust years – 2021 and 2022 – characterized by heightened demand following the pandemic’s peak, alongside recent headwinds such as inflationary pressures, reduced housing starts, and a stricter financing environment, contributing to the company’s overall position.

Notably, the most pivotal development in recent months came in December 2023 when the company announced significant changes in its management. Kevin R. Hoben will assume the CEO position, steering the company through its current challenges and potential risks. As we delve into the Q3 2023 results, let’s break down the most significant aspects.

Trajectory of Revenues

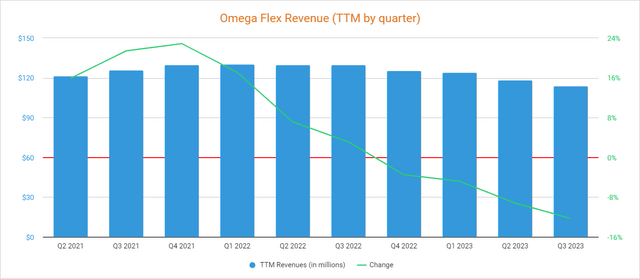

From 2009 to 2019, the company witnessed a commendable 152% increase in sales, despite infrequent product launches and limited dependence on acquisitions for growth. The disruptive impact of the coronavirus pandemic led to a marginal sales decline in 2020, followed by a rebound in 2021. However, this resurgence was coupled with a slight dip in 2022, further intensifying in H1 2023.

Amidst these fluctuations, Q3 2023 saw a 6.43% increase in revenues, amounting to $27.5 million, quarter over quarter. Nonetheless, this represented a 13.07% downturn from the same quarter in 2022, resulting in a 12.29% reduction in trailing twelve months’ revenue to $114.1 million. Despite this decline, trailing twelve-month revenues stand 2.4% higher than those in 2019. Consequently, the dwindling share price has precipitated a steep fall in the P/S ratio to 6.167, indicating that the company currently generates $0.16 in annual revenues for every dollar held in shares by investors.

Omega Flex: Navigating Economic Storms

The housing market has been a hot topic lately, with housing starts declining and investor expectations adjusting to a more moderate pace. Omega Flex, a key player in the industry, has shown resilience in the face of these challenges, navigating the economic storms with calculated moves and strategic positioning.

Adapting to Evolving Markets

In response to the decline in housing starts, Omega Flex is charting a course for long-term growth by diversifying its geographical presence. With a focus on new geographies and natural gas distribution systems, the company aims to reduce its dependence on the North American market, paving the way for new opportunities and revenue streams.

Despite the current industry headwinds, Omega Flex has witnessed an improvement in sales and profitability in Q3 2023, signaling a positive trajectory amidst challenging market conditions.

Anchored by Strong Profit Margins

Omega Flex boasts exceptionally high profit margins, underscoring its operational excellence and product quality. The company’s robust pricing power has garnered the trust of both institutional and individual customers, further solidifying its position in the market.

Resilient Balance Sheet

Amidst fluctuating operational dynamics, Omega Flex maintains a strong balance sheet, underpinned by substantial cash reserves, high inventory levels, and an absence of debt. While recent decreases in cash and equivalents and inventories reflect the impact of market conditions, the company’s profitability remains robust, as evidenced by its positive net income in Q3 2023.

Securing the Dividend

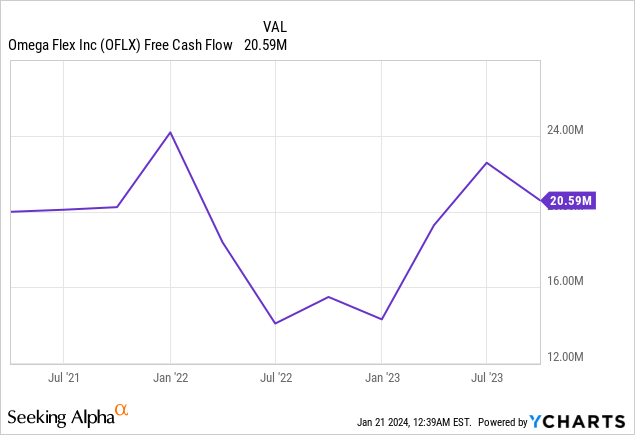

Omega Flex’s commitment to shareholder value is evident in its sustained dividend growth. With prudent financial management and a historically low cash payout ratio, the company has ensured the stability of its dividend payments. Despite short-term challenges, Omega Flex’s cash generation capabilities remain resilient, providing ample coverage for its dividend obligations.

Omega Flex: Navigating Choppy Waters with Dexterity

| $15.0 | $16.6 | $15.2 | $20.6 | $23.8 | $22.2 | ||||

| Dividends paid (TTM, in millions) | $11.6 | $14.9 | $12.0 | $12.2 | $12.3 | $9.5 | $12.7 | $12.9 | $13.0 |

| Cash payout ratio | 55% | 59% | 63% | 81% | 74% | 63% | 62% | 54% | 59% |

As one can see in the table above, the trailing twelve months’ cash payout ratio has remained at safe levels in recent quarters and was at 59% in Q3. This means that the company can continue to cover its dividend through actual operations and still generate some excess cash thanks to very low capital expenditures and non-existent interest expenses. TTM free cash flow remained positive quarter after quarter and continues to be high at $20.6 million.

For this reason, current headwinds are not deteriorating the balance sheet, which suggests that the dividend is safe and greatly reduces the risk in the short and medium term as time doesn’t play against the company until these headwinds eventually ease.

Potential Risks and Considerations

While the risk profile of Omega Flex is low, there are certain risks worth highlighting, especially in the short and medium term.

- Despite the share price being 60.5% below all-time highs reached in 2021, the current valuation is still relatively high compared to the sector median.

- Interest rate hikes could trigger a recession, impacting revenues and profit margins due to lower volumes.

- Recovery of operations may be prolonged due to the speculative nature of interest rate declines and continued industry weakness and volatility.

- The management’s conservative nature could lead to a dividend cut if operations continue to deteriorate, although this is unlikely given the company’s robust balance sheet and high profitability.

- Continued market and operational volatility may lead to further share price declines.

Conclusion and Investment Perspective

Although the valuation remains relatively high, certain factors must be taken into account as the premium price investors are paying could be worth it in the long term. The balance sheet is very robust, and the company has managed to grow by launching new products, contributing to long-term steady revenue growth. In addition, sales and profit margins have slightly improved in the last quarter, leading to a significant improvement in valuation.

Considering Omega Flex’s strengths and qualities, conservative investors may find it fitting for a long-term dividend-focused portfolio. With the improvement in the P/E ratio and continued acquisition of shares, the current period presents an opportunity, albeit amid ongoing market volatility and industry weaknesses.