Emerging Victorious in the Face of Adversity

Omnicom Group (OMC), the advertising and marketing giant, has showcased an impressive performance in the stock market landscape over the past six months. With a commendable surge of 11.9%, Omnicom has outshined the industry it pertains to, which recorded a mere 2.3% incline.

Strategic Investments in Growth

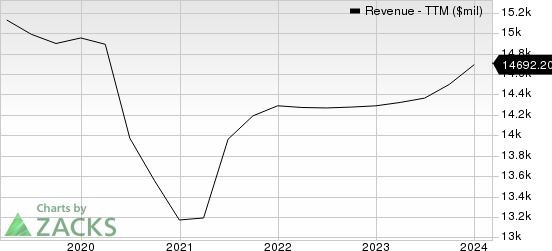

Omnicom’s foray into areas like real estate, back-office services, IT, data analytics, and cutting-edge precision marketing underpins its robust internal development strategy. These investments are anticipated to propel Omnicom towards higher revenues, relying on organic growth. Projections indicate a promising 3.6% uptick in revenues for 2024.

A standout attribute of Omnicom lies in its multifaceted presence across various segments of the advertising and marketing industry. This diversification not only broadens revenue streams but also equips the company with the agility and acumen necessary to maneuver through the constantly evolving marketing domain.

A cornerstone of Omnicom’s operational ethos is its unwavering commitment to enhancing shareholder value through consistent dividends and share buybacks. In 2023, Omnicom disbursed dividends totaling $562.7 million and repurchased shares amounting to $570.8 million, a testament to its dedication. Such initiatives not only bolster investor confidence but also wield a positive impact on the company’s earnings trajectory.

However, existing within a cutthroat industry milieu necessitates Omnicom to swiftly adapt, offer unparalleled global services, and secure clientele against competitors. Customer reviews can potentially sway the company’s fortunes either way, expediting the need for Omnicom to continuously innovate and excel in service delivery.

The close of the fourth quarter of 2023 saw Omnicom grappling with a current ratio of 0.95, a tad lower than the previous year’s ratio of 0.97. This slim ratio hints at potential liquidity challenges in meeting immediate financial obligations, emphasizing the need for strategic financial management.

Market Ranking and Selections Worth Exploring

Presently holding a Zacks Rank #3 (Hold), Omnicom stands as a stalwart in the industry. For investors seeking promising avenues in the Business Services sector, titans like Booz Allen Hamilton (BAH) and Jamf (JAMF) offer compelling investment prospects. Booz Allen Hamilton sports a Zacks Rank of 1, forecasting robust long-term earnings growth at 12.6%, while Jamf, with a Zacks Rank of 2, eyes an impressive long-term earnings growth rate of 22.5%.

Boasting a remarkable average trailing four-quarter earnings surprise of 12.7%, BAH has substantiated its market prowess. Similarly, JAMF showcases a solid trailing four-quarter earnings surprise of 49.4%, illustrating its consistent growth trajectory in the sector.

Omnicom’s resilience amidst market flux, propelled by strategic diversification and shareholder-centric initiatives, heralds a promising outlook in the realm of advertising and marketing. Navigating through liquidity challenges while amplifying growth avenues, Omnicom remains a beacon of stability in a dynamic industry landscape.